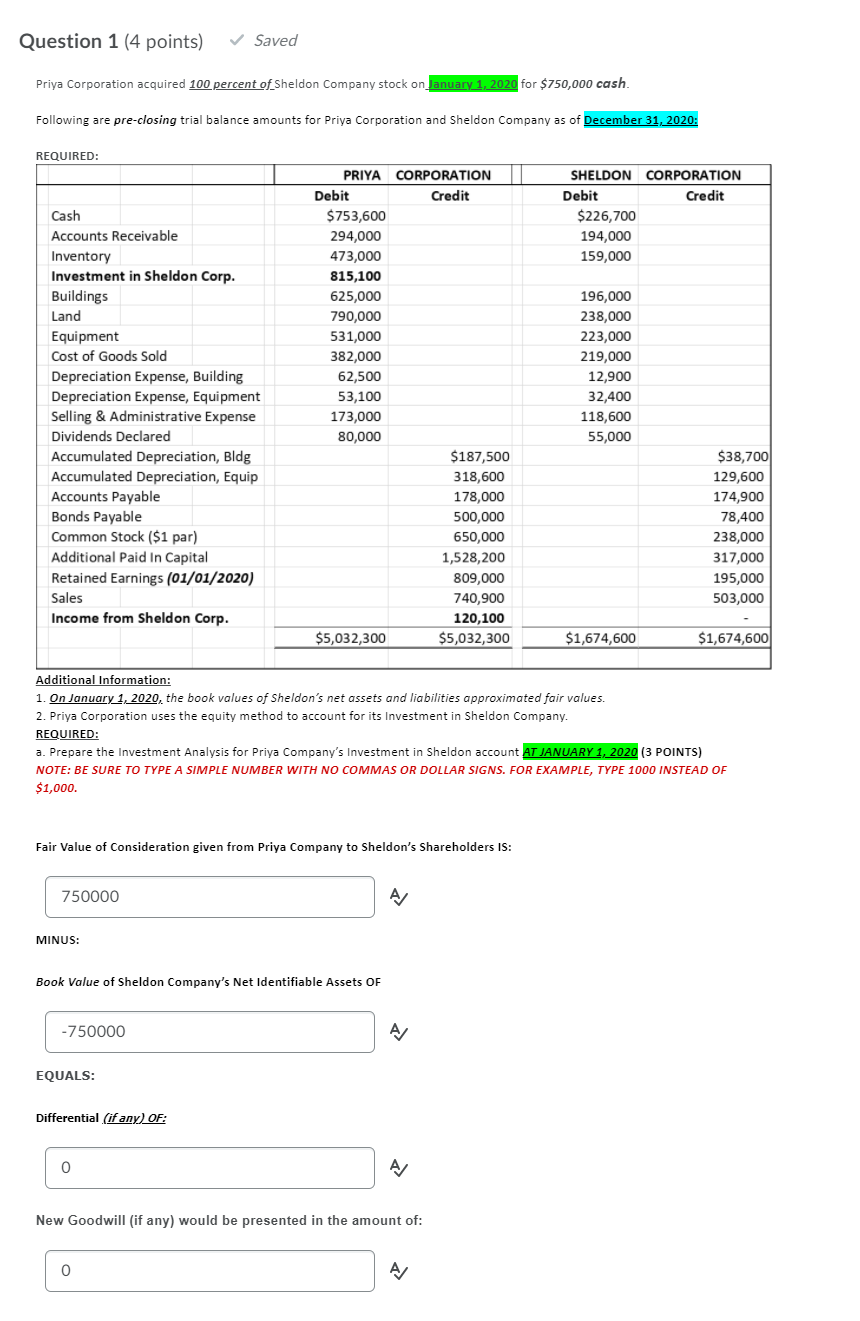

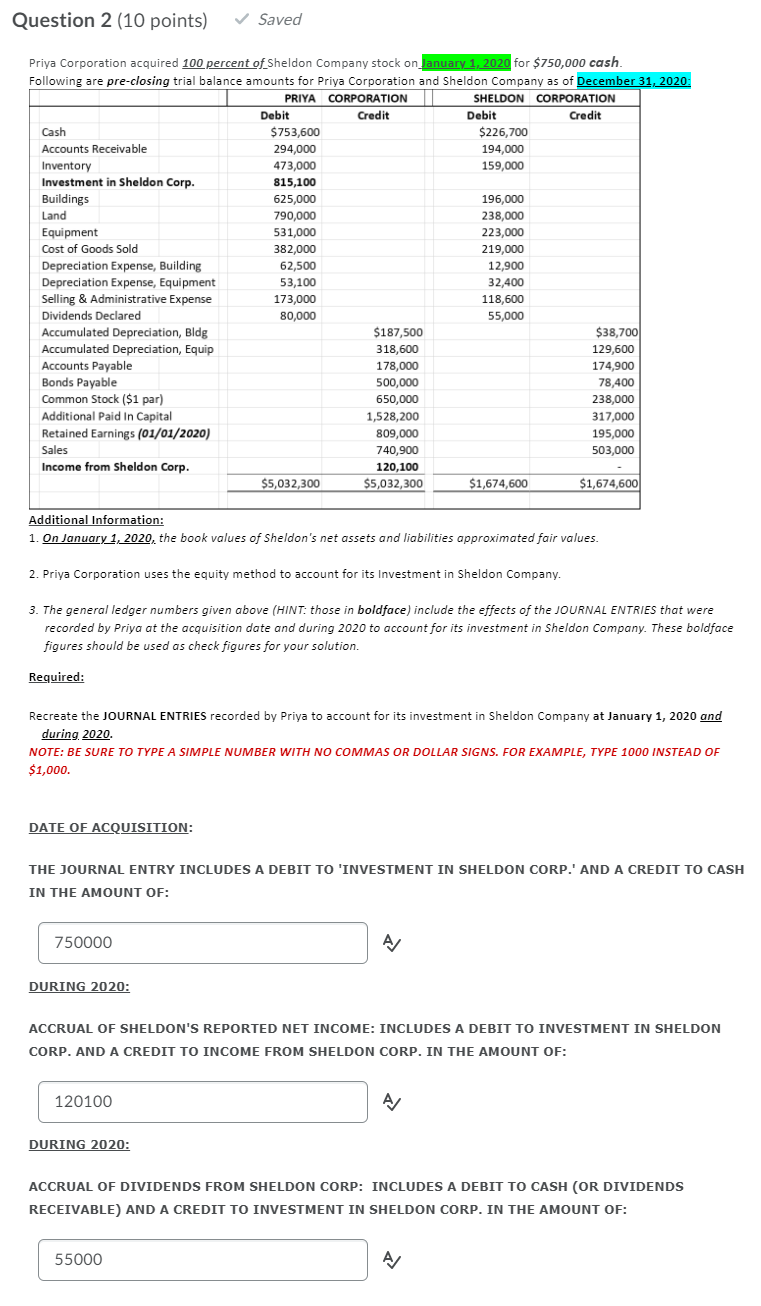

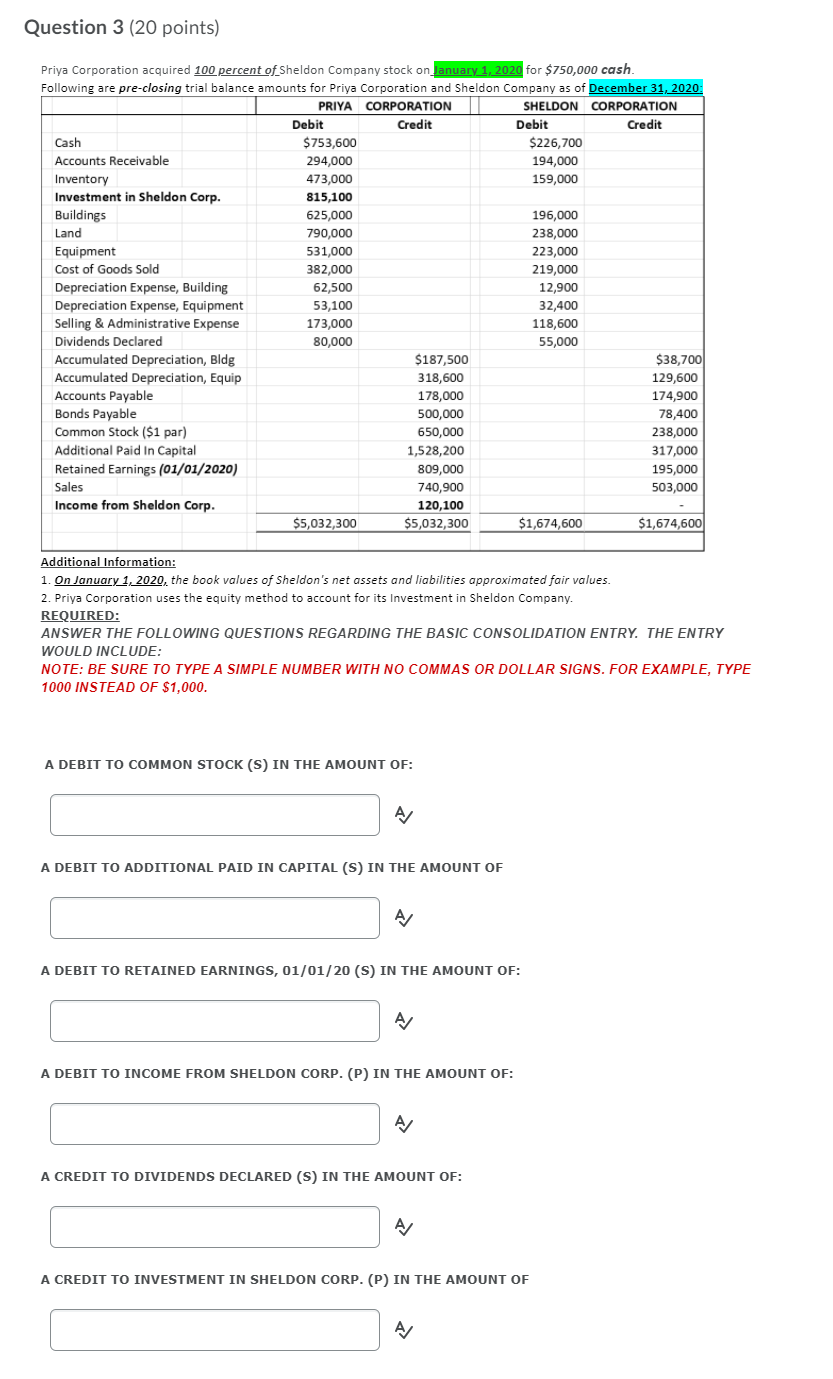

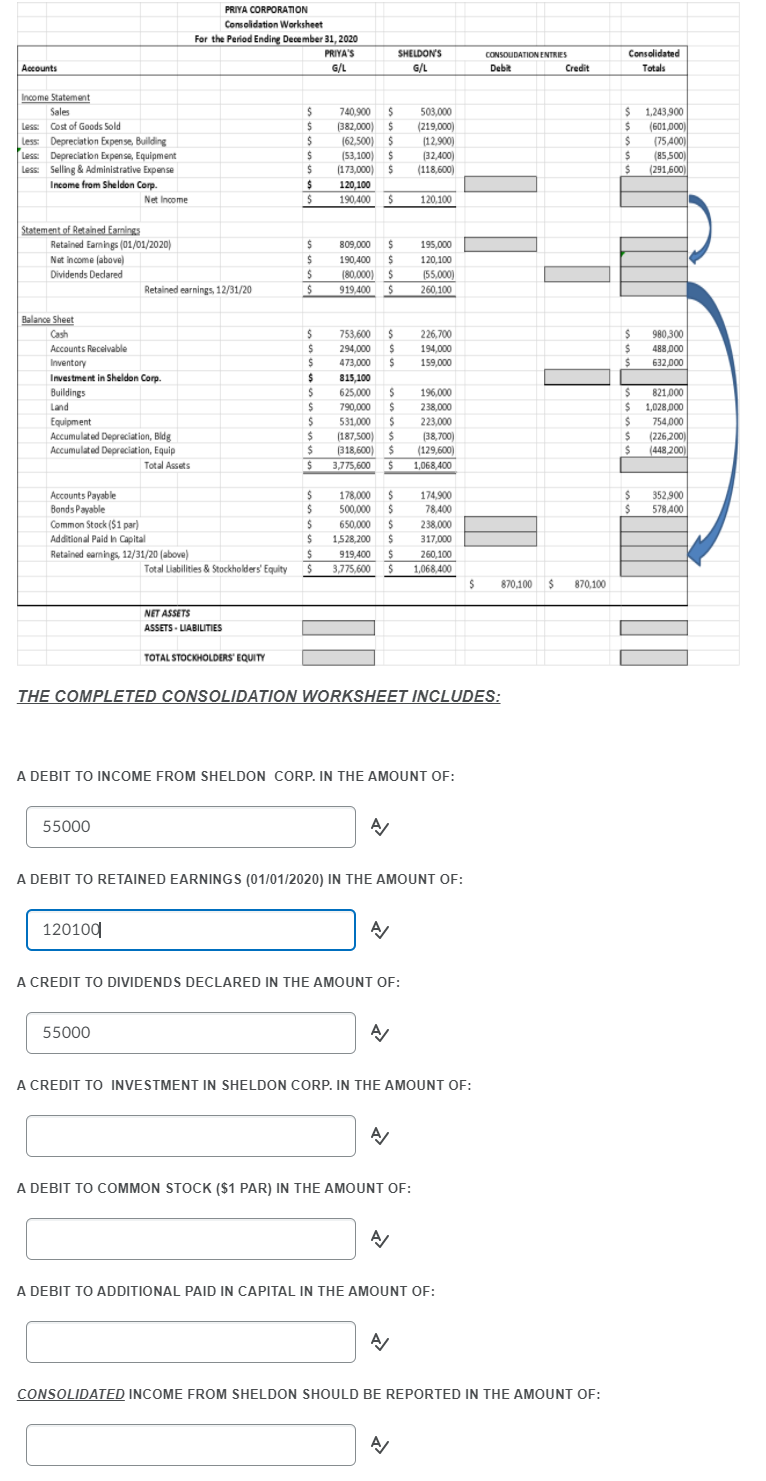

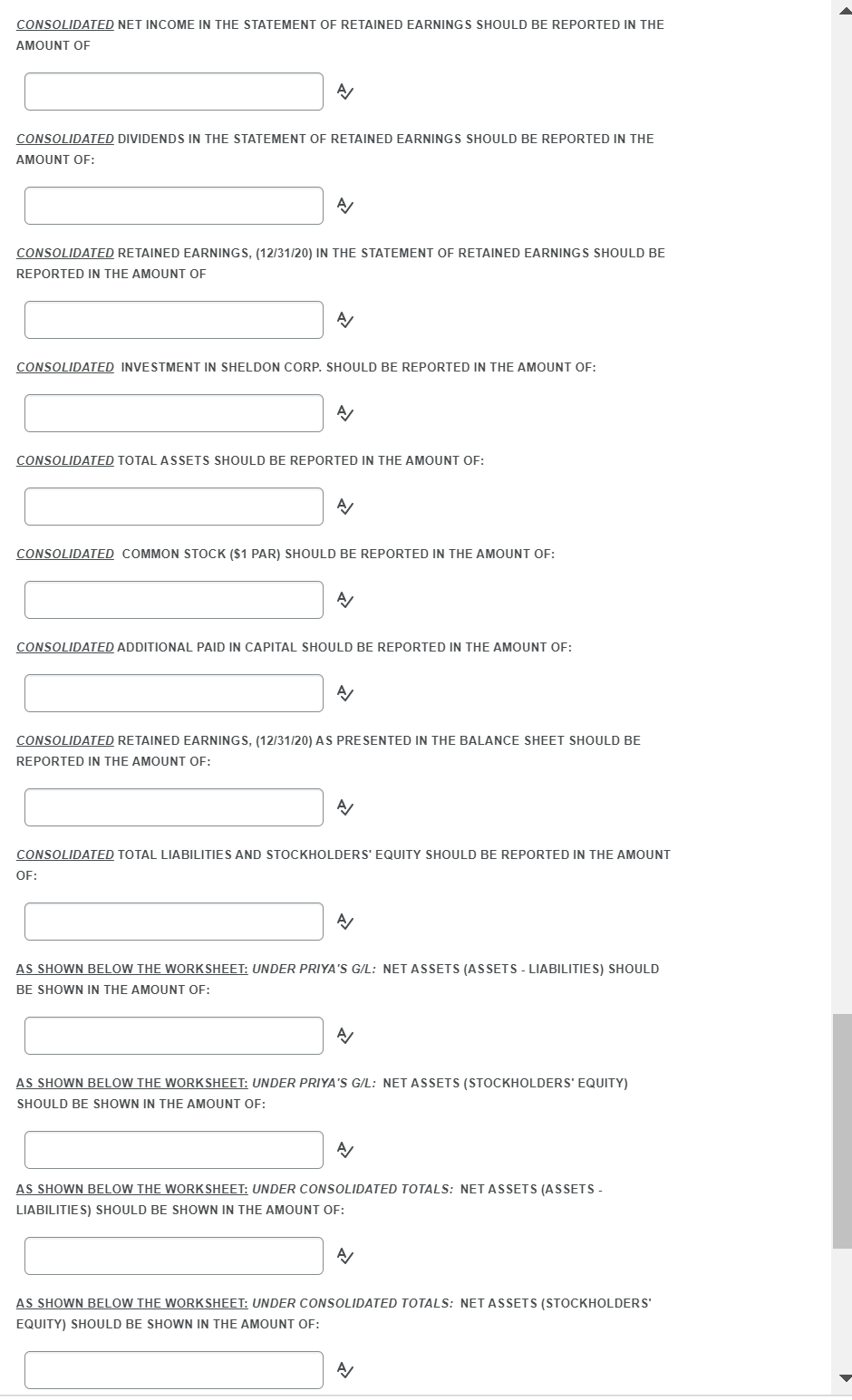

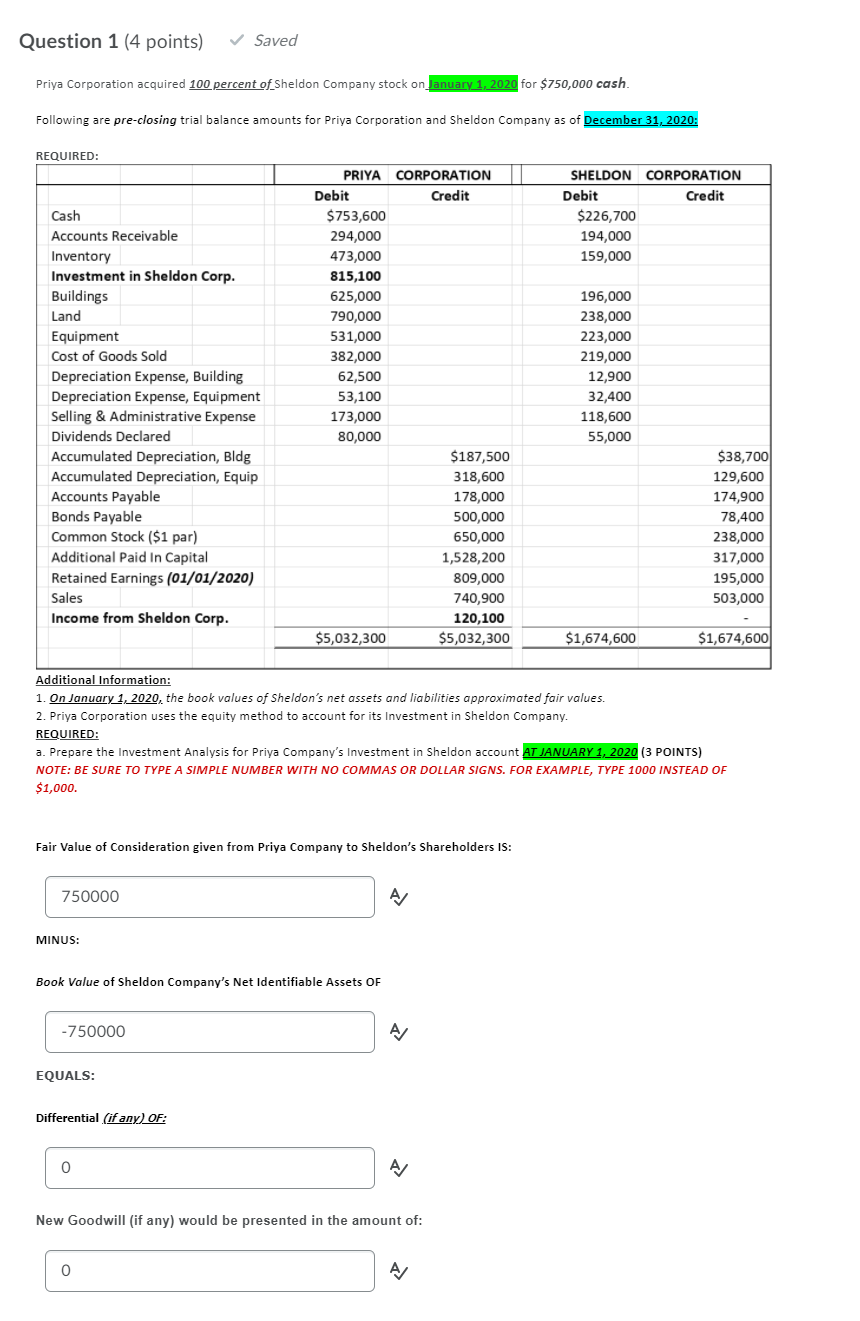

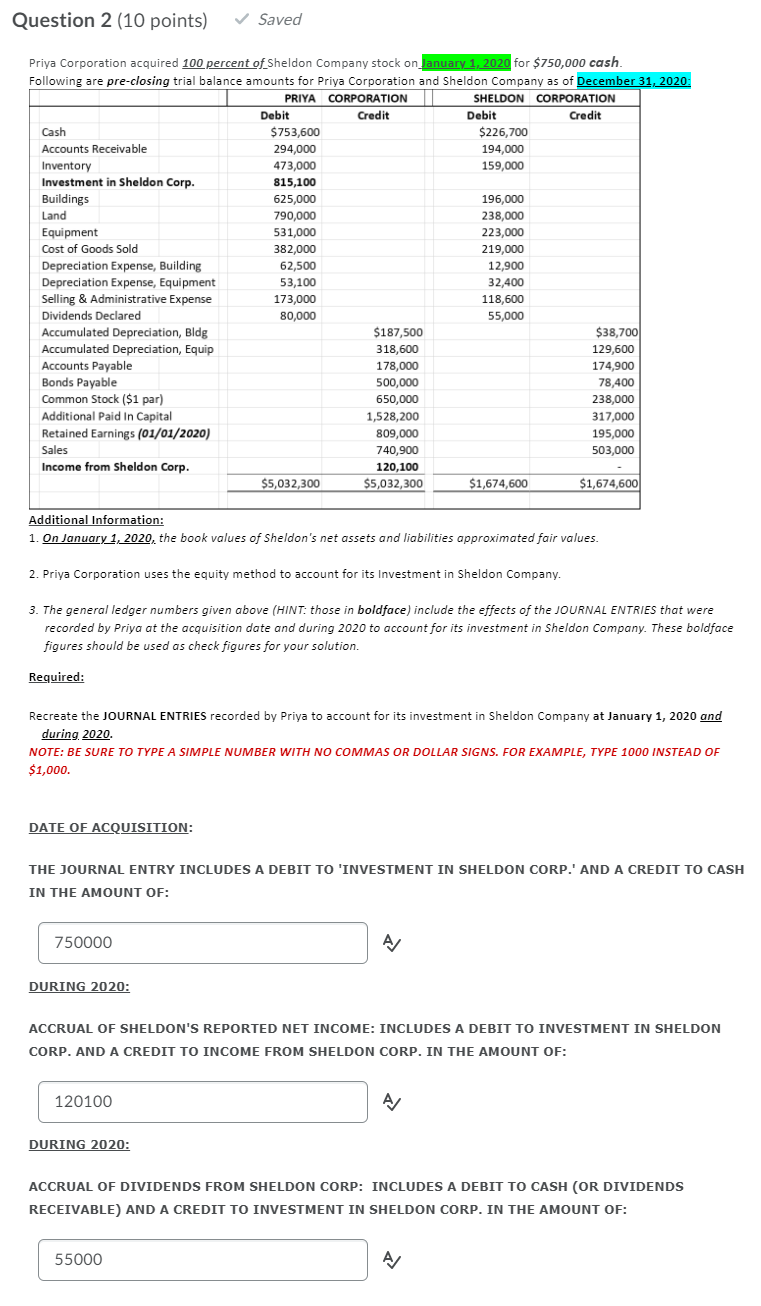

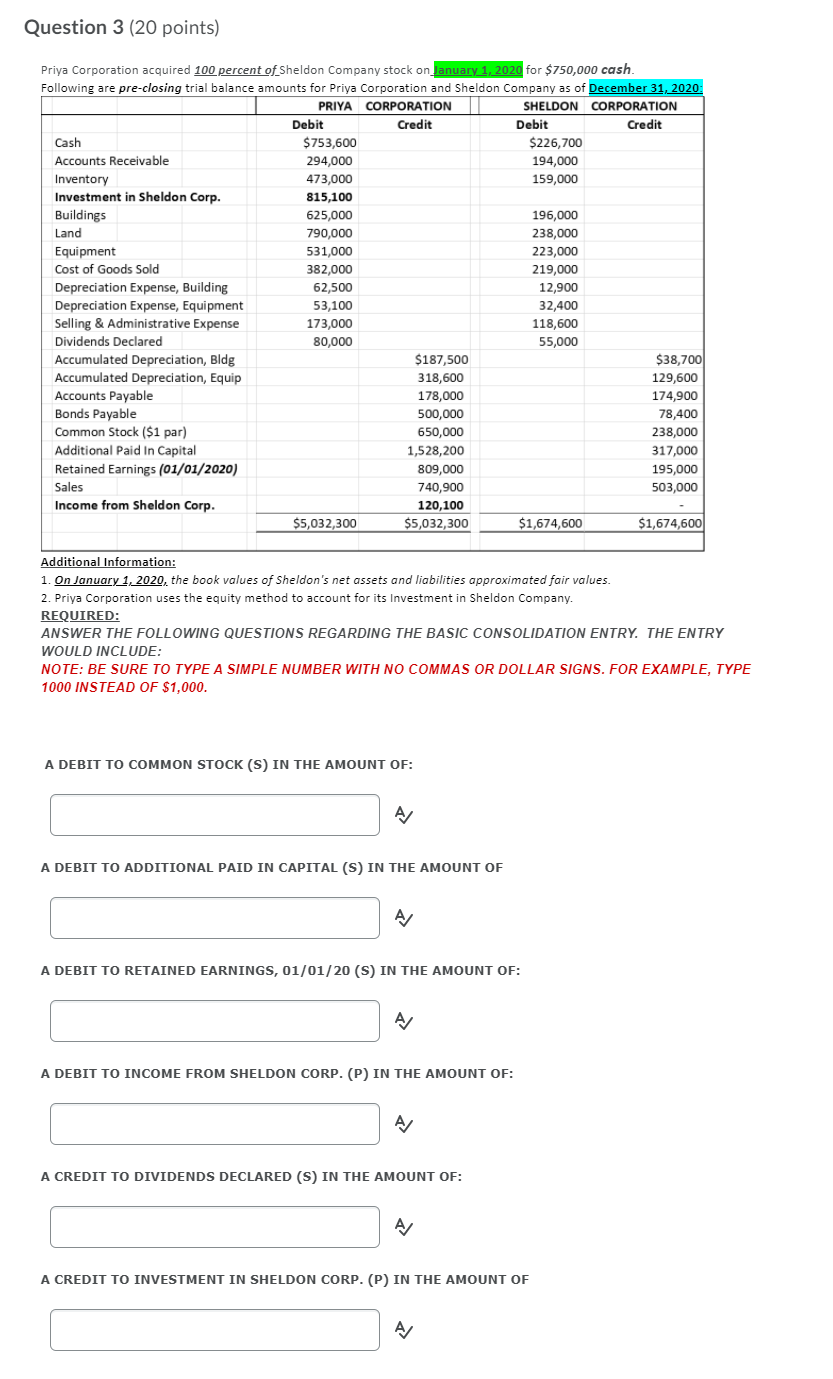

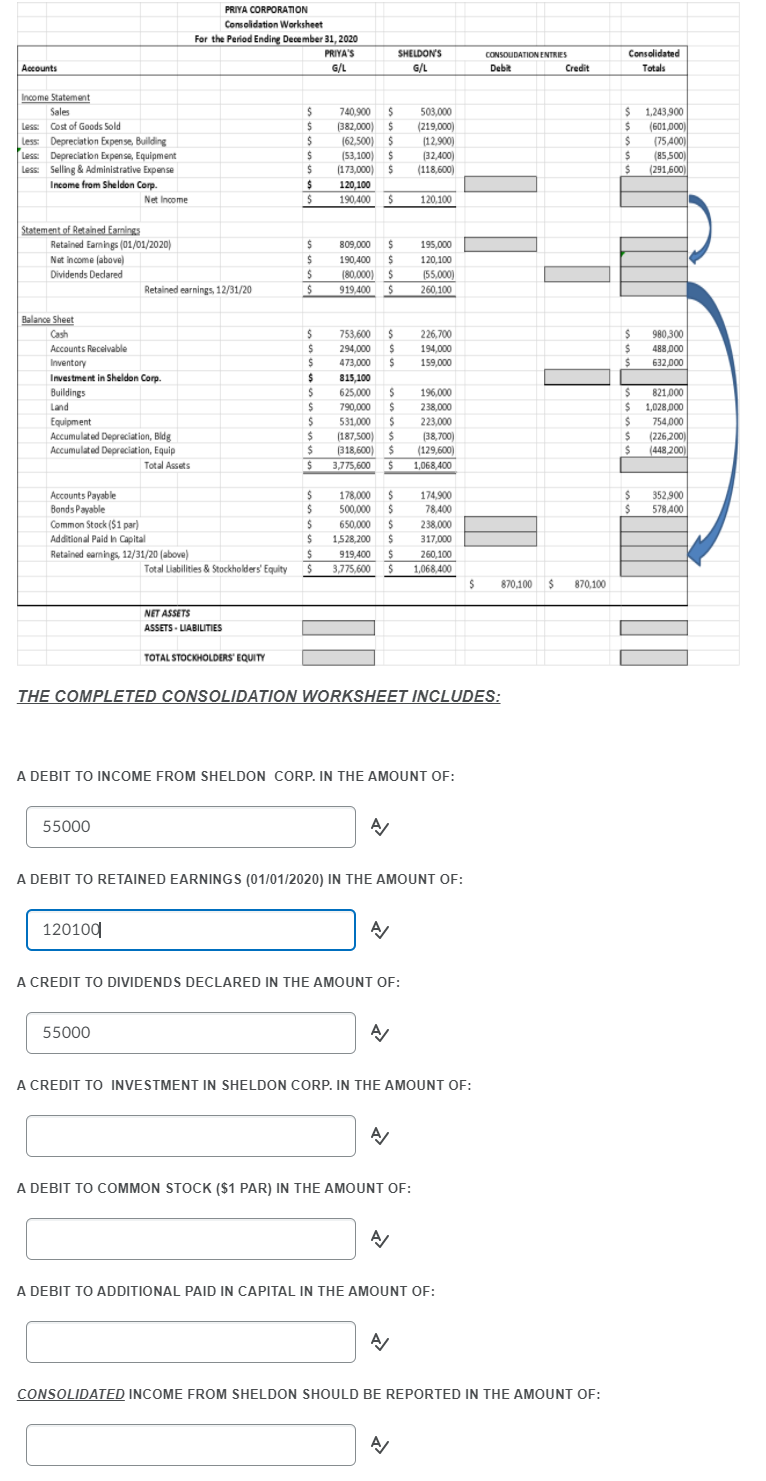

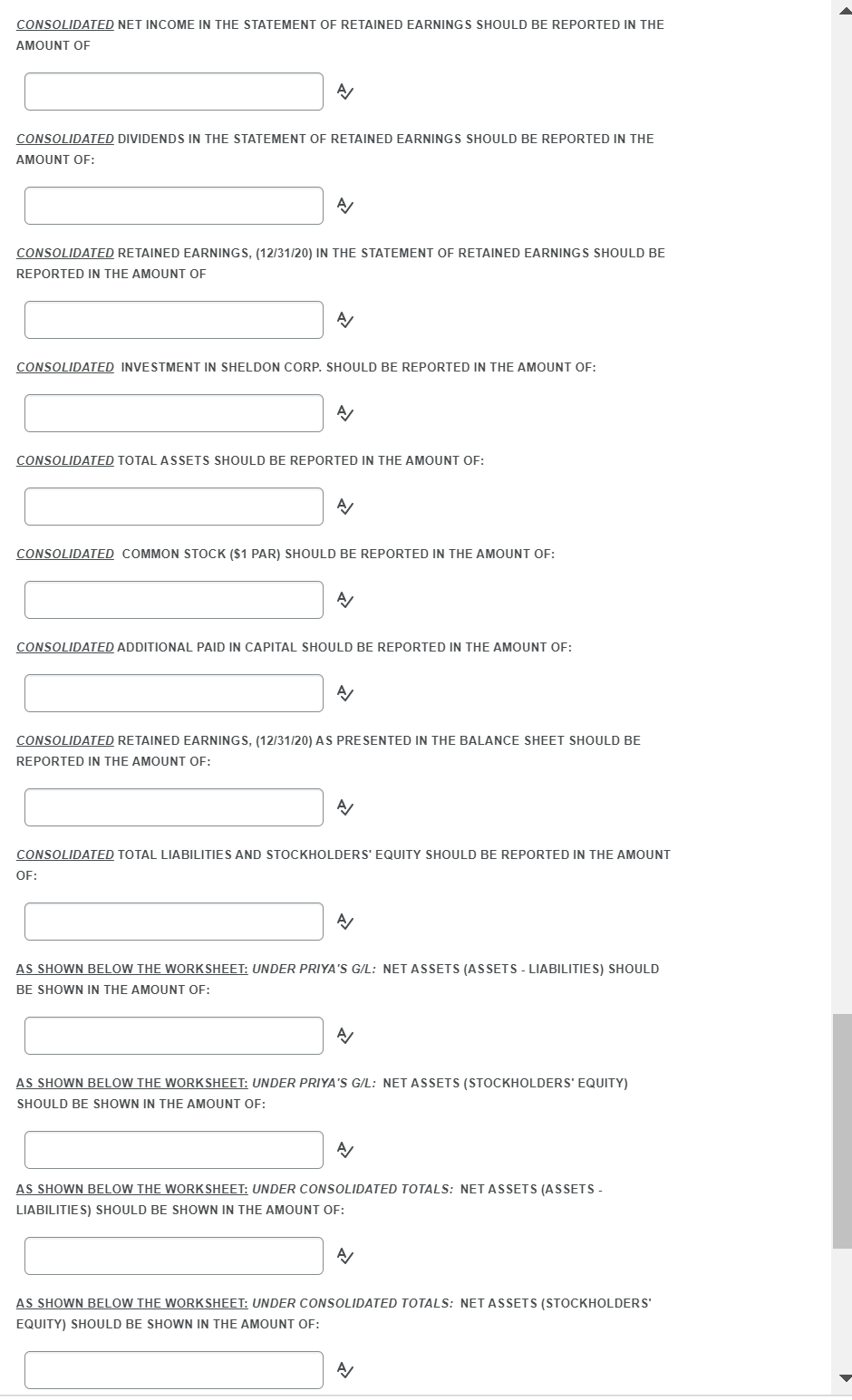

Question 2 (10 points) Saved 62,500 Priya Corporation acquired 100 percent of Sheldon Company stock on January 1, 2020 for $750,000 cash. Following are pre-closing trial balance amounts for Priya Corporation and Sheldon Company as of December 31, 2020: PRIYA CORPORATION SHELDON CORPORATION Debit Credit Debit Credit Cash $753,600 $226,700 Accounts Receivable 294,000 194,000 Inventory 473,000 159,000 Investment in Sheldon Corp. 815,100 Buildings 625,000 196,000 Land 790,000 238,000 Equipment 531,000 223,000 Cost of Goods Sold 382,000 219,000 Depreciation Expense, Building 12,900 Depreciation Expense, Equipment 53,100 32,400 Selling & Administrative Expense 173,000 118,600 Dividends Declared 80,000 55,000 Accumulated Depreciation, Bldg $187,500 $38,700 Accumulated Depreciation, Equip 318,600 129,600 Accounts Payable 178,000 174,900 Bonds Payable 500,000 78,400 Common Stock ($1 par) 650,000 238,000 Additional Paid In Capital 1,528,200 317,000 Retained Earnings (01/01/2020) 809,000 195,000 Sales 740,900 503,000 Income from Sheldon Corp. 120,100 $5,032,300 $5,032,300 $1,674,600 $1,674,600 Additional Information: 1. On January 1, 2020, the book values of Sheldon's net assets and liabilities approximated fair values. 2. Priya Corporation uses the equity method to account for its Investment in Sheldon Company. 