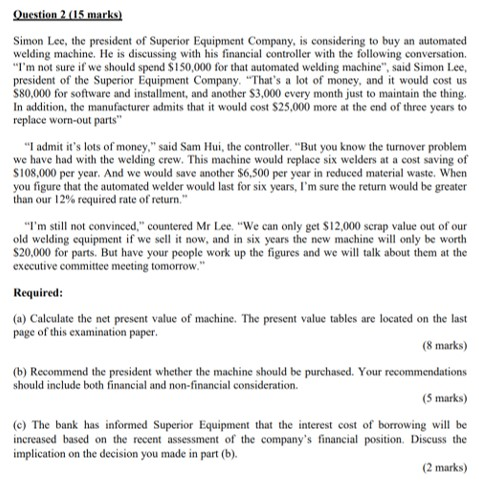

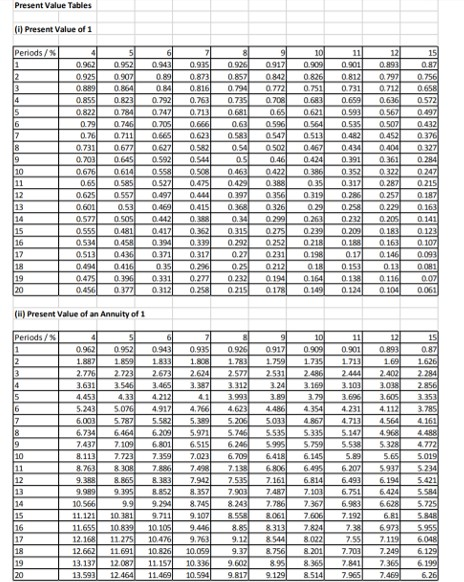

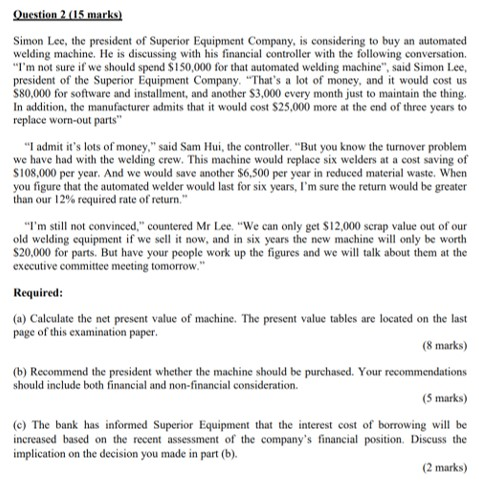

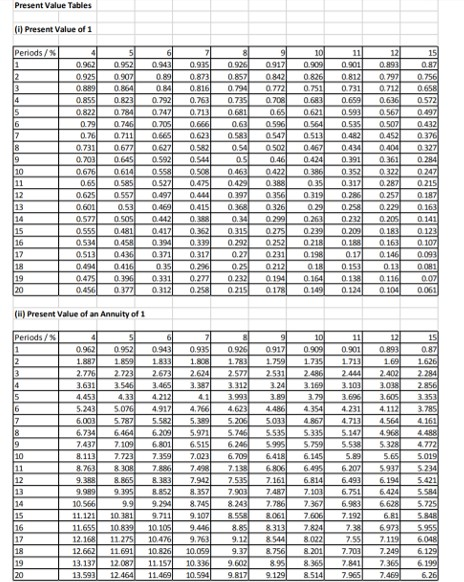

Question 2 (15 marks) Simon Lee, the president of Superior Equipment Company, is considering to buy an automated welding machine. He is discussing with his financial controller with the following conversation. "I'm not sure if we should spend S150,000 for that automated welding machine", said Simon Lee, president of the Superior Equipment Company. "That's a lot of money, and it would cost us $80,000 for software and installment, and another $3,000 every month just to maintain the thing, In addition, the manufacturer admits that it would cost $25.000 more at the end of three years to replace worn-out parts "I admit it's lots of money," said Sam Hui, the controller. "But you know the turnover problem we have had with the welding crew. This machine would replace six welders at a cost saving of S108,000 per year. And we would save another $6,500 per year in reduced material waste. When you figure that the automated welder would last for six years, I'm sure the return would be greater than our 12% required rate of return." "I'm still not convinced," countered Mr Lee. "We can only get $12,000 scrap value out of our old welding equipment if we sell it now, and in six years the new machine will only be worth $20,000 for parts. But have your people work up the figures and we will talk about them at the executive committee meeting tomorrow." Required: (a) Calculate the net present value of machine. The present value tables are located on the last page of this examination paper. (8 marks) (b) Recommend the president whether the machine should be purchased. Your recommendations should include both financial and non-financial consideration. (5 marks) (e) The bank has informed Superior Equipment that the interest cost of borrowing will be increased based on the recent assessment of the company's financial position Discuss the implication on the decision you made in part (b). (2 marks) Present Value Tables Present Value of 1 020706 Qol 0.544 0.91 Periods/4567891011121 292 293 0.9250 925 0917 0909 090109 0925 0907 0.89 0.873 0.857084210826 0.812 0.790 0.756 0.899 0864 084 08160794 0.772 0.751 0.7311 0.722 0.85 0.8230.792 0.753 0.73507080683 0.659 572 0.822 0.786 0.747 0723 0681 0651 0.593 0.56) 0.70 0.66 0.596 0.564 0.535 0.500 0.432 0.665 0.623 Q583 0.513 0.482 0:37 0.627 0.582 0.54 0502 0.067 0.434 0.327 0.592 OS 0.46 0.424 0.361 0.558 0.50 0.422 0.396 0.322 0247 0.45 0.3881 0:35 0.317 0.280 0215 0.4971 0.397 0356 0315 0.2570187 0.489 0.415 0.368 0.326 0.29 0258 0229 0163 0.4421 0299 0.261 2050 141 04171 0.3621 0.315 0275 0239 0 2091 0.183 0123 0.45 0.394 0.3391 0.292 0252 0218 .18 1600 1071 0.513 0.436 0.371 0.3171 0.22 0231 0.19 0.17 0.146 0.093 04160 35 0.296 0.250 212 1 01500100081 19 0.4751 0.396 0.331 0.2721 0.23210 144 0.164 0.19 0110 0.02 0.456 0.3770.3120.2580.215 0.178 0.149 0.1240104 0.061 527 0 4251 0.6061 0286 lalala 094 () Present Value of an Annuity of 1 Periods / 2284 5335 5.147 5 6 7 8 9 10 11 12 15 0.962 0 952 0943 0.935 0.926 09170909090109930.87 1.882 1859 1833 1.808 1.783 1759 1735 1713 161 1626 2.726 2.723 2673 2.624 2.577125311 2.496 2 4041 2.4021 3.631 354634653321331213243.369 3.100 3.038 2.856 4.453 4.33 4.2121 41 3.993 3.89 3.79 3.696 3.605 5243026491214.266 4.23 448643544231 4. 112 6.0035787 558252295206 5.033 4867 4.7131 4.564 67341 6.4646.2095.971 5.746 5535 7.430 7.109 6.801 6.515 6.246 5995 5.52 8.113 7.7237.359 7.022 6.418 8.763 8 2087 2088 6.095 9.388 65 9.989992 8357 7.103 10.566959.294 8.745 7367 11.121 10:381 9.711 9.107 11.655 10.89 10.105 9.46 12.168 11 275 10.476 9.753 12.663 11691 10.326 10.059 13.132 12.080 1115 10338 13.53 12 464 11 459 10 594