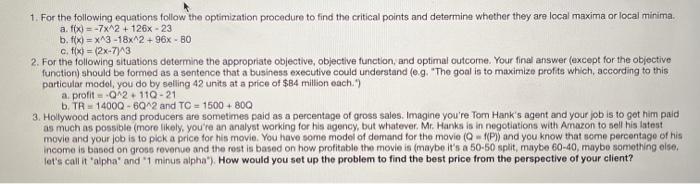

1. For the following equations follow the optimization procedure to find the critical points and determine whether they are local maxima or local minima. a fix) = -7x^2 + 126x - 23 b. f(x) = x^3 -18x^2 +96x - BO cfx} = (2x-7743 2. For the following situations determine the appropriate objective, objective function, and optimal outcome. Your final answer (except for the objective function) should be formed as a sentence that a business executive could understand (eg. "The goal is to maximize profits which, according to this particular model, you do by selling 42 units at a price of $84 million euch.) a profit 0 2110-21 b. TR - 14000-60-2 and TC = 1500 - 800 3. Hollywood actors and producers are sometimes paid as a percentage of gross sales. Imagine you're Tom Hank's agent and your job is to get him puld as much as possible (more likely, you're an analyst working for his agency, but whatever. Mr. Hanks is in negotiations with Amazon to sell his latest movie and your job is to plok a price for his movie. You have some model of demand for the movie (QP) and you know that some percentage of his income is based on gross rovenue and the rest is based on how profitable the movie is (maybe it's a 50-50 split, maybe 60-40, maybe something else, let's call it'alpha" and "1 minus alpha"). How would you set up the problem to find the best price from the perspective of your client? 1. For the following equations follow the optimization procedure to find the critical points and determine whether they are local maxima or local minima. a fix) = -7x^2 + 126x - 23 b. f(x) = x^3 -18x^2 +96x - BO cfx} = (2x-7743 2. For the following situations determine the appropriate objective, objective function, and optimal outcome. Your final answer (except for the objective function) should be formed as a sentence that a business executive could understand (eg. "The goal is to maximize profits which, according to this particular model, you do by selling 42 units at a price of $84 million euch.) a profit 0 2110-21 b. TR - 14000-60-2 and TC = 1500 - 800 3. Hollywood actors and producers are sometimes paid as a percentage of gross sales. Imagine you're Tom Hank's agent and your job is to get him puld as much as possible (more likely, you're an analyst working for his agency, but whatever. Mr. Hanks is in negotiations with Amazon to sell his latest movie and your job is to plok a price for his movie. You have some model of demand for the movie (QP) and you know that some percentage of his income is based on gross rovenue and the rest is based on how profitable the movie is (maybe it's a 50-50 split, maybe 60-40, maybe something else, let's call it'alpha" and "1 minus alpha"). How would you set up the problem to find the best price from the perspective of your client