3. The general ledger numbers given above (HINT: those in boldface) include the effects of the JOURNAL ENTRIES that were recorded by Priya at the acquisition date and during 2020 to account for its investment in Sheldon Company. These boldface figures should be used as check figures for your solution. Required: Recreate the JOURNAL ENTRIES recorded by Priya to account for its investment in Sheldon Company at January 1, 2020 and during 2020. NOTE: BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000. DATE OF ACQUISITION: THE JOURNAL ENTRY INCLUDES A DEBIT TO 'INVESTMENT IN SHELDON CORP.' AND A CREDIT TO CASH IN THE AMOUNT OF: 750000 AJ DURING 2020: ACCRUAL OF SHELDON'S REPORTED NET INCOME: INCLUDES A DEBIT TO INVESTMENT IN SHELDON CORP. AND A CREDIT TO INCOME FROM SHELDON CORP. IN THE AMOUNT OF: 120100 A DURING 2020: ACCRUAL OF DIVIDENDS FROM SHELDON CORP: INCLUDES A DEBIT TO CASH (OR DIVIDENDS RECEIVABLE) AND A CREDIT TO INVESTMENT IN SHELDON CORP. IN THE AMOUNT OF: 55000 A/ Question 3 (20 points) Priya Corporation acquired 100 percent of Sheldon Company stock on January 1, 2020 for $750,000 cash. Following are pre-closing trial balance amounts for Priya Corporation and Sheldon Company as of December 31, 2020: PRIYA CORPORATION SHELDON CORPORATION Debit Credit Debit Credit Cash $753,600 $226,700 Accounts Receivable 294,000 194,000 Inventory 473,000 159,000 Investment in Sheldon Corp. 815,100 Buildings 625,000 196,000 Land 790,000 238,000 Equipment 531,000 223,000 Cost of Goods Sold 382.000 219,000 Depreciation Expense, Building 62.500 12,900 Depreciation Expense, Equipment 53,100 32,400 Selling & Administrative Expense 173,000 118,600 Dividends Declared 80,000 55,000 Accumulated Depreciation, Bldg $187,500 $38,700 Accumulated Depreciation, Equip 318,600 129,600 Accounts Payable 178,000 174,900 Bonds Payable 500,000 78,400 Common Stock ($1 par) 650,000 238,000 Additional Paid In Capital 1,528,200 317,000 Retained Earnings (01/01/2020) 809,000 195,000 Sales 740,900 503,000 Income from Sheldon Corp. 120,100 $5,032,300 $5,032,300 $1,674,600 $1,674,600 Additional Information: 1. On January 1, 2020, the book values of Sheldon's net assets and liabilities approximated fair values. 