Answered step by step

Verified Expert Solution

Question

1 Approved Answer

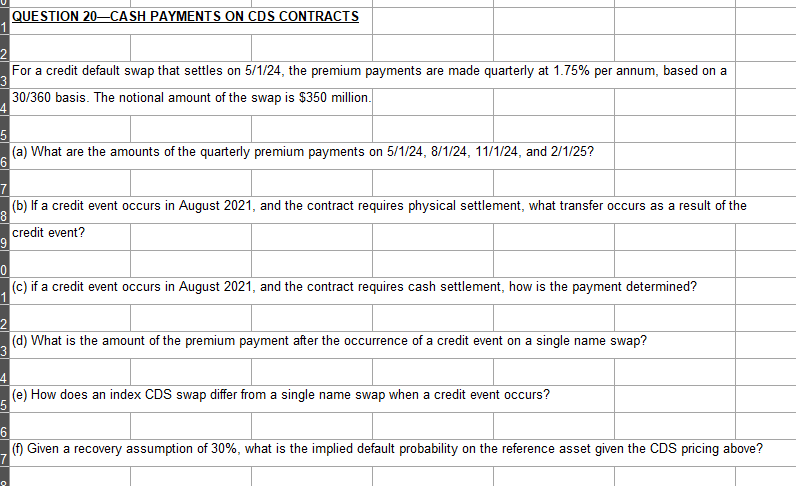

QUESTION 2 0 - CASH PAYMENTS ON CDS CONTRACTS For a credit default swap that settles on 5 1 ? 2 4 , the premium

QUESTION CASH PAYMENTS ON CDS CONTRACTS

For a credit default swap that settles on the premium payments are made quarterly at per annum, based on a

basis. The notional amount of the swap is $ million.

a What are the amounts of the quarterly premium payments on and

b If a credit event occurs in August and the contract requires physical settlement, what transfer occurs as a result of the

credit event?

c if a credit event occurs in August and the contract requires cash settlement, how is the payment determined?

d What is the amount of the premium payment after the occurrence of a credit event on a single name swap?

e How does an index CDS swap differ from a single name swap when a credit event occurs?

f Given a recovery assumption of what is the implied default probability on the reference asset given the CDS pricing above?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started