Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 . 1 7 Mr A . Miller is a young financial director of a listed company. Although he enjoys his work, he wants

Question

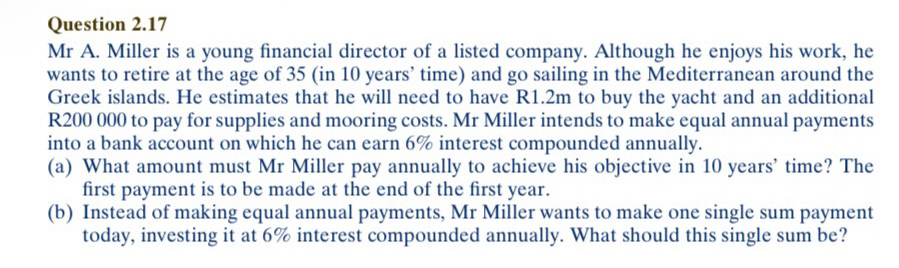

Mr A Miller is a young financial director of a listed company. Although he enjoys his work, he wants to retire at the age of in years' time and go sailing in the Mediterranean around the Greek islands. He estimates that he will need to have Rm to buy the yacht and an additional R to pay for supplies and mooring costs. Mr Miller intends to make equal annual payments into a bank account on which he can earn interest compounded annually.

a What amount must Mr Miller pay annually to achieve his objective in years' time? The first payment is to be made at the end of the first year.

b Instead of making equal annual payments, Mr Miller wants to make one single sum payment today, investing it at interest compounded annually. What should this single sum be

Note : this is a financial management Question

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started