2. Priya Corporation uses the equity method to account for its Investment in Sheldon Company. REQUIRED: ANSWER THE FOLLOWING QUESTIONS REGARDING THE BASIC CONSOLIDATION ENTRY. THE ENTRY WOULD INCLUDE: NOTE: BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000. A DEBIT TO COMMON STOCK (S) IN THE AMOUNT OF: A/ A DEBIT TO ADDITIONAL PAID IN CAPITAL (S) IN THE AMOUNT OF A DEBIT TO RETAINED EARNINGS, 01/01/20 (S) IN THE AMOUNT OF: A/ A DEBIT TO INCOME FROM SHELDON CORP. (P) IN THE AMOUNT OF: A A CREDIT TO DIVIDENDS DECLARED (S) IN THE AMOUNT OF: A/ A CREDIT TO INVESTMENT IN SHELDON CORP. (P) IN THE AMOUNT OF A PRIYA CORPORATION Consolidation Worksheet For the Period Ending December 31, 2020 PRIYA'S G/L SHELDON'S G/L CONSOUDATION ENTRIES Debit Credit Consolidated Totals Accounts Income Statement Sales Less: Cost of Goods Sold less: Depreciation Expense, Building Less Depreciation Expense, Equipment Less: Selling & Administrative Expense Income from Sheldon Corp. Net Income S $ $ $ $ $ $ S 740.900 $ (382,000 $ (62,500) $ (53,100 $ (173,000) $ 120,100 190.400 5 503,000 (219,000) 112.900) 132.400 (118,600) $ $ $ $ $ 1.243.900 (601,000 (75 400) 85,500) (291,600 120.100 Statement of Retained Earnings Retained Earnings (01/01/2020) Net Income (above) Dividends Declared Retained earnings, 12/31/20 $ $ $ S $ 809,000 190,400 S (80,000) $ 919,400 $ 195,000 120,100 155.0001 260,100 $ $ $ 226.700 194,000 159,000 S $ 980 300 488.000 632000 Balance Sheet Cash Accounts Receivable Inventory Investment in Sheldon Corp. Buildings Land Equipment Accumulated Depreciation, Bidg Accumulated Depreciation, Equip Total Assets $ $ $ $ $ $ $ $ $ $ 753.600 294,000 473,000 815,100 625,000 790,000 531,000 (187,500) 318,600) 3,775,600 $ $ S $ $ $ 196.000 238,000 223.000 (38,700) (129,600) 1,068,400 $ $ S $ $ $ 821,000 1,028,000 754.000 (226.2001 (448200) $ $ 352 900 578 400 Accounts Payable