Answered step by step

Verified Expert Solution

Question

1 Approved Answer

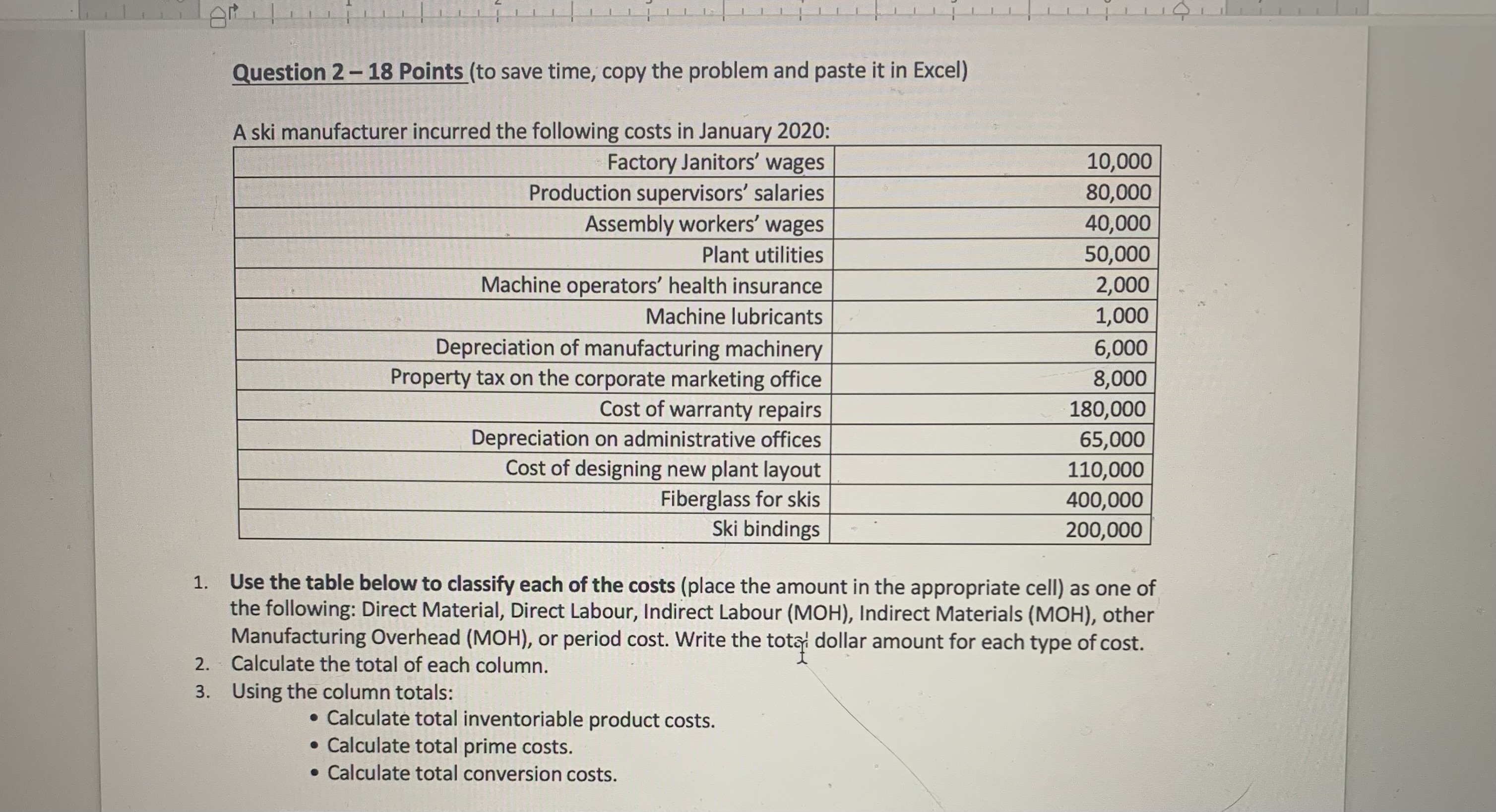

Question 2 - 1 8 Points ( to save time, copy the problem and paste it in Excel ) A ski manufacturer incurred the following

Question Points to save time, copy the problem and paste it in Excel

A ski manufacturer incurred the following costs in January :

tableFactory Janitors' wages,Production supervisors' salaries,Assembly workers' wages,Plant utilities,Machine operators' health insurance,Machine lubricants,Depreciation of manufacturing machinery,Property tax on the corporate marketing office,Cost of warranty repairs,Depreciation on administrative offices,Cost of designing new plant layout,Fiberglass for skis,Ski bindings,

Use the table below to classify each of the costs place the amount in the appropriate cell as one of the following: Direct Material, Direct Labour, Indirect Labour MOH Indirect Materials MOH other Manufacturing Overhead or period cost. Write the totar dollar amount for each type of cost

Calculate the total of each column.

Using the column totals:

Calculate total inventoriable product costs.

Calculate total prime costs.

Calculate total conversion costs.

Question Points to save time, copy the problem and paste it in Excel

A ski manufacturer incurred the following costs in January :

tableFactory Janitors' wages,Production supervisors' salaries,Assembly workers' wages,Plant utilities,Machine operators' health insurance,Machine lubricants,Depreciation of manufacturing machinery,Property tax on the corporate marketing office,Cost of warranty repairs,Depreciation on administrative offices,Cost of designing new plant layout,Fiberglass for skis,Ski bindings,

Use the table below to classify each of the costs place the amount in the appropriate cell as one of the following: Direct Material, Direct Labour, Indirect Labour MOH Indirect Materials MOH other Manufacturing Overhead or period cost. Write the totar dollar amount for each type of cost

Calculate the total of each column.

Using the column totals:

Calculate total inventoriable product costs.

Calculate total prime costs.

Calculate total conversion costs.

Use the table below to classify each of the costs place the amount in the appropriate cell as one of the following: Direct Material, Direct Labour, Indirect Labour MOH Indirect Materials MOH other Manufacturing Overhead or period cost. Write the total dollar amount for each type of cost

Calculate the total of each column.

Using the column totals:

Calculate total inventoriable product costs.

Calculate total prime costs.

Calculate total conversion costs.

tableDescriptiontableDirectMaterialtableDirectLabourtableIndirectbabourMOHtableIndirectMaterial

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started