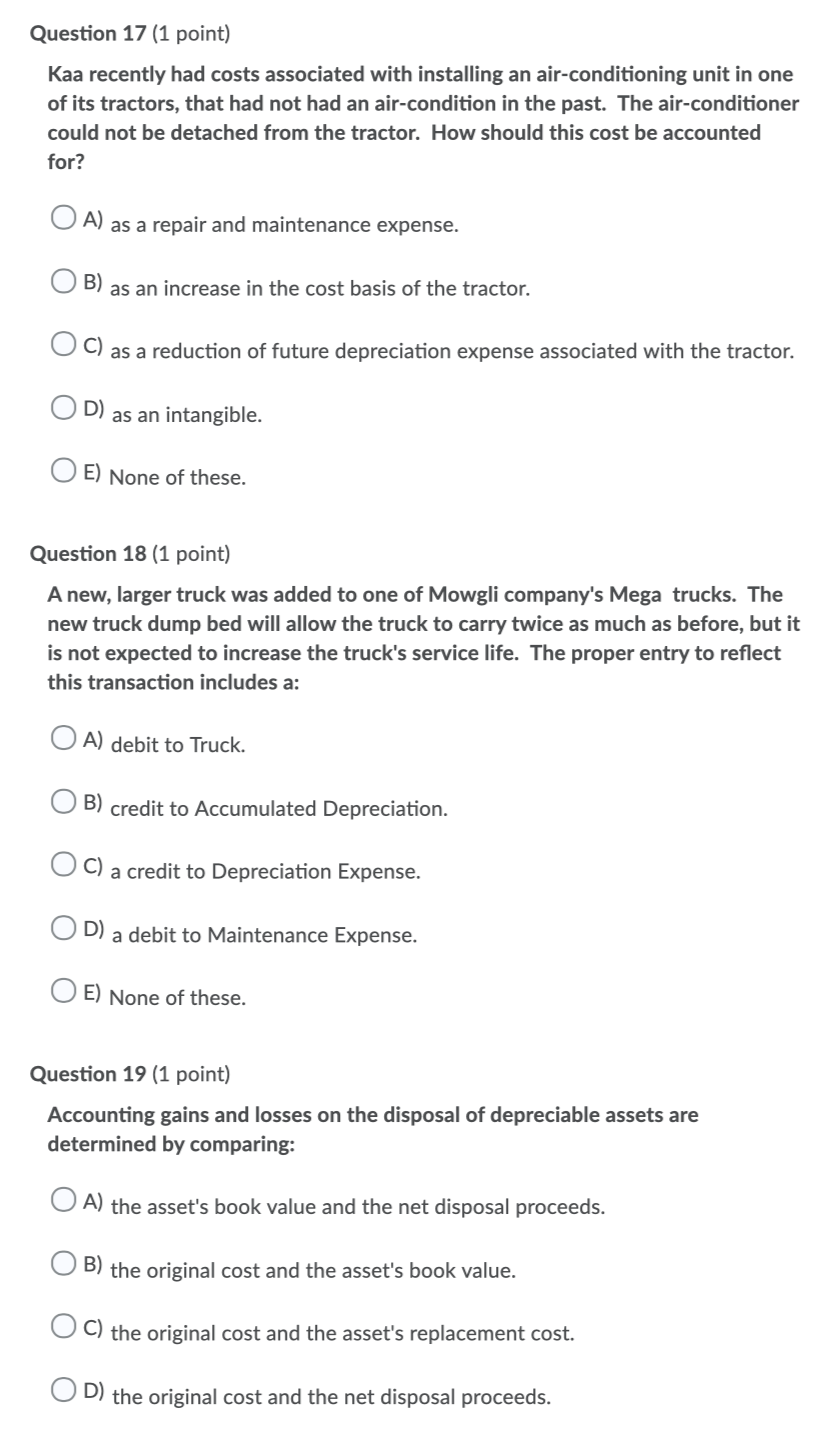

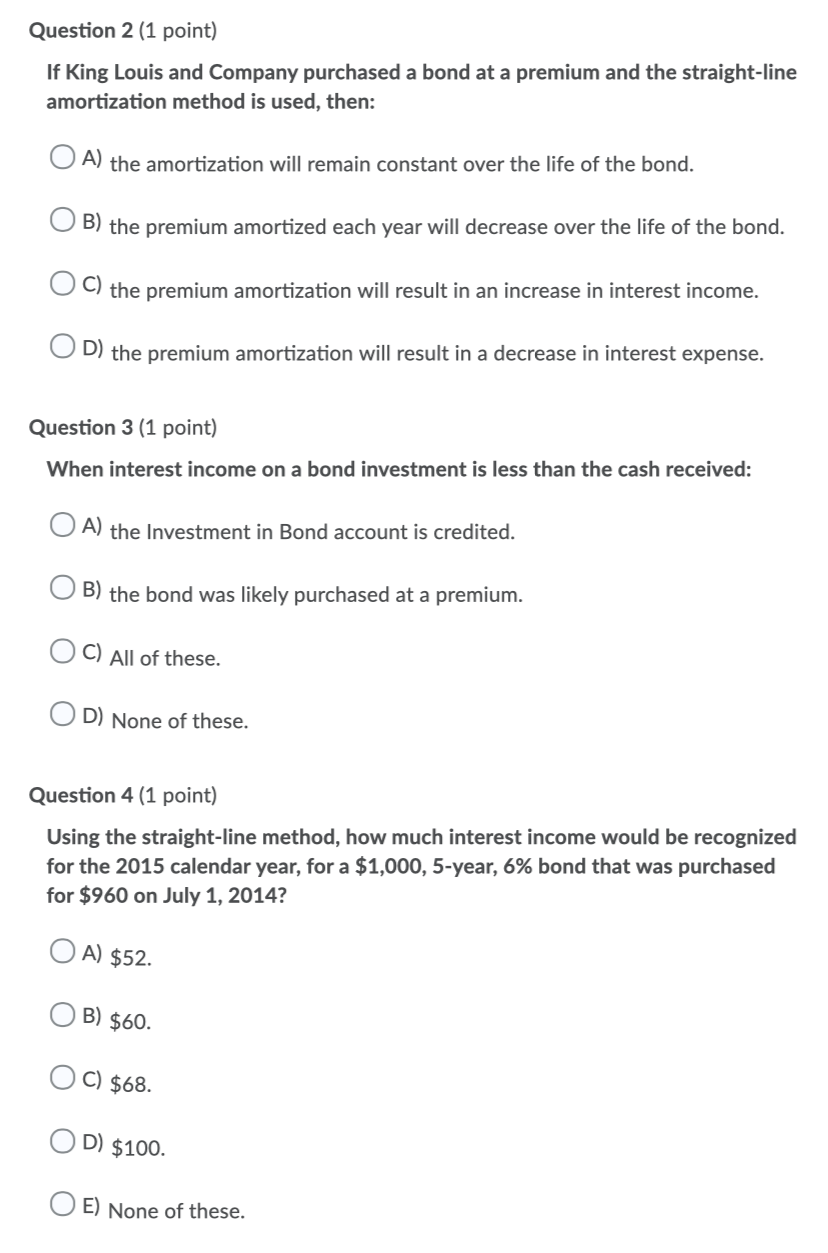

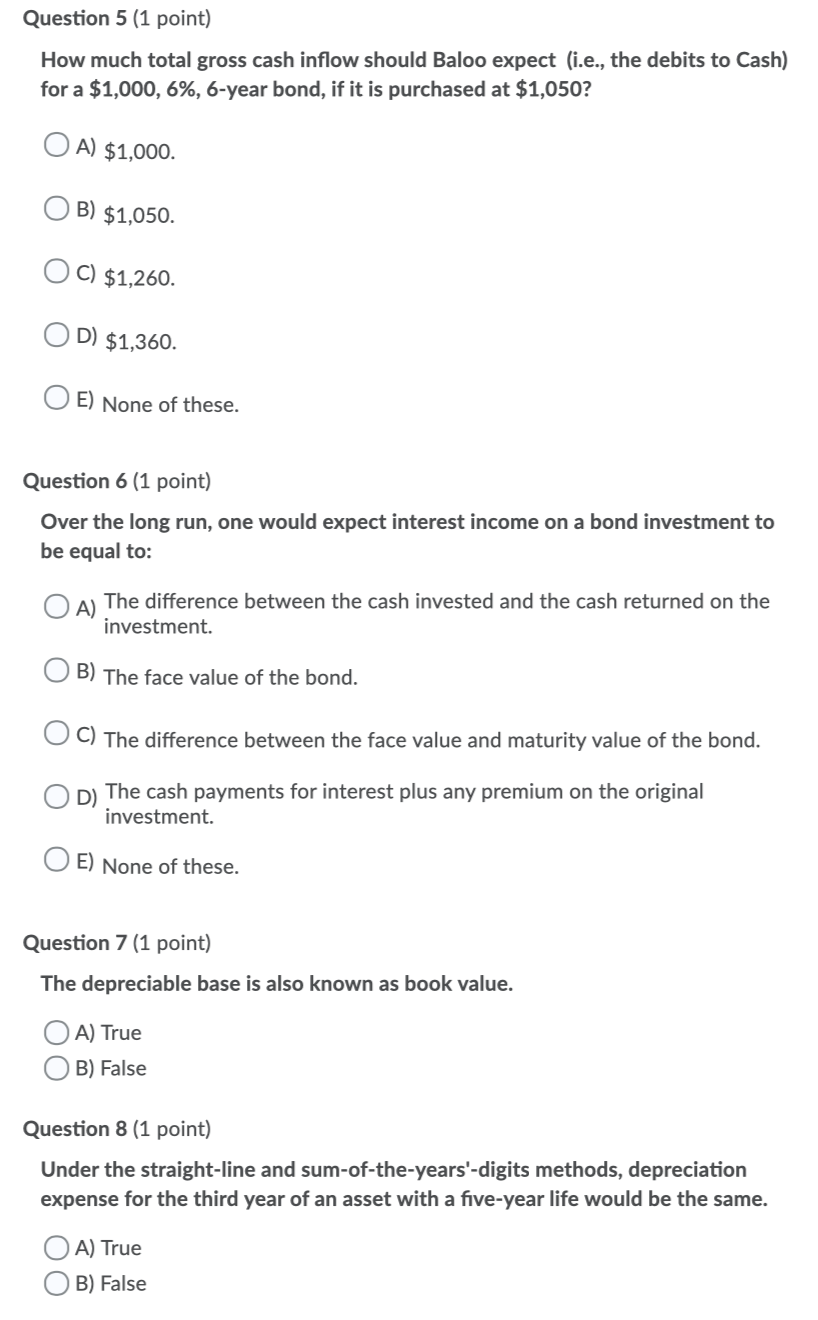

Question 2 (1 point) If King Louis and Company purchased a bond at a premium and the straight-line amortization method is used, then: OA) the amortization will remain constant over the life of the bond. OB) the premium amortized each year will decrease over the life of the bond. OC) the premium amortization will result in an increase in interest income. UD) the premium amortization will result in a decrease in interest expense. Question 3 (1 point) When interest income on a bond investment is less than the cash received: OA) the Investment in Bond account is credited. UB) the bond was likely purchased at a premium. OC) All of these. OD) None of these. Question 4 (1 point) Using the straight-line method, how much interest income would be recognized for the 2015 calendar year, for a $1,000, 5-year, 6% bond that was purchased for $960 on July 1, 2014? OA) $52. OB) $60. OC) $68. OD) $100. OE) None of these. Question 5 (1 point) How much total gross cash inflow should Baloo expect i.e., the debits to Cash) for a $1,000, 6%, 6-year bond, if it is purchased at $1,050? O A) $1,000. OB) $1,050. O C) $1,260. OD) $1,360. OE) None of these. Question 6 (1 point) Over the long run, one would expect interest income on a bond investment to be equal to: OA) The difference between the cash invested and the cash returned on the investment. OB) The face value of the bond. C) The difference between the face value and maturity value of the bond. OD) The cash payments for interest plus any premium on the original investment. OE) None of these. Question 7 (1 point) The depreciable base is also known as book value. OA) True OB) False