Bonds Payable Common Stock (51 par) Additional Paid In Capital Retained earnings, 12/31/20 (above) Total Liabilities & Stockholders' Equity $ $ $ $ $ S 178,000 500,000 650,000 1,528.200 919.400 3.775.600 S S $ $ $ $ 174.900 78.400 238.000 317,000 260,100 1,068.400 $ 870.100 $ 870.100 NET ASSETS ASSETS - LIABILITIES TOTAL STOCKHOLDERS' EQUITY THE COMPLETED CONSOLIDATION WORKSHEET INCLUDES: A DEBIT TO INCOME FROM SHELDON CORP. IN THE AMOUNT OF: 55000 A DEBIT TO RETAINED EARNINGS (01/01/2020) IN THE AMOUNT OF: 120100 A A CREDIT TO DIVIDENDS DECLARED IN THE AMOUNT OF: 55000 A A CREDIT TO INVESTMENT IN SHELDON CORP. IN THE AMOUNT OF: A A DEBIT TO COMMON STOCK ($1 PAR) IN THE AMOUNT OF: A DEBIT TO ADDITIONAL PAID IN CAPITAL IN THE AMOUNT OF: A CONSOLIDATED INCOME FROM SHELDON SHOULD BE REPORTED IN THE AMOUNT OF: A CONSOLIDATED NET INCOME IN THE STATEMENT OF RETAINED EARNINGS SHOULD BE REPORTED IN THE AMOUNT OF A/ CONSOLIDATED DIVIDENDS IN THE STATEMENT OF RETAINED EARNINGS SHOULD BE REPORTED IN THE AMOUNT OF: A CONSOLIDATED RETAINED EARNINGS, (12/31/20) IN THE STATEMENT OF RETAINED EARNINGS SHOULD BE REPORTED IN THE AMOUNT OF A/ CONSOLIDATED INVESTMENT IN SHELDON CORP. SHOULD BE REPORTED IN THE AMOUNT OF: A CONSOLIDATED TOTAL ASSETS SHOULD BE REPORTED IN THE AMOUNT OF: A CONSOLIDATED COMMON STOCK ($1 PAR) SHOULD BE REPORTED IN THE AMOUNT OF: A CONSOLIDATED ADDITIONAL PAID IN CAPITAL SHOULD BE REPORTED IN THE AMOUNT OF: A/ CONSOLIDATED RETAINED EARNINGS, (12/31/20) AS PRESENTED IN THE BALANCE SHEET SHOULD BE REPORTED IN THE AMOUNT OF: A/ CONSOLIDATED TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY SHOULD BE REPORTED IN THE AMOUNT OF: A/ AS SHOWN BELOW THE WORKSHEET: UNDER PRIYA'S G/L: NET ASSETS (ASSETS - LIABILITIES) SHOULD BE SHOWN IN THE AMOUNT OF: A/ AS SHOWN BELOW THE WORKSHEET: UNDER PRIYA'S G/L: NET ASSETS (STOCKHOLDERS' EQUITY) SHOULD BE SHOWN IN THE AMOUNT OF: A AS SHOWN BELOW THE WORKSHEET: UNDER CONSOLIDATED