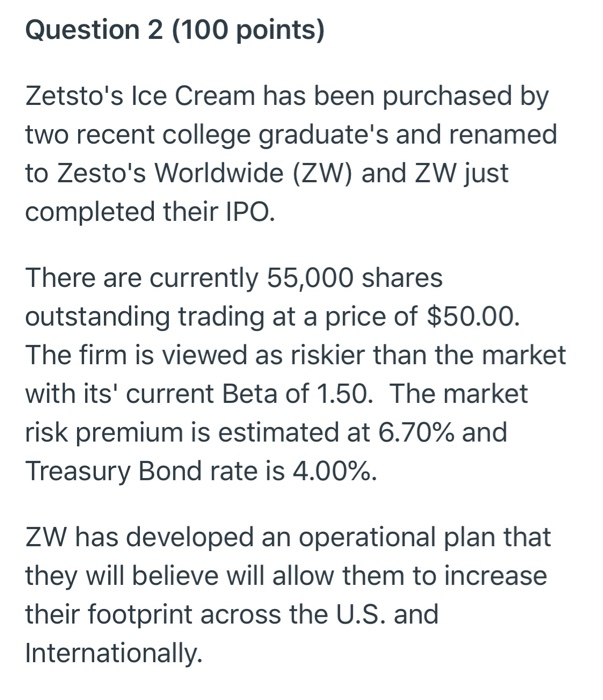

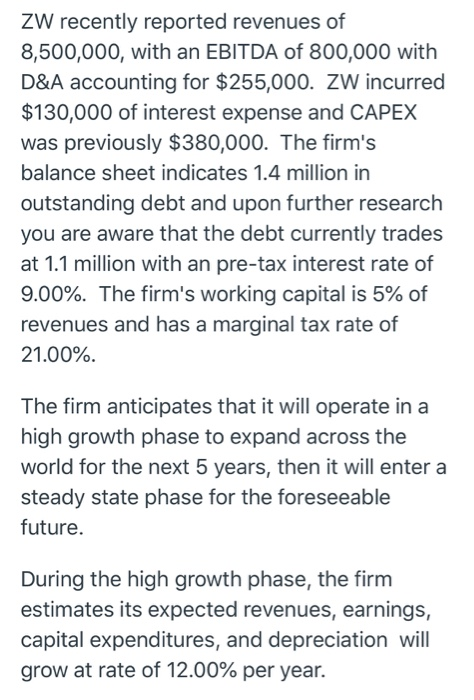

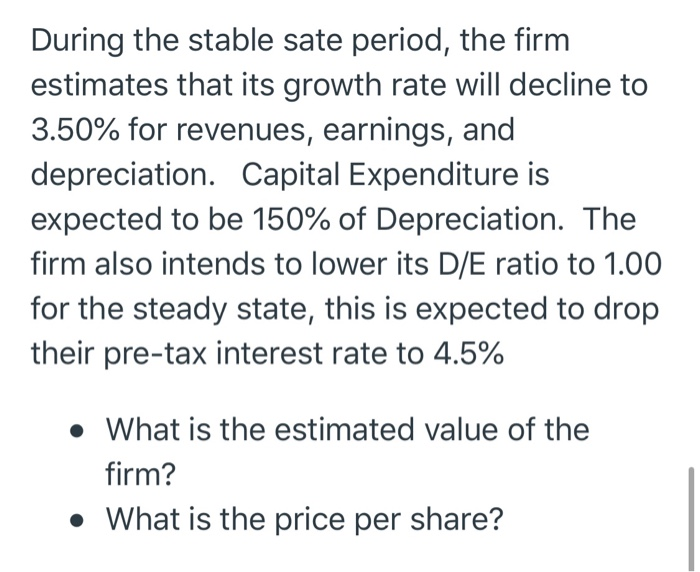

Question 2 (100 points) Zetsto's Ice Cream has been purchased by two recent college graduate's and renamed to Zesto's Worldwide (ZW) and ZW just completed their IPO. There are currently 55,000 shares outstanding trading at a price of $50.00. The firm is viewed as riskier than the market with its' current Beta of 1.50. The market risk premium is estimated at 6.70% and Treasury Bond rate is 4.00%. ZW has developed an operational plan that they will believe will allow them to increase their footprint across the U.S. and Internationally. ZW recently reported revenues of 8,500,000, with an EBITDA of 800,000 with D&A accounting for $255,000. ZW incurred $130,000 of interest expense and CAPEX was previously $380,000. The firm's balance sheet indicates 1.4 million in outstanding debt and upon further research you are aware that the debt currently trades at 1.1 million with an pre-tax interest rate of 9.00%. The firm's working capital is 5% of revenues and has a marginal tax rate of 21.00% The firm anticipates that it will operate in a high growth phase to expand across the world for the next 5 years, then it will enter a steady state phase for the foreseeable future. During the high growth phase, the firm estimates its expected revenues, earnings, capital expenditures, and depreciation will grow at rate of 12.00% per year. During the stable sate period, the firm estimates that its growth rate will decline to 3.50% for revenues, earnings, and depreciation. Capital Expenditure is expected to be 150% of Depreciation. The firm also intends to lower its D/E ratio to 1.00 for the steady state, this is expected to drop their pre-tax interest rate to 4.5% What is the estimated value of the firm? What is the price per share? Question 2 (100 points) Zetsto's Ice Cream has been purchased by two recent college graduate's and renamed to Zesto's Worldwide (ZW) and ZW just completed their IPO. There are currently 55,000 shares outstanding trading at a price of $50.00. The firm is viewed as riskier than the market with its' current Beta of 1.50. The market risk premium is estimated at 6.70% and Treasury Bond rate is 4.00%. ZW has developed an operational plan that they will believe will allow them to increase their footprint across the U.S. and Internationally. ZW recently reported revenues of 8,500,000, with an EBITDA of 800,000 with D&A accounting for $255,000. ZW incurred $130,000 of interest expense and CAPEX was previously $380,000. The firm's balance sheet indicates 1.4 million in outstanding debt and upon further research you are aware that the debt currently trades at 1.1 million with an pre-tax interest rate of 9.00%. The firm's working capital is 5% of revenues and has a marginal tax rate of 21.00% The firm anticipates that it will operate in a high growth phase to expand across the world for the next 5 years, then it will enter a steady state phase for the foreseeable future. During the high growth phase, the firm estimates its expected revenues, earnings, capital expenditures, and depreciation will grow at rate of 12.00% per year. During the stable sate period, the firm estimates that its growth rate will decline to 3.50% for revenues, earnings, and depreciation. Capital Expenditure is expected to be 150% of Depreciation. The firm also intends to lower its D/E ratio to 1.00 for the steady state, this is expected to drop their pre-tax interest rate to 4.5% What is the estimated value of the firm? What is the price per share