Answered step by step

Verified Expert Solution

Question

1 Approved Answer

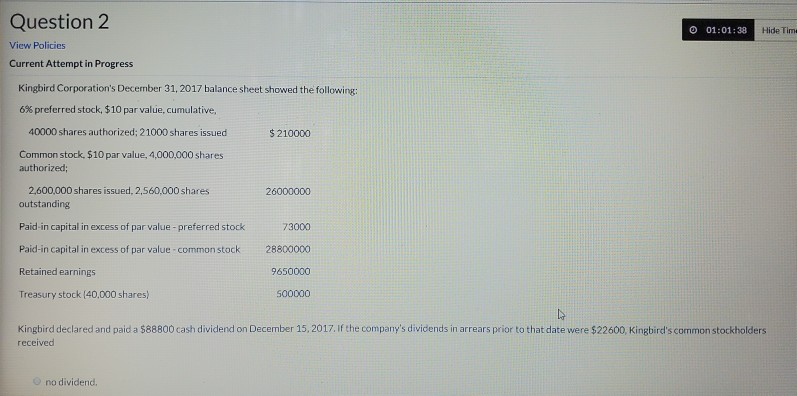

Question 2 01:01:38 Hide Tim View Policies Current Attempt in Progress Kingbird Corporation's December 31, 2017 balance sheet showed the following: 6% preferred stock, $10

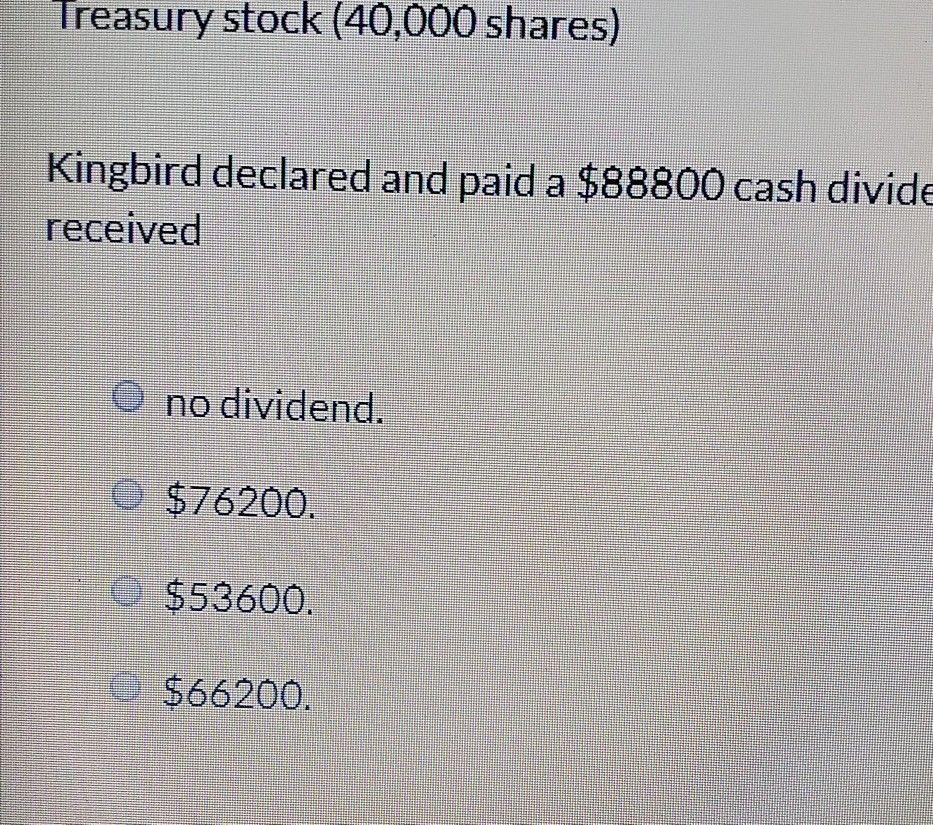

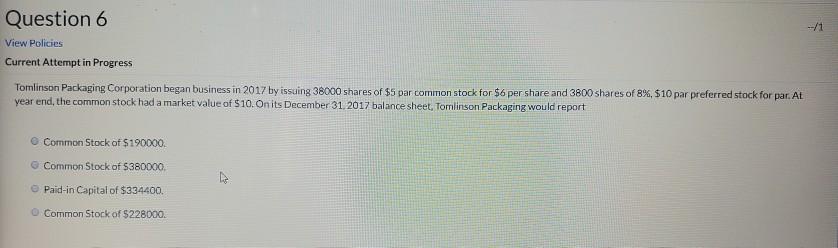

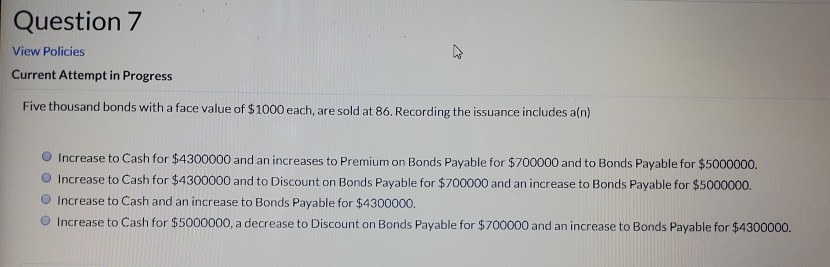

Question 2 01:01:38 Hide Tim View Policies Current Attempt in Progress Kingbird Corporation's December 31, 2017 balance sheet showed the following: 6% preferred stock, $10 par value, cumulative, 40000 shares authorized: 21000 shares issued $ 210000 Common stock, $10 par value, 4,000,000 shares authorized; 2,600,000 shares issued, 2,560,000 shares outstanding 26000000 Paid-in capital in excess of par value - preferred stock Paid-in capital in excess of par value.common stock 73000 28800000 9650000 500000 Retained earnings Treasury stock (40,000 shares) Kingbird declared and paid a $88800 cash dividend on December 15, 2017. If the company's dividends in arrears prior to that date were $22600, Kingbird's common stockholders received no dividend, Treasury stock (40,000 shares) E LLE HERRE Kingbird declared and paid a $88800 cash divide received O no dividend. O $76200. ES ELE $53600. SHELL T HIS DI HER HIFLE RE HI $66200. HE Question 6 View Policies Current Attempt in Progress Tomlinson Packaging Corporation began business in 2017 by issuing 38000 shares of $5 par common stock for $6 per share and 3800 shares of 8%, $10 par preferred stock for par. At year end, the common stock had a market value of $10.Onits December 31, 2017 balance sheet. Tomlinson Packaging would report Common Stock of $190000 Common Stock of $380000. Paid-in Capital of $334400. Common Stock of $228000. Question 7 View Policies Current Attempt in Progress Five thousand bonds with a face value of $1000 each, are sold at 86. Recording the issuance includes a(n) Increase to Cash for $4300000 and an increases to Premium on Bonds Payable for $700000 and to Bonds Payable for $5000000. Increase to Cash for $4300000 and to Discount on Bonds Payable for $700000 and an increase to Bonds Payable for $5000000 Increase to Cash and an increase to Bonds Payable for $4300000. Increase to Cash for $5000000, a decrease to Discount on Bonds Payable for $700000 and an increase to Bonds Payable for $4300000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started