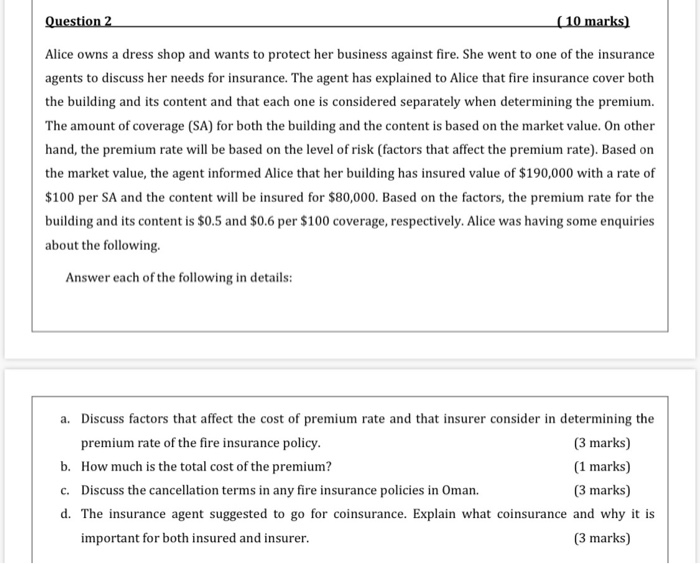

Question 2 (10 marks) Alice owns a dress shop and wants to protect her business against fire. She went to one of the insurance agents to discuss her needs for insurance. The agent has explained to Alice that fire insurance cover both the building and its content and that each one is considered separately when determining the premium. The amount of coverage (SA) for both the building and the content is based on the market value. On other hand, the premium rate will be based on the level of risk factors that affect the premium rate). Based on the market value, the agent informed Alice that her building has insured value of $190,000 with a rate of $100 per SA and the content will be insured for $80,000. Based on the factors, the premium rate for the building and its content is $0.5 and $0.6 per $100 coverage, respectively. Alice was having some enquiries about the following. Answer each of the following in details: a. Discuss factors that affect the cost of premium rate and that insurer consider in determining the premium rate of the fire insurance policy. (3 marks) b. How much is the total cost of the premium? (1 marks) c. Discuss the cancellation terms in any fire insurance policies in Oman. (3 marks) d. The insurance agent suggested to go for coinsurance. Explain what coinsurance and why it is important for both insured and insurer. (3 marks) Question 2 (10 marks) Alice owns a dress shop and wants to protect her business against fire. She went to one of the insurance agents to discuss her needs for insurance. The agent has explained to Alice that fire insurance cover both the building and its content and that each one is considered separately when determining the premium. The amount of coverage (SA) for both the building and the content is based on the market value. On other hand, the premium rate will be based on the level of risk factors that affect the premium rate). Based on the market value, the agent informed Alice that her building has insured value of $190,000 with a rate of $100 per SA and the content will be insured for $80,000. Based on the factors, the premium rate for the building and its content is $0.5 and $0.6 per $100 coverage, respectively. Alice was having some enquiries about the following. Answer each of the following in details: a. Discuss factors that affect the cost of premium rate and that insurer consider in determining the premium rate of the fire insurance policy. (3 marks) b. How much is the total cost of the premium? (1 marks) c. Discuss the cancellation terms in any fire insurance policies in Oman. (3 marks) d. The insurance agent suggested to go for coinsurance. Explain what coinsurance and why it is important for both insured and insurer