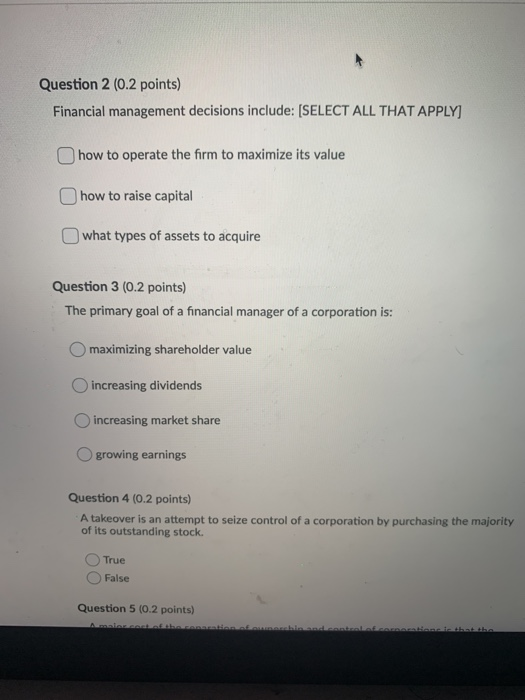

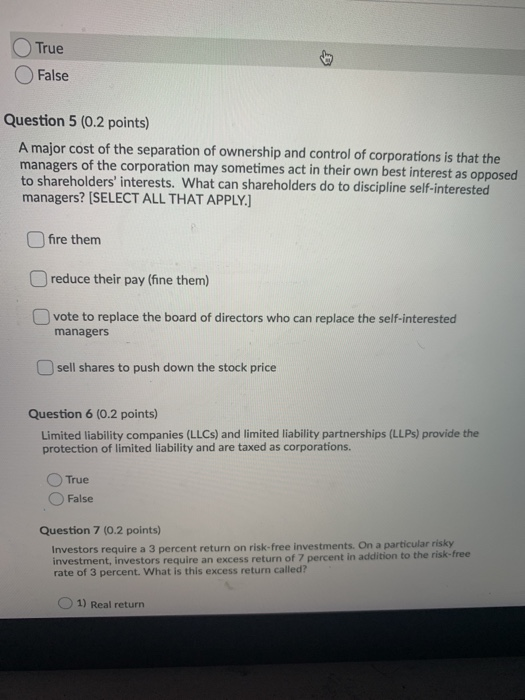

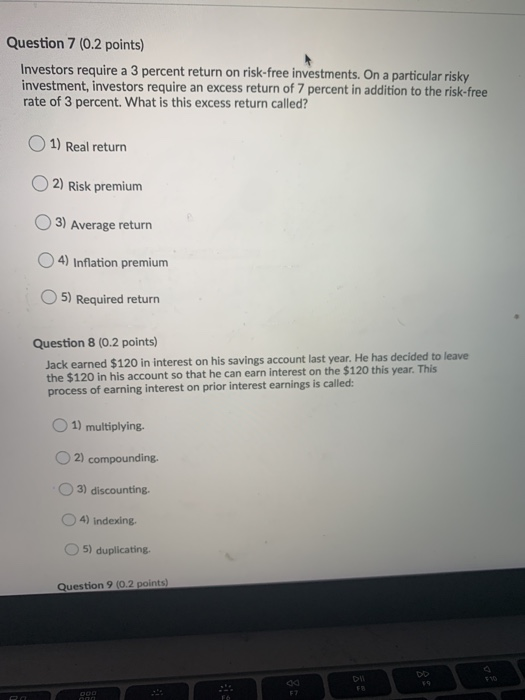

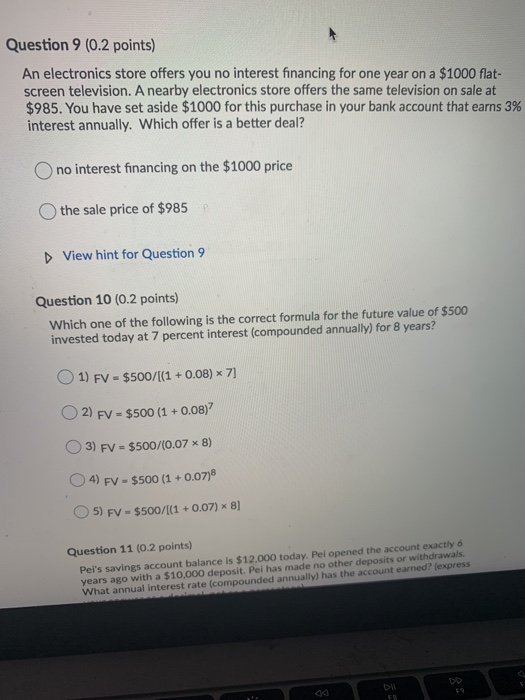

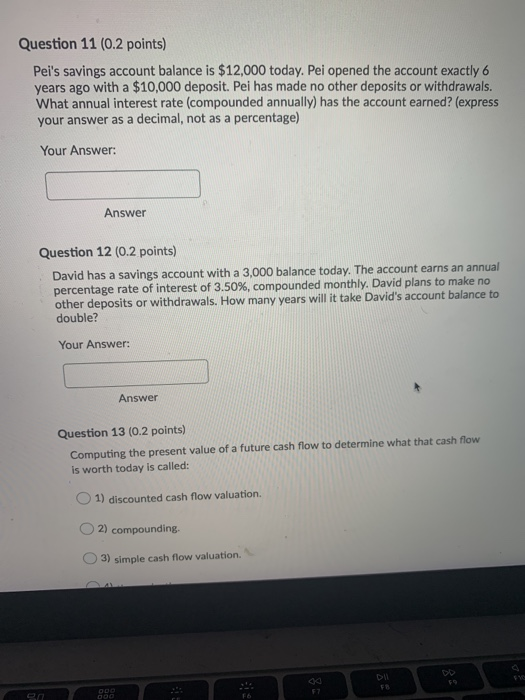

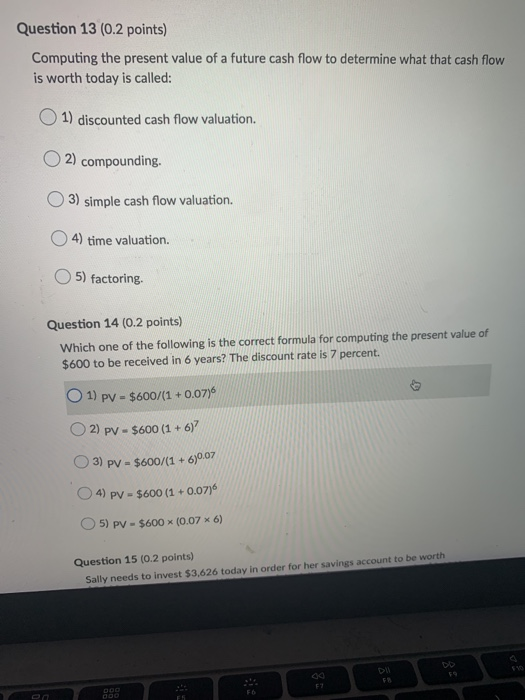

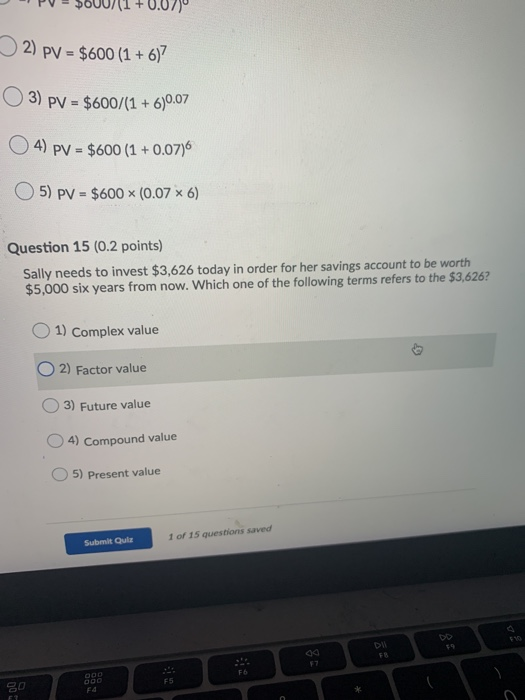

Question 2 (0.2 points) Financial management decisions include: [SELECT ALL THAT APPLY how to operate the firm to maximize its value how to raise capital what types of assets to acquire Question 3 (0.2 points) The primary goal of a financial manager of a corporation is: O maximizing shareholder value increasing dividends increasing market share growing earnings Question 4 (0.2 points) A takeover is an attempt to seize control of a corporation by purchasing the majority of its outstanding stock True False Question 5 (0.2 points) After aftale True False Question 5 (0.2 points) A major cost of the separation of ownership and control of corporations is that the managers of the corporation may sometimes act in their own best interest as opposed to shareholders' interests. What can shareholders do to discipline self-interested managers? (SELECT ALL THAT APPLY.] fire them reduce their pay (fine them) vote to replace the board of directors who can replace the self-interested managers sell shares to push down the stock price Question 6 (0.2 points) Limited liability companies (LLCs) and limited liability partnerships (LLPs) provide the protection of limited liability and are taxed as corporations. True False Question 7 (0.2 points) Investors require a 3 percent return on risk-free investments. On a particular risky investment, investors require an excess return of 7 percent in addition to the risk-free rate of 3 percent. What is this excess return called? 