Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 1 1 pts Which of the following statements describes the nature of accrued expenses most appropriately? They are expenses that will be incurred

Question

pts

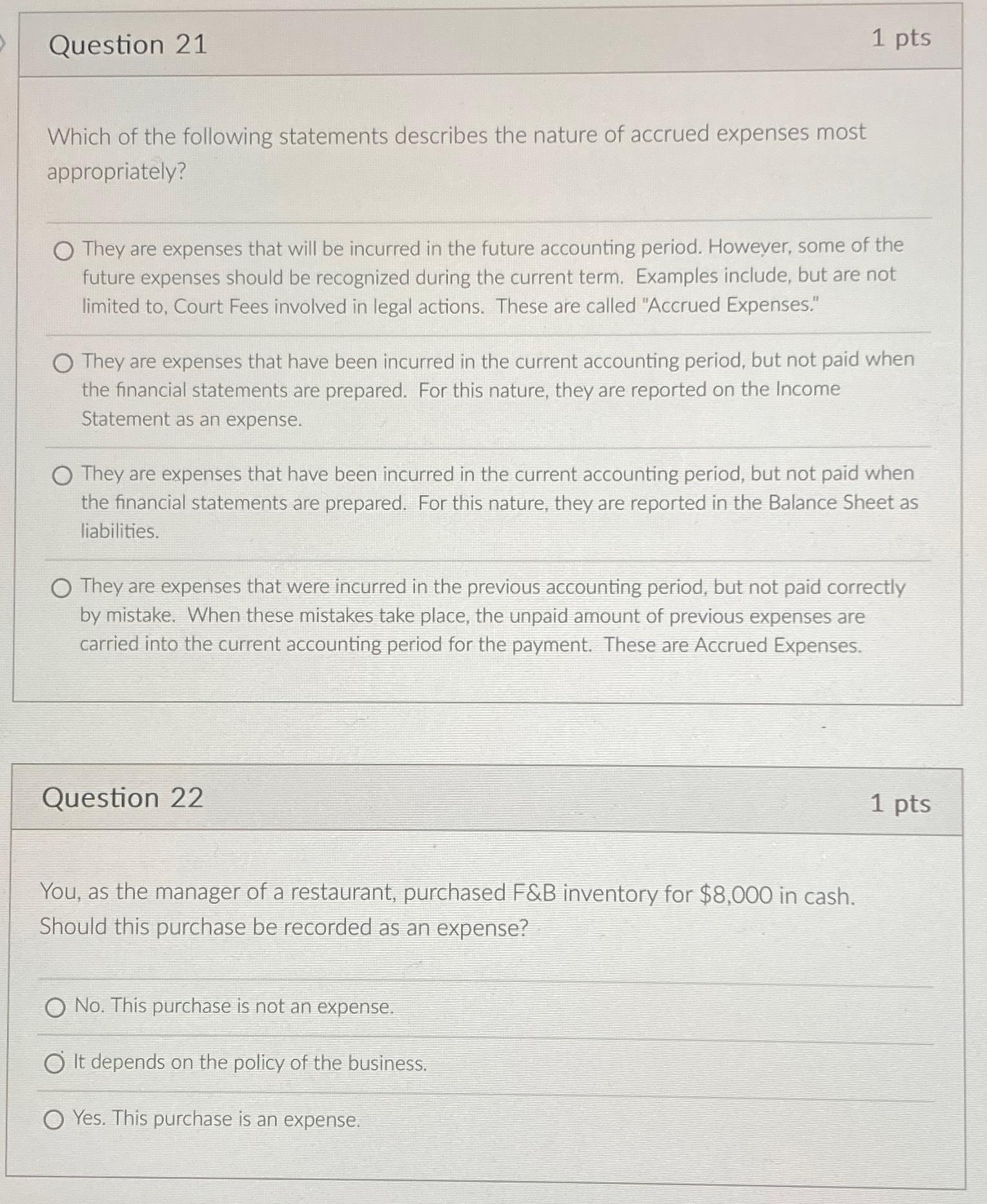

Which of the following statements describes the nature of accrued expenses most appropriately?

They are expenses that will be incurred in the future accounting period. However, some of the future expenses should be recognized during the current term. Examples include, but are not limited to Court Fees involved in legal actions. These are called "Accrued Expenses."

They are expenses that have been incurred in the current accounting period, but not paid when the financial statements are prepared. For this nature, they are reported on the Income Statement as an expense.

They are expenses that have been incurred in the current accounting period, but not paid when the financial statements are prepared. For this nature, they are reported in the Balance Sheet as liabilities.

They are expenses that were incurred in the previous accounting period, but not paid correctly by mistake. When these mistakes take place, the unpaid amount of previous expenses are carried into the current accounting period for the payment. These are Accrued Expenses.

Question

pts

You, as the manager of a restaurant, purchased & inventory for $ in cash. Should this purchase be recorded as an expense?

No This purchase is not an expense.

It depends on the policy of the business.

Yes. This purchase is an expense.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started