TOTALS: NET ASSETS (ASSETS - LIABILITIES) SHOULD BE SHOWN IN THE AMOUNT OF: A AS SHOWN BELOW THE WORKSHEET: UNDER CONSOLIDATED TOTALS: NET ASSETS (STOCKHOLDERS' EQUITY) SHOULD BE SHOWN IN THE AMOUNT OF: A/ Question 2 (10 points) Saved 62,500 Priya Corporation acquired 100 percent of Sheldon Company stock on January 1, 2020 for $750,000 cash. Following are pre-closing trial balance amounts for Priya Corporation and Sheldon Company as of December 31, 2020: PRIYA CORPORATION SHELDON CORPORATION Debit Credit Debit Credit Cash $753,600 $226,700 Accounts Receivable 294,000 194,000 Inventory 473,000 159,000 Investment in Sheldon Corp. 815,100 Buildings 625,000 196,000 Land 790,000 238,000 Equipment 531,000 223,000 Cost of Goods Sold 382,000 219,000 Depreciation Expense, Building 12,900 Depreciation Expense, Equipment 53,100 32,400 Selling & Administrative Expense 173,000 118,600 Dividends Declared 80,000 55,000 Accumulated Depreciation, Bldg $187,500 $38,700 Accumulated Depreciation, Equip 318,600 129,600 Accounts Payable 178,000 174,900 Bonds Payable 500,000 78,400 Common Stock ($1 par) 650,000 238,000 Additional Paid In Capital 1,528,200 317,000 Retained Earnings (01/01/2020) 809,000 195,000 Sales 740,900 503,000 Income from Sheldon Corp. 120,100 $5,032,300 $5,032,300 $1,674,600 $1,674,600 Additional Information: 1. On January 1, 2020, the book values of Sheldon's net assets and liabilities approximated fair values. 2. Priya Corporation uses the equity method to account for its Investment in Sheldon Company. 3. The general ledger numbers given above (HINT: those in boldface) include the effects of the JOURNAL ENTRIES that were recorded by Priya at the acquisition date and during 2020 to account for its investment in Sheldon Company. These boldface figures should be used as check figures for your solution. Required: Recreate the JOURNAL ENTRIES recorded by Priya to account for its investment in Sheldon Company at January 