1) Real return Question 7 (0.2 points) Investors require a 3 percent return on risk-free investments. On a particular risky investment, investors require an excess return of 7 percent in addition to the risk-free rate of 3 percent. What is this excess return called? 1) Real return 2) Risk premium 3) Average return 4) Inflation premium 5) Required return Question 8 (0.2 points) Jack earned $120 in interest on his savings account last year. He has decided to leave the $120 in his account so that he can earn interest on the $120 this year. This process of earning interest on prior interest earnings is called: 1) multiplying. 2) compounding. 3) discounting. 4) indexing 5) duplicating Question 9 (0.2 points) Question 9 (0.2 points) An electronics store offers you no interest financing for one year on a $1000 flat- screen television. A nearby electronics store offers the same television on sale at $985. You have set aside $1000 for this purchase in your bank account that earns 3% interest annually. Which offer is a better deal? no interest financing on the $1000 price the sale price of $985 View hint for Question 9 Question 10 (0.2 points) Which one of the following is the correct formula for the future value of $500 invested today at 7 percent interest (compounded annually) for 8 years? 1) FV - $500/[(1 + 0.08) * 7] 2) FV - $500 (1 +0.08)? 3) FV = $500/(0.07 * 8) 4) FV - $500 (1 + 0.07) 5) FV - $500/[(1 +0.07) 8] Question 11 (0.2 points) Pei's savings account balance is $12,000 today. Pel opened the account eactly 6 years ago with a $10,000 deposit. Pel has made no other deposits or withdrawals. What annual interest rate compounded annually) has the account earned? express Question 11 (0.2 points) Pei's savings account balance is $12,000 today. Pei opened the account exactly 6 years ago with a $10,000 