Answered step by step

Verified Expert Solution

Question

1 Approved Answer

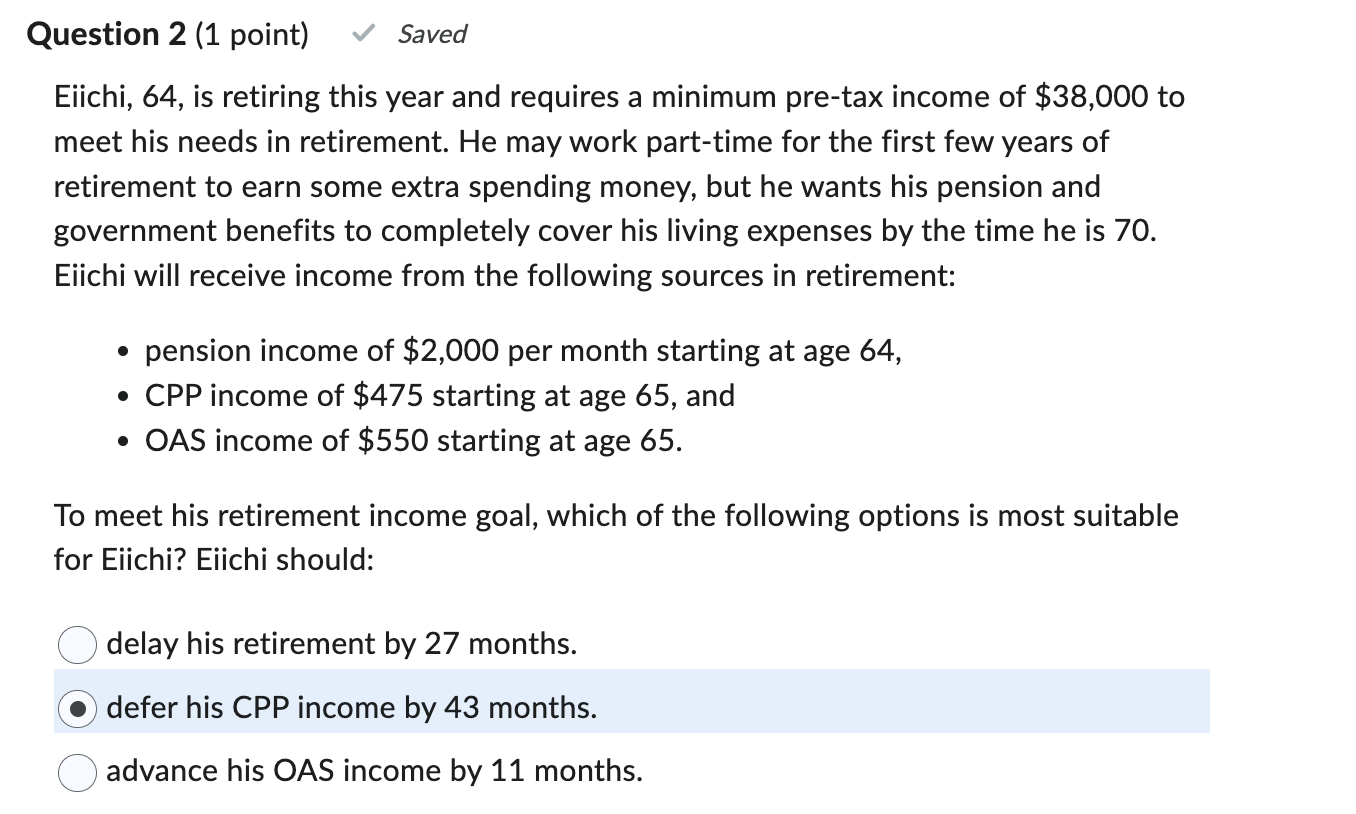

Question 2 ( 1 point ) * * In Canada * * Eiichi, 6 4 , is retiring this year and requires a minimum pre

Question point In Canada

Eiichi, is retiring this year and requires a minimum pretax income of $ to

meet his needs in retirement. He may work parttime for the first few years of

retirement to earn some extra spending money, but he wants his pension and

government benefits to completely cover his living expenses by the time he is

Eiichi will receive income from the following sources in retirement:

pension income of $ per month starting at age

CPP income of $ starting at age and

OAS income of $ starting at age

To meet his retirement income goal, which of the following options is most suitable

for Eiichi? Eiichi should:

delay his retirement by months.

defer his CPP income by months.

advance his OAS income by months.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started