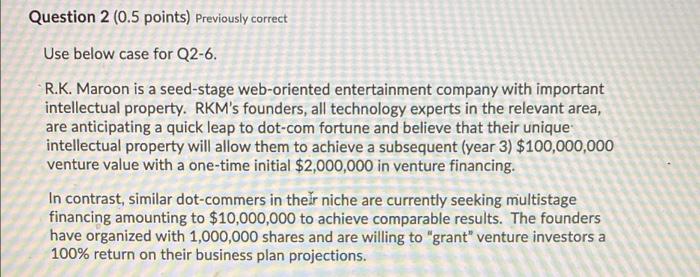

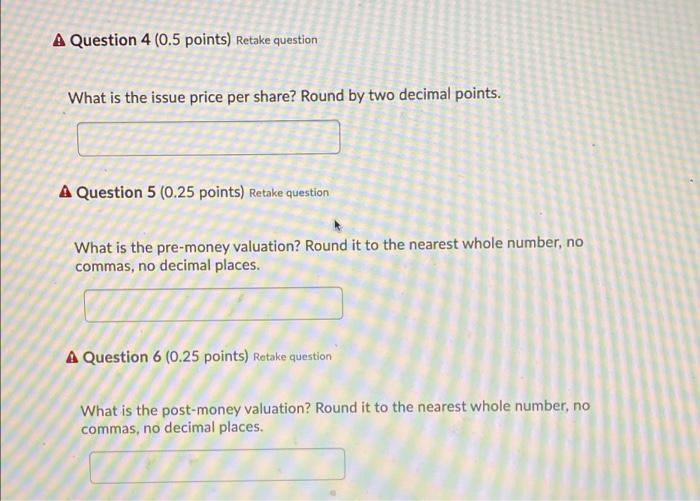

Question 2 (0.5 points) Previously correct Use below case for Q2-6. R.K. Maroon is a seed-stage web-oriented entertainment company with important intellectual property. RKM's founders, all technology experts in the relevant area, are anticipating a quick leap to dot-com fortune and believe that their unique intellectual property will allow them to achieve a subsequent (year 3) $100,000,000 venture value with a one-time initial $2,000,000 in venture financing. In contrast, similar dot-commers in their niche are currently seeking multistage financing amounting to $10,000,000 to achieve comparable results. The founders have organized with 1,000,000 shares and are willing to "grant" venture investors a 100% return on their business plan projections. A Question 4 (0.5 points) Retake question What is the issue price per share? Round by two decimal points. A Question 5 (0.25 points) Retake question What is the pre-money valuation? Round it to the nearest whole number, no commas, no decimal places. A Question 6 (0.25 points) Retake question What is the post-money valuation? Round it to the nearest whole number, no commas, no decimal places. Question 2 (0.5 points) Previously correct Use below case for Q2-6. R.K. Maroon is a seed-stage web-oriented entertainment company with important intellectual property. RKM's founders, all technology experts in the relevant area, are anticipating a quick leap to dot-com fortune and believe that their unique intellectual property will allow them to achieve a subsequent (year 3) $100,000,000 venture value with a one-time initial $2,000,000 in venture financing. In contrast, similar dot-commers in their niche are currently seeking multistage financing amounting to $10,000,000 to achieve comparable results. The founders have organized with 1,000,000 shares and are willing to "grant" venture investors a 100% return on their business plan projections. A Question 4 (0.5 points) Retake question What is the issue price per share? Round by two decimal points. A Question 5 (0.25 points) Retake question What is the pre-money valuation? Round it to the nearest whole number, no commas, no decimal places. A Question 6 (0.25 points) Retake question What is the post-money valuation? Round it to the nearest whole number, no commas, no decimal places