deposit. Pei has made no other deposits or withdrawals. What annual interest rate (compounded annually) has the account earned? (express your answer as a decimal, not as a percentage) Your Answer: Answer Question 12 (0.2 points) David has a savings account with a 3,000 balance today. The account earns an annual percentage rate of interest of 3.50%, compounded monthly. David plans to make no other deposits or withdrawals. How many years will it take David's account balance to double? Your Answer: Answer Question 13 (0.2 points) Computing the present value of a future cash flow to determine what that cash flow is worth today is called: 1) discounted cash flow valuation. 2) compounding 3) simple cash flow valuation. Question 13 (0.2 points) Computing the present value of a future cash flow to determine what that cash flow is worth today is called: 1) discounted cash flow valuation. 2) compounding. 3) simple cash flow valuation. 4) time valuation. 5) factoring Question 14 (0.2 points) Which one of the following is the correct formula for computing the present value of $600 to be received in 6 years? The discount rate is 7 percent. 1) PV - $600/(1 +0.07) O2) pV - $600 (1 + 6)? 3) PV - $600/(1 + 670.07 4) PV - $600 (1 + 0.0716 5) PV - $600 (0.07 * 6) Question 15 (0.2 points) Sally needs to invest $3,626 today in order for her savings account to be worth PV - $600/(1+0.07) 2) PV = $600 (1 + 637 3) PV = $600/(1 + 6)0.07 4) PV = $600 (1 + 0.07)6 5) PV = $600 (0.07 x 6) Question 15 (0.2 points) Sally needs to invest $3,626 today in order for her savings account to be worth $5,000 six years from now. Which one of the following terms refers to the $3,626? 1) Complex value 2) Factor value 3) Future value 4) Compound value 5) Present value Submit Quiz 1 of 15 questions saved 80