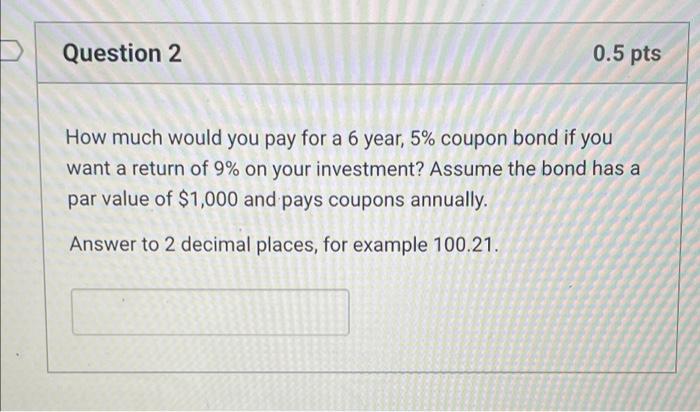

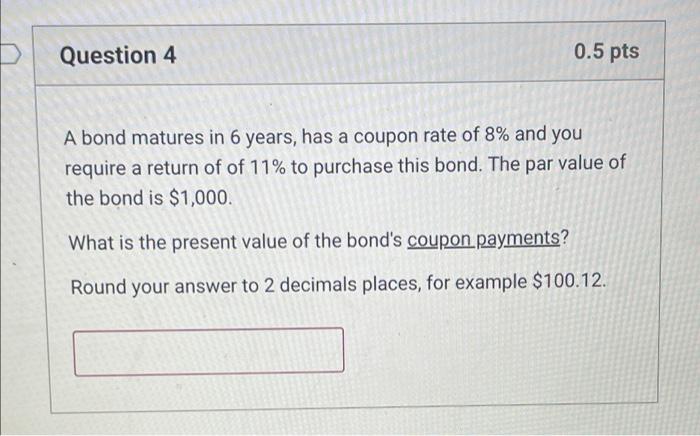

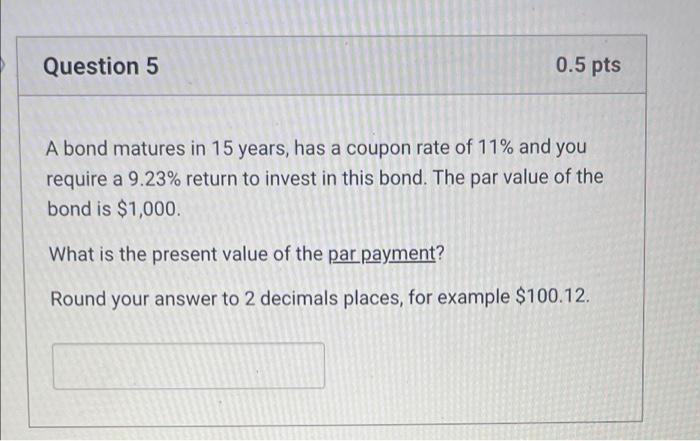

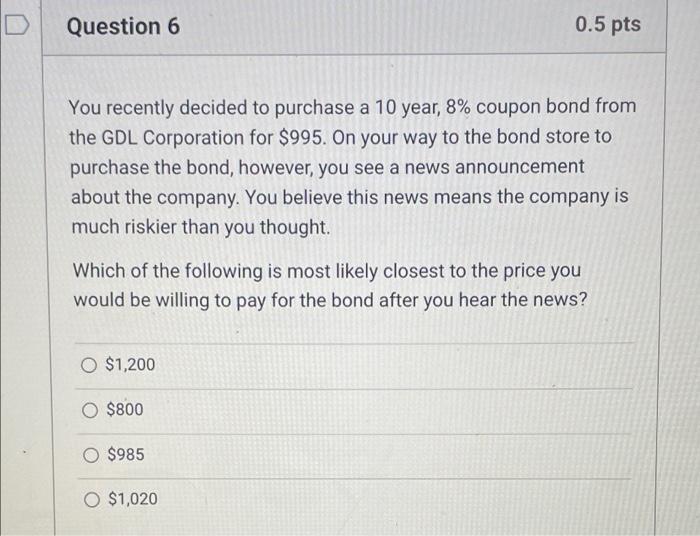

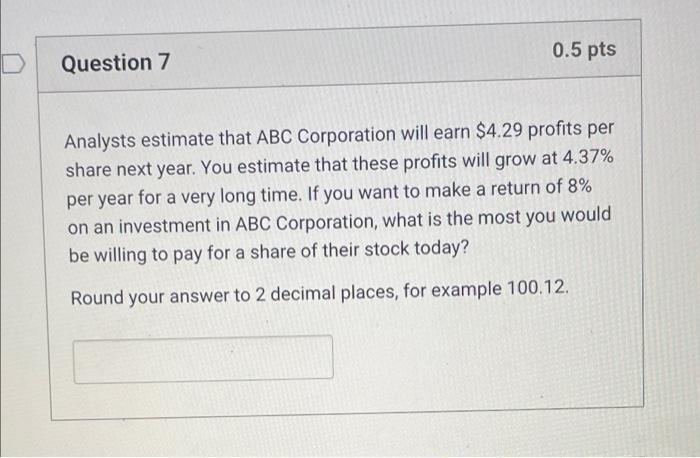

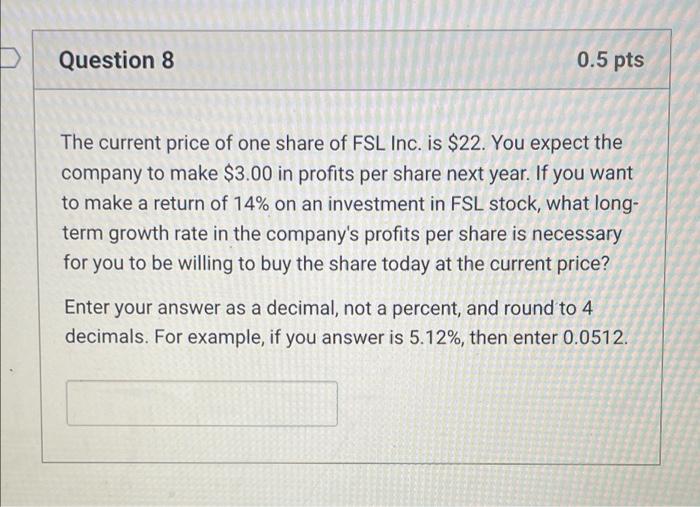

Question 2 0.5 pts How much would you pay for a 6 year, 5% coupon bond if you want a return of 9% on your investment? Assume the bond has a par value of $1,000 and pays coupons annually. Answer to 2 decimal places, for example 100.21. Question 4 0.5 pts A bond matures in 6 years, has a coupon rate of 8% and you require a return of of 11% to purchase this bond. The par value of the bond is $1,000. What is the present value of the bond's coupon payments? Round your answer to 2 decimals places, for example $100.12. Question 5 0.5 pts A bond matures in 15 years, has a coupon rate of 11% and you require a 9.23% return to invest in this bond. The par value of the bond is $1,000 What is the present value of the par payment? Round your answer to 2 decimals places, for example $100.12. Question 6 0.5 pts You recently decided to purchase a 10 year, 8% coupon bond from the GDL Corporation for $995. On your way to the bond store to purchase the bond, however, you see a news announcement about the company. You believe this news means the company is much riskier than you thought. Which of the following is most likely closest to the price you would be willing to pay for the bond after you hear the news? O $1,200 $800 O $985 O $1,020 0.5 pts Question 7 Analysts estimate that ABC Corporation will earn $4.29 profits per share next year. You estimate that these profits will grow at 4.37% per year for a very long time. If you want to make a return of 8% on an investment in ABC Corporation, what is the most you would be willing to pay for a share of their stock today? Round your answer to 2 decimal places, for example 100.12. Question 8 0.5 pts The current price of one share of FSL Inc. is $22. You expect the company to make $3.00 in profits per share next year. If you want to make a return of 14% on an investment in FSL stock, what long- term growth rate in the company's profits per share is necessary for you to be willing to buy the share today at the current price? Enter your answer as a decimal, not a percent, and round to 4 decimals. For example, if you answer is 5.12%, then enter 0.0512