Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2. (10 MARKS) Lockheed Martin Inc. a U.S. defense contractor producing ballistic missile defense systems, distributed dividends of $10 per share in 2019 on

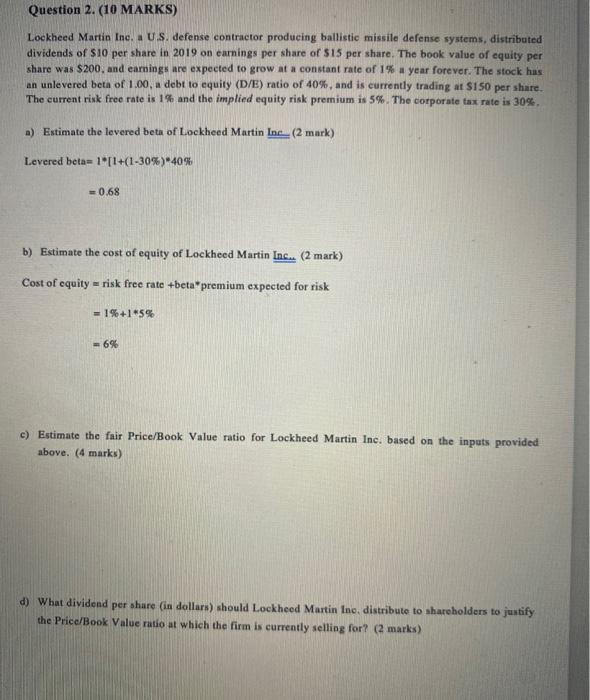

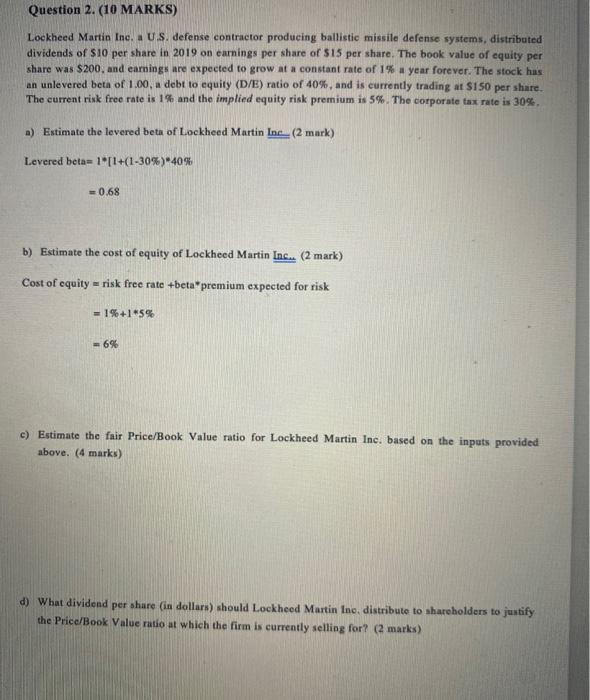

Question 2. (10 MARKS) Lockheed Martin Inc. a U.S. defense contractor producing ballistic missile defense systems, distributed dividends of $10 per share in 2019 on earnings per share of $15 per share. The book value of equity per share was $200, and earnings are expected to grow at a constant rate of 1% a year forever. The stock has an unlevered beta of 1.00, a debt to equity (D/E) ratio of 40%, and is currently trading at $150 per share. The current risk free rate is 1% and the implied equity risk premium is 5%. The corporate tax rate is 30%. a) Estimate the levered beta of Lockheed Martin Inc (2 mark) Levered beta=1"[1+(1-30%)*40% = 0.68 b) Estimate the cost of equity of Lockheed Martin Inc. (2 mark) Cost of equity = risk free rate +beta premium expected for risk = 1% +1.5% = 69 c) Estimate the fair Price/Book Value ratio for Lockheed Martin Inc. based on the inputs provided above. (4 marks) d) What dividend per share (in dollars) should Lockheed Martin Inc, distribute to shareholders to justify the Price/Book Value ratio at which the firm is currently selling for? (2 marks)

Question 2. (10 MARKS) Lockheed Martin Inc. a U.S. defense contractor producing ballistic missile defense systems, distributed dividends of $10 per share in 2019 on earnings per share of $15 per share. The book value of equity per share was $200, and earnings are expected to grow at a constant rate of 1% a year forever. The stock has an unlevered beta of 1.00, a debt to equity (D/E) ratio of 40%, and is currently trading at $150 per share. The current risk free rate is 1% and the implied equity risk premium is 5%. The corporate tax rate is 30%. a) Estimate the levered beta of Lockheed Martin Inc (2 mark) Levered beta=1"[1+(1-30%)*40% = 0.68 b) Estimate the cost of equity of Lockheed Martin Inc. (2 mark) Cost of equity = risk free rate +beta premium expected for risk = 1% +1.5% = 69 c) Estimate the fair Price/Book Value ratio for Lockheed Martin Inc. based on the inputs provided above. (4 marks) d) What dividend per share (in dollars) should Lockheed Martin Inc, distribute to shareholders to justify the Price/Book Value ratio at which the firm is currently selling for? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started