Question 8 (1 point) Under the straight-line and sum-of-the-years'-digits methods, depreciation expense for the third year of an asset with a five-year life would be the same. OA) True OB) False Question 9 (1 point) Changing an estimated useful life for an item of depreciable property will likely entail restating financial statements of prior years. OA) True OB) False Question 10 (1 point) The USA tax rules provide for a depreciation technique known as Straight Line Depreciation. OA) True OB) False Question 11 (1 point) Which of the following items is included in property, plant, and equipment? UA) Buildings and machinery which are idle. OB) Land held for speculation. U C) Land held for future plant expansion. OD) All of the above. OE) None of these. Question 12 (1 point) Which of the following costs is normally a capital expenditure? O A ) Normal installation fees on a long-lived asset. OB) Freight charges incurred on the purchased of new equipment. O C) Interest charges during the active construction period of a new building. OD) All of the above. Cogsworth Company acquired a site for the construction of a clock new plant. Which of the following costs should not be included in the Land account? OA) Surveying fees. OB) Costs to clear and drain the property. C) Real estate commissions on the purchase of the property. OD) Property taxes accruing after the plant is constructed. OE) None of these. Question 14 (1 point) If an asset is simply being scrapped (abandoned), a journal entry is necessary. OA) True OB) False Question 15 (1 point) Costs related to property, plant, and equipment which are incurred subsequent to acquisition should be added to an asset's depreciable base if the: OA) the service life of an asset is prolonged. OB) the