Answered step by step

Verified Expert Solution

Question

1 Approved Answer

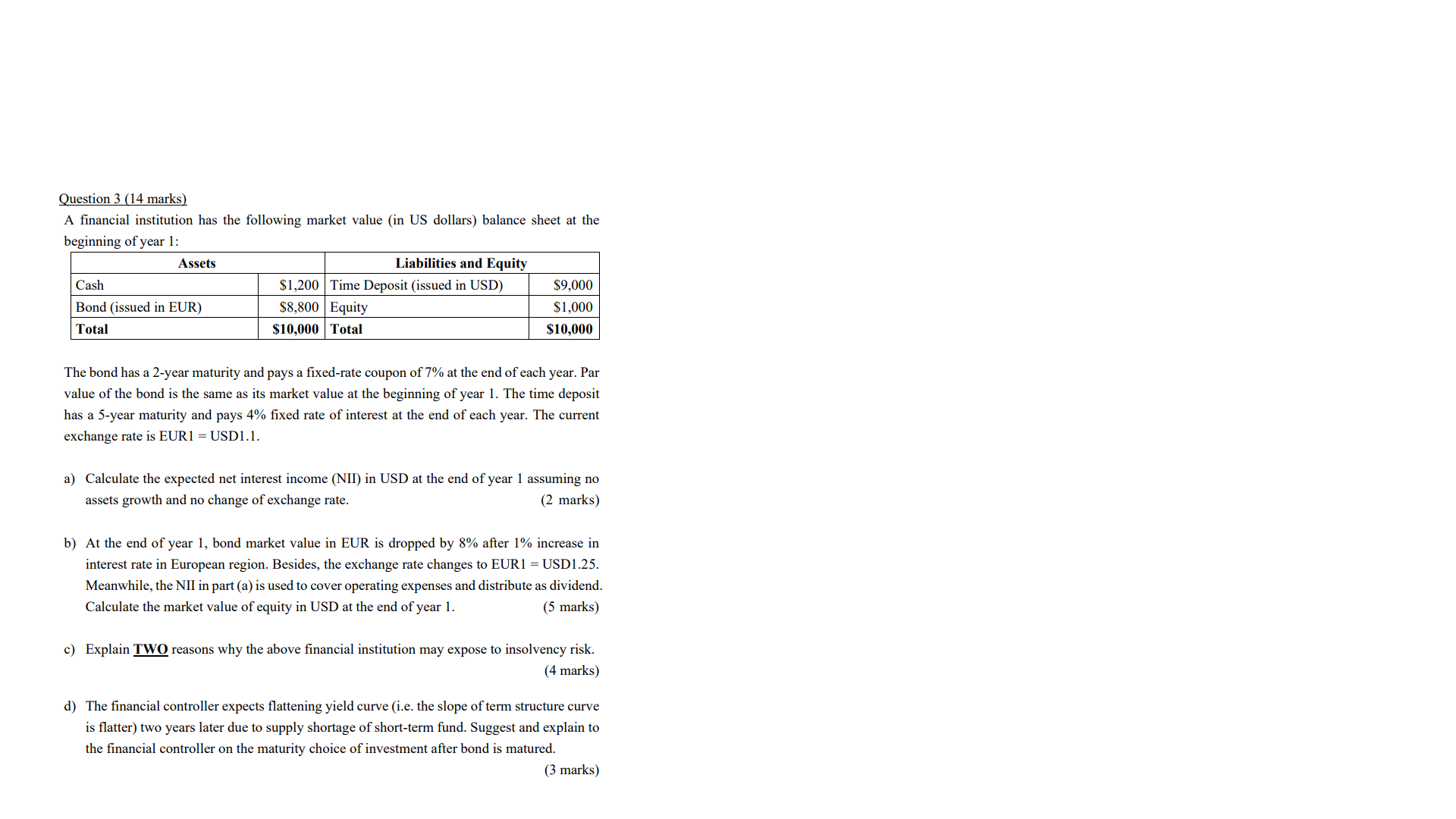

Question 3 (14 marks) A financial institution has the following market value (in US dollars) balance sheet at the beginning of year 1: Assets

Question 3 (14 marks) A financial institution has the following market value (in US dollars) balance sheet at the beginning of year 1: Assets Cash Bond (issued in EUR) Total Liabilities and Equity $1,200 Time Deposit (issued in USD) $8,800 Equity $10,000 Total $9,000 $1,000 $10,000 The bond has a 2-year maturity and pays a fixed-rate coupon of 7% at the end of each year. Par value of the bond is the same as its market value at the beginning of year 1. The time deposit has a 5-year maturity and pays 4% fixed rate of interest at the end of each year. The current exchange rate is EUR1 = USD1.1. a) Calculate the expected net interest income (NII) in USD at the end of year 1 assuming no assets growth and no change of exchange rate. (2 marks) b) At the end of year 1, bond market value in EUR is dropped by 8% after 1% increase in interest rate in European region. Besides, the exchange rate changes to EUR1 = USD1.25. Meanwhile, the NII in part (a) is used to cover operating expenses and distribute as dividend. Calculate the market value of equity in USD at the end of year 1. (5 marks) c) Explain TWO reasons why the above financial institution may expose to insolvency risk. (4 marks) d) The financial controller expects flattening yield curve (i.e. the slope of term structure curve is flatter) two years later due to supply shortage of short-term fund. Suggest and explain to the financial controller on the maturity choice of investment after bond is matured. (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the expected net interest income NII in USD at the end of year 1 we need to calculate the interest income and interest expense for both ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started