Answered step by step

Verified Expert Solution

Question

1 Approved Answer

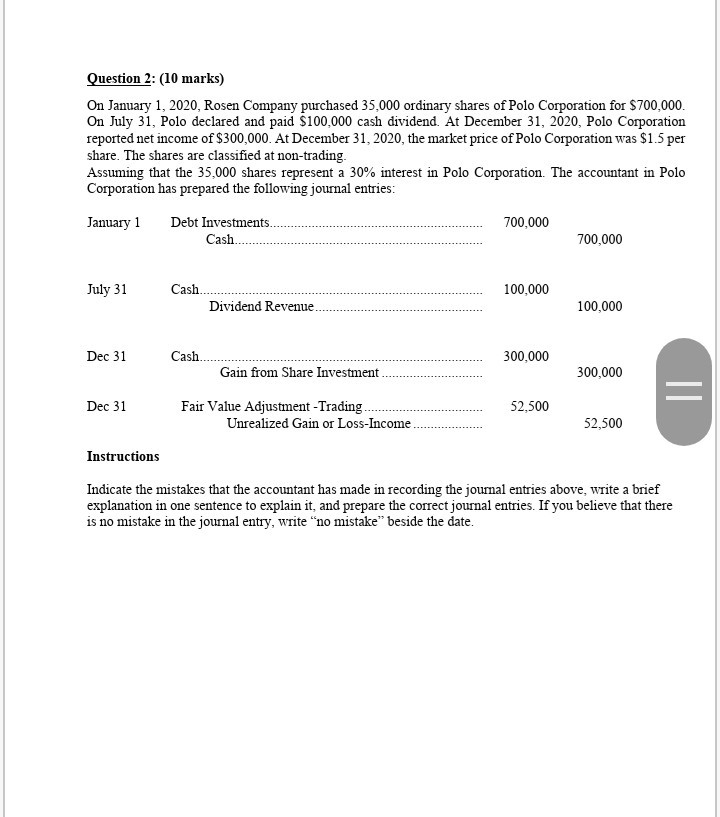

Question 2: (10 marks) On January 1, 2020, Rosen Company purchased 35,000 ordinary shares of Polo Corporation for $700,000. On July 31, Polo declared and

Question 2: (10 marks) On January 1, 2020, Rosen Company purchased 35,000 ordinary shares of Polo Corporation for $700,000. On July 31, Polo declared and paid $100,000 cash dividend. At December 31, 2020, Polo Corporation reported net income of $300,000. At December 31, 2020, the market price of Polo Corporation was $1.5 per share. The shares are classified at non-trading. Assuming that the 35,000 shares represent a 30% interest in Polo Corporation. The accountant in Polo Corporation has prepared the following journal entries: January 1 700,000 Debt Investments........ Cash..................................................................... 700,000 July 31 100,000 Cash. Dividend Revenue........... 100,000 Dec 31 Cash.. 300,000 Gain from Share Investment 300,000 Dec 31 52,500 Fair Value Adjustment -Trading. Unrealized Gain or Loss-Income............. 52,500 Instructions Indicate the mistakes that the accountant has made in recording the journal entries above, write a brief explanation in one sentence to explain it, and prepare the correct journal entries. If you believe that there is no mistake in the journal entry, write "no mistake beside the date

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started