Question

Question #2 - (10 marks): The date is Jan 1, 2021 and you are a financial consultant that has been hired by Leenan Capital Inc.

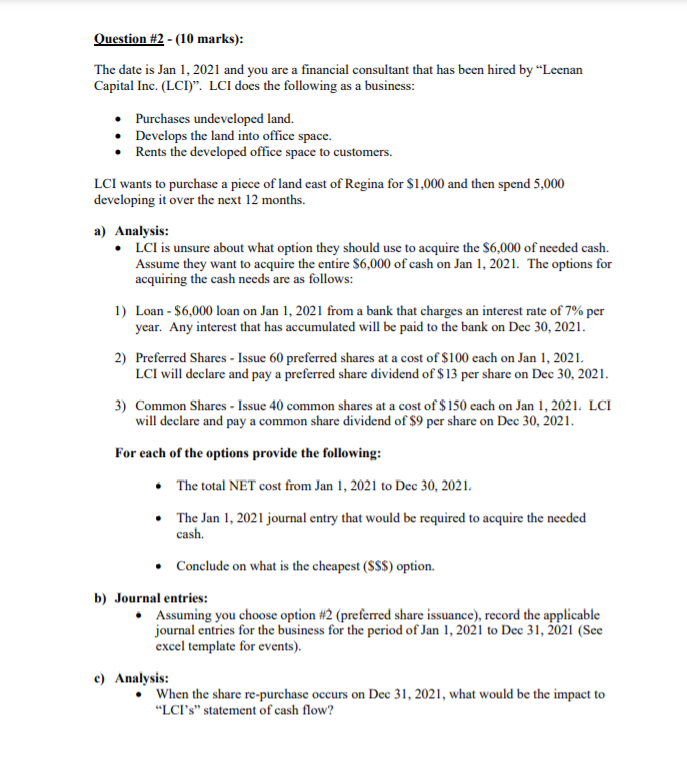

Question #2 - (10 marks): The date is Jan 1, 2021 and you are a financial consultant that has been hired by Leenan Capital Inc. (LCI). LCI does the following as a business: Purchases undeveloped land. Develops the land into office space. Rents the developed office space to customers. LCI wants to purchase a piece of land east of Regina for $1,000 and then spend 5,000 developing it over the next 12 months. a) Analysis: LCI is unsure about what option they should use to acquire the $6,000 of needed cash. Assume they want to acquire the entire $6,000 of cash on Jan 1, 2021. The options for acquiring the cash needs are as follows: 1) Loan - $6,000 loan on Jan 1, 2021 from a bank that charges an interest rate of 7% per year. Any interest that has accumulated will be paid to the bank on Dec 30, 2021. 2) Preferred Shares - Issue 60 preferred shares at a cost of $100 each on Jan 1, 2021. LCI will declare and pay a preferred share dividend of $13 per share on Dec 30, 2021. 3) Common Shares - Issue 40 common shares at a cost of $150 each on Jan 1, 2021. LCI will declare and pay a common share dividend of $9 per share on Dec 30, 2021. For each of the options provide the following: The total NET cost from Jan 1, 2021 to Dec 30, 2021. The Jan 1, 2021 journal entry that would be required to acquire the needed cash. Conclude on what is the cheapest ($$$) option. b) Journal entries: Assuming you choose option #2 (preferred share issuance), record the applicable journal entries for the business for the period of Jan 1, 2021 to Dec 31, 2021 (See excel template for events). c) Analysis: When the share re-purchase occurs on Dec 31, 2021, what would be the impact to LCIs statement of cash flow?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started