1, 2020 and during 2020. NOTE: BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000. DATE OF ACQUISITION: THE JOURNAL ENTRY INCLUDES A DEBIT TO 'INVESTMENT IN SHELDON CORP.' AND A CREDIT TO CASH IN THE AMOUNT OF: 750000 AJ DURING 2020: ACCRUAL OF SHELDON'S REPORTED NET INCOME: INCLUDES A DEBIT TO INVESTMENT IN SHELDON CORP. AND A CREDIT TO INCOME FROM SHELDON CORP. IN THE AMOUNT OF: 120100 A DURING 2020: ACCRUAL OF DIVIDENDS FROM SHELDON CORP: INCLUDES A DEBIT TO CASH (OR DIVIDENDS RECEIVABLE) AND A CREDIT TO INVESTMENT IN SHELDON CORP. IN THE AMOUNT OF: 55000 A/ Question 3 (20 points) Priya Corporation acquired 100 percent of Sheldon Company stock on January 1, 2020 for $750,000 cash. Following are pre-closing trial balance amounts for Priya Corporation and Sheldon Company as of December 31, 2020: PRIYA CORPORATION SHELDON CORPORATION Debit Credit Debit Credit Cash $753,600 $226,700 Accounts Receivable 294,000 194,000 Inventory 473,000 159,000 Investment in Sheldon Corp. 815,100 Buildings 625,000 196,000 Land 790,000 238,000 Equipment 531,000 223,000 Cost of Goods Sold 382.000 219,000 Depreciation Expense, Building 62.500 12,900 Depreciation Expense, Equipment 53,100 32,400 Selling & Administrative Expense 173,000 118,600 Dividends Declared 80,000 55,000 Accumulated Depreciation, Bldg $187,500 $38,700 Accumulated Depreciation, Equip 318,600 129,600 Accounts Payable 178,000 174,900 Bonds Payable 500,000 78,400 Common Stock ($1 par) 650,000 238,000 Additional Paid In Capital 1,528,200 317,000 Retained Earnings (01/01/2020) 809,000 195,000 Sales 740,900 503,000 Income from Sheldon Corp. 120,100 $5,032,300 $5,032,300 $1,674,600 $1,674,600 Additional Information: 1. On January 1, 2020, the book values of Sheldon's net assets and liabilities approximated fair values. 