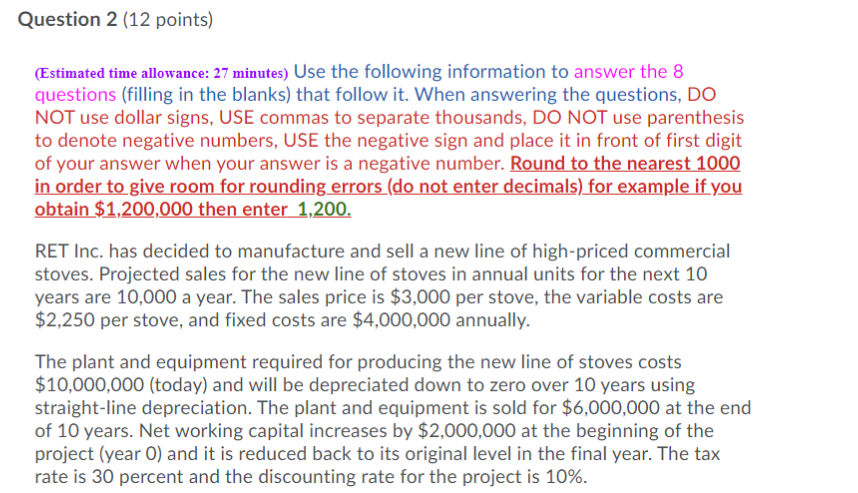

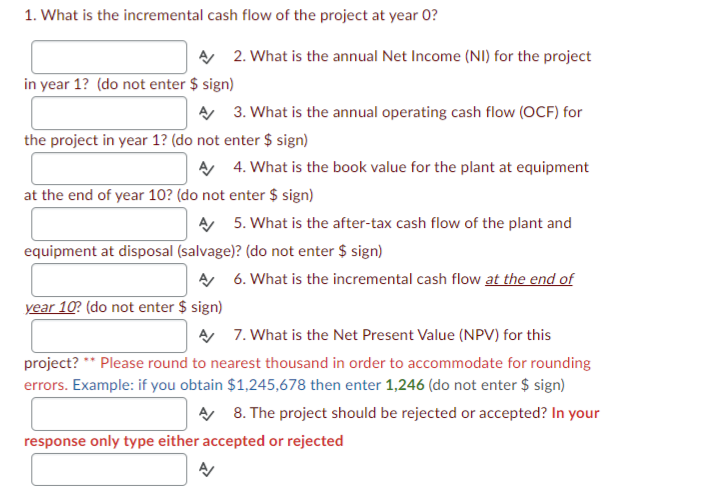

Question 2 (12 points) (Estimated time allowance: 27 minutes) Use the following information to answer the 8 questions (filling in the blanks) that follow it. When answering the questions, DO NOT use dollar signs, USE commas to separate thousands, DO NOT use parenthesis to denote negative numbers, USE the negative sign and place it in front of first digit of your answer when your answer is a negative number. Round to the nearest 1000 in order to give room for rounding errors (do not enter decimals) for example if you obtain $1,200,000 then enter 1,200. RET Inc. has decided to manufacture and sell a new line of high-priced commercial stoves. Projected sales for the new line of stoves in annual units for the next 10 years are 10,000 a year. The sales price is $3,000 per stove, the variable costs are $2,250 per stove, and fixed costs are $4,000,000 annually. The plant and equipment required for producing the new line of stoves costs $10,000,000 (today) and will be depreciated down to zero over 10 years using straight-line depreciation. The plant and equipment is sold for $6,000,000 at the end of 10 years. Net working capital increases by $2,000,000 at the beginning of the project (year O) and it is reduced back to its original level in the final year. The tax rate is 30 percent and the discounting rate for the project is 10%. 1. What is the incremental cash flow of the project at year 0? A 2. What is the annual Net Income (NI) for the project in year 12 (do not enter $ sign) A 3. What is the annual operating cash flow (OCF) for the project in year 12 (do not enter $ sign) A 4. What is the book value for the plant at equipment at the end of year 102 (do not enter $ sign) A 5. What is the after-tax cash flow of the plant and equipment at disposal (salvage)? (do not enter $ sign) A 6. What is the incremental cash flow at the end of year 10? (do not enter $ sign) A 7. What is the Net Present Value (NPV) for this project? ** Please round to nearest thousand in order to accommodate for rounding errors. Example: if you obtain $1,245,678 then enter 1,246 (do not enter $ sign) A 8. The project should be rejected or accepted? In your response only type either accepted or rejected