Answered step by step

Verified Expert Solution

Question

1 Approved Answer

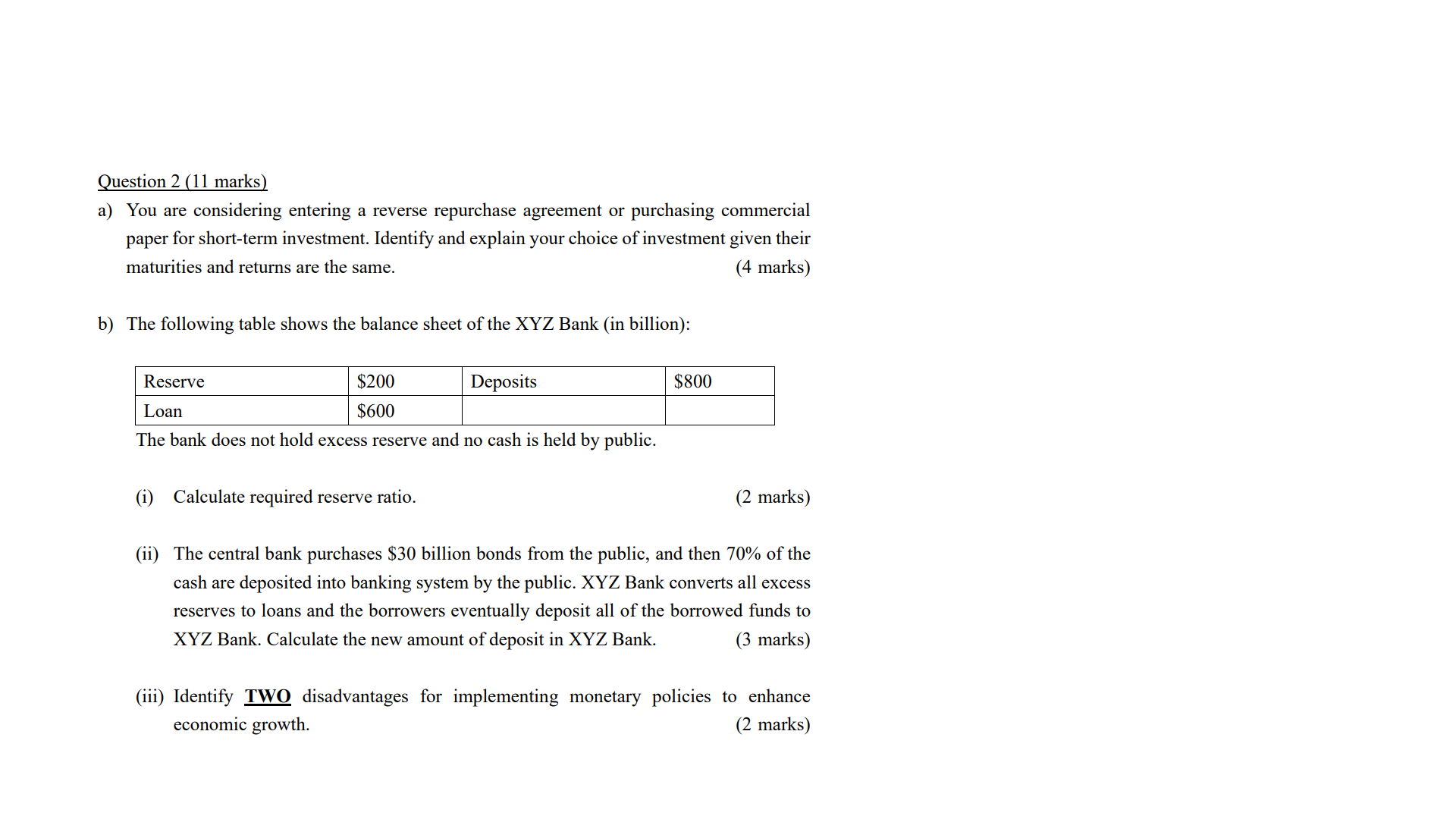

Question 2 (11 marks) a) You are considering entering a reverse repurchase agreement or purchasing commercial paper for short-term investment. Identify and explain your

Question 2 (11 marks) a) You are considering entering a reverse repurchase agreement or purchasing commercial paper for short-term investment. Identify and explain your choice of investment given their maturities and returns are the same. (4 marks) b) The following table shows the balance sheet of the XYZ Bank (in billion): Reserve Loan $200 $600 Deposits The bank does not hold excess reserve and no cash is held by public. (i) Calculate required reserve ratio. $800 (2 marks) (ii) The central bank purchases $30 billion bonds from the public, and then 70% of the cash are deposited into banking system by the public. XYZ Bank converts all excess reserves to loans and the borrowers eventually deposit all of the borrowed funds to XYZ Bank. Calculate the new amount of deposit in XYZ Bank. (3 marks) (iii) Identify TWO disadvantages for implementing monetary policies to enhance economic growth. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Given that the maturities and returns are the same the choice between entering a reverse repurchas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started