Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 (15 marks) AUD Q4 2022 Fundamental Forecast: Australian Dollar Outlook Sees the Fed Running Harder and Faster than the RBA Oct 1, 2022

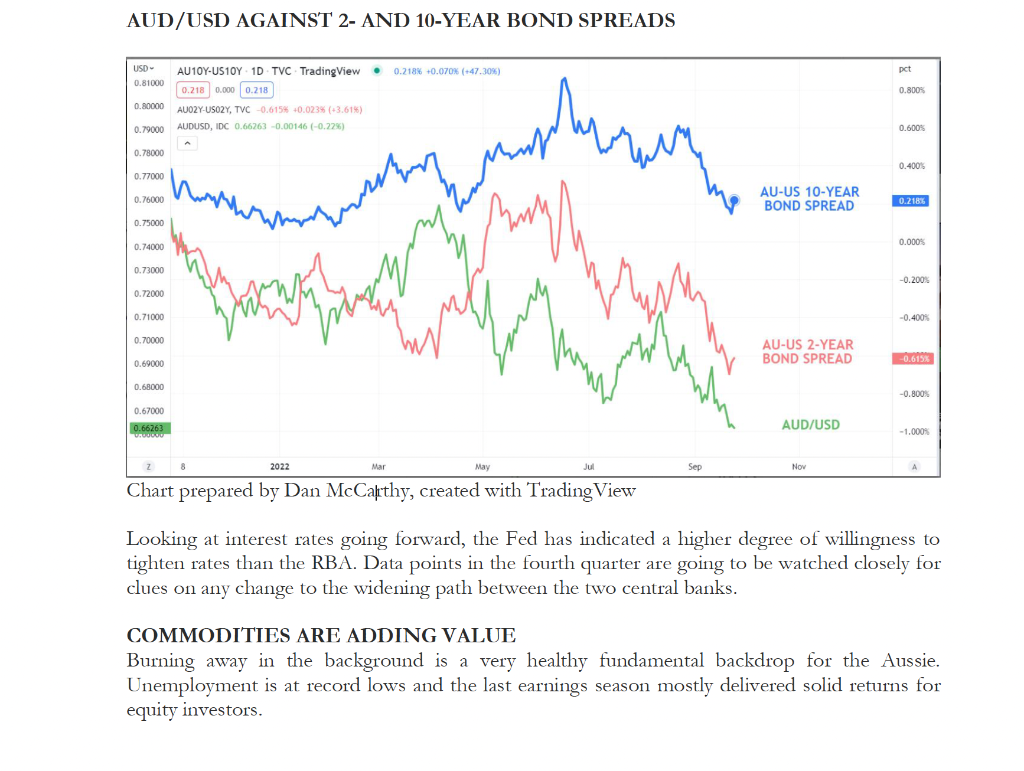

Question 2 (15 marks) AUD Q4 2022 Fundamental Forecast: Australian Dollar Outlook Sees the Fed Running Harder and Faster than the RBA Oct 1, 2022 1:00 PM +10:00 Daniel McCarthy, Strategist - The Australian Dollar appears hostage to global forces going into year end - While the RBA and the Fed are tightening, the velocity of change is apparent - Central bank actions are moving markets. Will rates undermine AUD/ USD? The Australian Dollar made a 2-year low against the US Dollar in September as global central banks ratcheted up their fight against inflation. The pivot toward a far more aggressive stance for the tightening of monetary policy in the second quarter was backed up by outsized hikes in rates in the third quarter by many global central banks. At the third quarter's end, the RBA appears to have backed away from ongoing outsized rate rises. The tightening of monetary policy is to allay fears of inflation becoming entrenched. The last read of Australian year-on-year CPI to the end of the second quarter came in at 6.1%, well above the RBA's target of 23% on average over the business cycle. CPI in other developed markets is notably higher, with the exception of Japan. The September quarter CPI number won't be known until 26th October and that is shaping up as a key component for the RBA board to consider at their November monetary policy meeting. MONETARY POLICY MATTERS Cash rate differentials are playing out across the yield curve. 'The Federal Reserve has maintained a more hawkish stance than the RB. Just prior to the end of the third quartcr, the Fed raised its funds target rate by 75 basis points as anticipated. The language in the post-decision briefing from Fed Chair Jerome Powell made it clear that the US central bank will be raising rates significantly higher into the fourth quarter. This has seen Treasury yields continuing higher at a faster clip than Australian Commonwealth Government Bonds (ACGB). The 2- and 10-ycar bond spreads have contracted in favour of USD and the corrclation becomes apparent in the chart. AUD/USD AGAINST 2- AND 10-YEAR BOND SPREADS Looking at interest rates going forward, the Fed has indicated a higher degree of willingness to tighten rates than the RBA. Data points in the fourth quarter are going to be watched closely for clues on any change to the widening path between the two central banks. COMMODITIES ARE ADDING VALUE Burning away in the background is a very healthy fundamental backdrop for the Aussie. Unemployment is at record lows and the last earnings season mostly delivered solid returns for equity investors. The commodity market has taken a hit in the second half of the year with energy being an exception. Australian liquefied natural gas (LNG) and coal exports remain in high demand. Iron ore and other base metals are significantly lower than the peaks over the last 12 -months or so but remain elevated relative to prior to the pandemic. A trade surplus continues to deliver around AUD 10 billion a month. The lower AUD/USD exchange rate has enhanced the domestic economy. Overall, changes to the cash rate outlook could provide the key to AUD/USD direction. AUD weakness may continue against a US Dollar that appears to have gale force tailwinds from the Fed. Source: Daily FX Required: (a) Assume you are the lead hedge strategist at ANZ Bank. ANZ has borrowed US $1Bn and the first repayment in due in 3 months. Based on the above article, would you recommend ANZ to hedge its exposure to exchange rate risk? Critically analyse your recommendation to hedge or not. (350 words) (8 marks) (b) Irrespective of your answer to (a), assume you are required to hedge exchange rate risk. Between futures and options (single and multiple option strategies/option structures) which strategy/instrument would you recommend