quantity of services expected from an asset is increased. U ) the quality of services expected from an asset is improved. OD) Any of the above choices. Question 16 (1 point) Gaston recently incurred costs associated with replacing the oil in one of its tractors. How should this cost be accounted for? OA) As a repair and maintenance expense. OB) As an increase in the cost basis of the tractor. UC) As a reduction of accumulated depreciation associated with the tractor. OD) As an intangible. OE) None of these. Question 17 (1 point) Kaa recently had costs associated with installing an air-conditioning unit in one of its tractors, that had not had an air-condition in the past. The air-conditioner could not be detached from the tractor. How should this cost be accounted for? OA) as a repair and maintenance expense. as an increase in the cost basis of the tractor. O C ) as a reduction of future depreciation expense associated with the tractor. OD) as an intangible. OE) None of these. Question 18 (1 point) A new, larger truck was added to one of Mowgli company's Mega trucks. The new truck dump bed will allow the truck to carry twice as much as before, but it is not expected to increase the truck's service life. The proper entry to reflect this transaction includes a: OA) debit to Truck. OB) credit to Accumulated Depreciation. OC) a credit to Depreciation Expense. D) a debit to Maintenance Expense. OE) None of these. Question 19 (1 point) Accounting gains and losses on the disposal of depreciable assets are determined by comparing: OA) the asset's book value and the net disposal proceeds. OB) the original cost and the asset's book value. OC) the original cost and the asset's replacement cost. D) the original cost and the net disposal proceeds