2. Priya Corporation uses the equity method to account for its Investment in Sheldon Company. REQUIRED: ANSWER THE FOLLOWING QUESTIONS REGARDING THE BASIC CONSOLIDATION ENTRY. THE ENTRY WOULD INCLUDE: NOTE: BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000. A DEBIT TO COMMON STOCK (S) IN THE AMOUNT OF: A/ A DEBIT TO ADDITIONAL PAID IN CAPITAL (S) IN THE AMOUNT OF A DEBIT TO RETAINED EARNINGS, 01/01/20 (S) IN THE AMOUNT OF: A/ A DEBIT TO INCOME FROM SHELDON CORP. (P) IN THE AMOUNT OF: A A CREDIT TO DIVIDENDS DECLARED (S) IN THE AMOUNT OF: A/ A CREDIT TO INVESTMENT IN SHELDON CORP. (P) IN THE AMOUNT OF A PRIYA CORPORATION Consolidation Worksheet For the Period Ending December 31, 2020 PRIYA'S G/L SHELDON'S G/L CONSOUDATION ENTRIES Debit Credit Consolidated Totals Accounts Income Statement Sales Less: Cost of Goods Sold less: Depreciation Expense, Building Less Depreciation Expense, Equipment Less: Selling & Administrative Expense Income from Sheldon Corp. Net Income S $ $ $ $ $ $ S 740.900 $ (382,000 $ (62,500) $ (53,100 $ (173,000) $ 120,100 190.400 5 503,000 (219,000) 112.900) 132.400 (118,600) $ $ $ $ $ 1.243.900 (601,000 (75 400) 85,500) (291,600 120.100 Statement of Retained Earnings Retained Earnings (01/01/2020) Net Income (above) Dividends Declared Retained earnings, 12/31/20 $ $ $ S $ 809,000 190,400 S (80,000) $ 919,400 $ 195,000 120,100 155.0001 260,100 $ $ $ 226.700 194,000 159,000 S $ 980 300 488.000 632000 Balance Sheet Cash Accounts Receivable Inventory Investment in Sheldon Corp. Buildings Land Equipment Accumulated Depreciation, Bidg Accumulated Depreciation, Equip Total Assets $ $ $ $ $ $ $ $ $ $ 753.600 294,000 473,000 815,100 625,000 790,000 531,000 (187,500) 318,600) 3,775,600 $ $ S $ $ $ 196.000 238,000 223.000 (38,700) (129,600) 1,068,400 $ $ S $ $ $ 821,000 1,028,000 754.000 (226.2001 (448200) $ $ 352 900 578 400 Accounts Payable Bonds Payable Common Stock (51 par) Additional Paid In Capital Retained earnings, 12/31/20 (above) Total Liabilities & Stockholders' Equity $ $ $ $ $ S 178,000 500,000 650,000 1,528.200 919.400 3.775.600 S S $ $ $ $ 174.900 78.400 238.000 317,000 260,100 1,068.400 $ 870.100 $ 870.100 NET ASSETS ASSETS - LIABILITIES TOTAL STOCKHOLDERS' EQUITY THE COMPLETED CONSOLIDATION WORKSHEET INCLUDES: A DEBIT TO INCOME FROM SHELDON CORP. IN THE AMOUNT OF: 55000 A DEBIT TO RETAINED EARNINGS (01/01/2020) IN THE AMOUNT OF: 120100 A A CREDIT TO DIVIDENDS DECLARED IN THE AMOUNT OF: 55000 A A CREDIT TO INVESTMENT IN SHELDON CORP. IN THE AMOUNT OF: A A DEBIT TO COMMON STOCK ($1 PAR) IN THE AMOUNT OF: A DEBIT TO ADDITIONAL PAID IN CAPITAL IN THE AMOUNT OF: A CONSOLIDATED INCOME FROM SHELDON SHOULD BE REPORTED IN THE AMOUNT OF: A CONSOLIDATED NET INCOME IN THE STATEMENT OF RETAINED EARNINGS SHOULD BE REPORTED IN THE AMOUNT OF A/ CONSOLIDATED DIVIDENDS IN THE STATEMENT OF RETAINED EARNINGS SHOULD BE REPORTED IN THE AMOUNT OF: A CONSOLIDATED RETAINED EARNINGS, (12/31/20) IN THE STATEMENT OF RETAINED EARNINGS SHOULD BE REPORTED IN THE AMOUNT OF A/ CONSOLIDATED INVESTMENT IN SHELDON CORP. SHOULD BE REPORTED IN THE AMOUNT OF: A CONSOLIDATED TOTAL ASSETS SHOULD BE REPORTED IN THE AMOUNT OF: A CONSOLIDATED COMMON STOCK ($1 PAR) SHOULD BE REPORTED IN THE AMOUNT OF: A CONSOLIDATED ADDITIONAL PAID IN CAPITAL SHOULD BE REPORTED IN THE AMOUNT OF: A/ CONSOLIDATED RETAINED EARNINGS, (12/31/20) AS PRESENTED IN THE BALANCE SHEET SHOULD BE REPORTED IN THE AMOUNT OF: A/ CONSOLIDATED TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY SHOULD BE REPORTED IN THE AMOUNT OF: A/ AS SHOWN BELOW THE WORKSHEET: UNDER PRIYA'S G/L: NET ASSETS (ASSETS - LIABILITIES) SHOULD BE SHOWN IN THE AMOUNT OF: A/ AS SHOWN BELOW THE WORKSHEET: UNDER PRIYA'S G/L: NET ASSETS (STOCKHOLDERS' EQUITY) SHOULD BE SHOWN IN THE AMOUNT OF: A AS SHOWN BELOW THE WORKSHEET: UNDER CONSOLIDATED TOTALS: NET ASSETS (ASSETS - LIABILITIES) SHOULD BE SHOWN IN THE AMOUNT OF: A AS SHOWN BELOW THE WORKSHEET: UNDER CONSOLIDATED TOTALS: NET ASSETS (STOCKHOLDERS' EQUITY) SHOULD BE SHOWN IN THE AMOUNT OF: A/