and why? Provide the reason for your choice above all other strategies. (350 words) Question 2 (15 marks) AUD Q4 2022 Fundamental Forecast: Australian Dollar Outlook Sees the Fed Running Harder and Faster than the RBA Oct 1, 2022 1:00 PM +10:00 Daniel McCarthy, Strategist - The Australian Dollar appears hostage to global forces going into year end - While the RBA and the Fed are tightening, the velocity of change is apparent - Central bank actions are moving markets. Will rates undermine AUD/ USD? The Australian Dollar made a 2-year low against the US Dollar in September as global central banks ratcheted up their fight against inflation. The pivot toward a far more aggressive stance for the tightening of monetary policy in the second quarter was backed up by outsized hikes in rates in the third quarter by many global central banks. At the third quarter's end, the RBA appears to have backed away from ongoing outsized rate rises. The tightening of monetary policy is to allay fears of inflation becoming entrenched. The last read of Australian year-on-year CPI to the end of the second quarter came in at 6.1%, well above the RBA's target of 23% on average over the business cycle. CPI in other developed markets is notably higher, with the exception of Japan. The September quarter CPI number won't be known until 26th October and that is shaping up as a key component for the RBA board to consider at their November monetary policy meeting. MONETARY POLICY MATTERS Cash rate differentials are playing out across the yield curve. 'The Federal Reserve has maintained a more hawkish stance than the RB. Just prior to the end of the third quartcr, the Fed raised its funds target rate by 75 basis points as anticipated. The language in the post-decision briefing from Fed Chair Jerome Powell made it clear that the US central bank will be raising rates significantly higher into the fourth quarter. This has seen Treasury yields continuing higher at a faster clip than Australian Commonwealth Government Bonds (ACGB). The 2- and 10-ycar bond spreads have contracted in favour of USD and the corrclation becomes apparent in the chart. AUD/USD AGAINST 2- AND 10-YEAR BOND SPREADS Looking at interest rates going forward, the Fed has indicated a higher degree of willingness to tighten rates than the RBA. Data points in the fourth quarter are going to be watched closely for clues on any change to the widening path between the two central banks. COMMODITIES ARE ADDING VALUE Burning away in the background is a very healthy fundamental backdrop for the Aussie. Unemployment is at record lows and the last earnings season mostly delivered solid returns for equity investors. The commodity market has taken a hit in the second half of the year with energy being an exception. Australian liquefied natural gas (LNG) and coal exports remain in high demand. Iron ore and other base metals are significantly lower than the peaks over the last 12 -months or so but remain elevated relative to prior to the pandemic. A trade surplus continues to deliver around AUD 10 billion a month. The lower AUD/USD exchange rate has enhanced the domestic economy. Overall, changes to the cash rate outlook could provide the key to AUD/USD direction. AUD weakness may continue against a US Dollar that appears to have gale force tailwinds from the Fed. Source: Daily FX Required: (a) Assume you are the lead hedge strategist at ANZ Bank. ANZ has borrowed US $1Bn and the first repayment in due in 3 months. Based on the above article, would you recommend ANZ to hedge its exposure to exchange rate risk? Critically analyse your recommendation to hedge or not. (350 words) (8 marks) (b) Irrespective of your answer to (a), assume you are required to hedge exchange rate risk. Between futures and options (single and multiple option strategies/option structures) which strategy/instrument would you recommend and why? Provide the reason for your choice above all other strategies. (350 words)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started