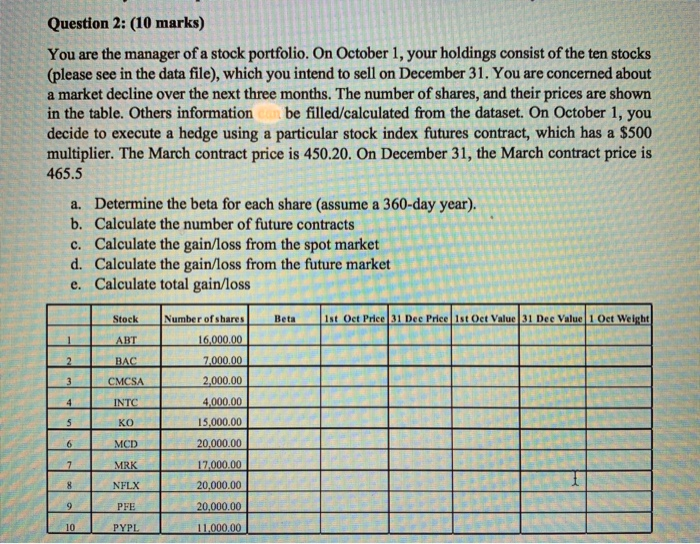

Question 2: (10 marks) You are the manager of a stock portfolio. On October 1, your holdings consist of the ten stocks (please see in the data file), which you intend to sell on December 31. You are concerned about a market decline over the next three months. The number of shares, and their prices are shown in the table. Others information be filled/calculated from the dataset. On October 1, you decide to execute a hedge using a particular stock index futures contract, which has a $500 multiplier. The March contract price is 450.20. On December 31, the March contract price is 465.5 a. Determine the beta for each share (assume a 360-day year). b. Calculate the number of future contracts c. Calculate the gain/loss from the spot market d. Calculate the gain/loss from the future market e. Calculate total gain/loss Stock Number of shares Beta 1st Oct Price 31 Dee Price 1st Oct Value 31 Dec Value 1 Oct Weight ABT 16,000.00 2 BAC 3 CMCSA 4 INTC 7,000.00 2,000.00 4,000.00 15,000.00 20,000.00 17,000.00 5 KO 6 MCD 7 MRK 8 NFLX 9 PFE 20,000.00 20,000.00 11.000,00 10 PYPL Question 2: (10 marks) You are the manager of a stock portfolio. On October 1, your holdings consist of the ten stocks (please see in the data file), which you intend to sell on December 31. You are concerned about a market decline over the next three months. The number of shares, and their prices are shown in the table. Others information be filled/calculated from the dataset. On October 1, you decide to execute a hedge using a particular stock index futures contract, which has a $500 multiplier. The March contract price is 450.20. On December 31, the March contract price is 465.5 a. Determine the beta for each share (assume a 360-day year). b. Calculate the number of future contracts c. Calculate the gain/loss from the spot market d. Calculate the gain/loss from the future market e. Calculate total gain/loss Stock Number of shares Beta 1st Oct Price 31 Dee Price 1st Oct Value 31 Dec Value 1 Oct Weight ABT 16,000.00 2 BAC 3 CMCSA 4 INTC 7,000.00 2,000.00 4,000.00 15,000.00 20,000.00 17,000.00 5 KO 6 MCD 7 MRK 8 NFLX 9 PFE 20,000.00 20,000.00 11.000,00 10 PYPL