Question

QUESTION 2 (15 marks) The bank reconciliation statement on 30 September 2018 included the following: The bank statement on 31 October 2018 showed a favourable

QUESTION 2 (15 marks)

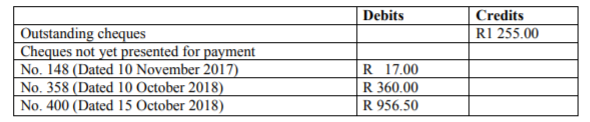

The bank reconciliation statement on 30 September 2018 included the following:

The bank statement on 31 October 2018 showed a favourable balance of R25 427.50.

The general ledger account on the 1 October 2018 showed a debit balance of R25 249.50.

The comparison of the bank statement of October with the bank reconciliation statement of September and the cash journals of October showed the following differences:

1. Entries credited on the bank statement which do not appear in the cash journal for October 2018:

Deposit R1 255

Direct deposit R480 by Mr. King.

2. Entries debited on the bank statement which do not appear in the cash journal for October 2018:

Debit order, R325. It is in favour of Knight Rental for rent.

Cheque no 358, R360.

Unpaid cheque, R582.50. This cheque was received from Ms. Queen but the cheque was returned on 27 October 2018 marked insufficient funds.

Unpaid cheque, R234.50. This cheque was received from Mr. Jack, deposited on 27 October, and returned on 28 October due to irregular signature.

Unpaid cheque, R247.50. This cheque was received from Ms. Ace and deposited. It was returned by the bank since it was dated 1 November 2018

. Cheque no. 223 issued to Mr. Ace for inventory, R1 285, was accidentally entered in the CPJ as R1 375.

Charges for services fees, R30.50, and cash handling fees, R18.

3. Entries in the cash journal that do not appear on the bank statement

: Cheque no 229 for R1 150 to Castle Wholesalers dated 15 October 2018.

Cheque no 243 for R112.50 to Z Zeven dated 1 October 2018.

Deposited on 1 October 2018, R2 445.

4. Cheque no 48 has not been re-issued to date.

You are required to:

a) Prepare the bank account in the general ledger for the month of October 2018. (10 Marks)

b) Prepare the bank reconciliation statement as at 30 October 2018. (5 Marks)

Debits Credits RI 255.00 Outstanding cheques Cheques not yet presented for payment No. 148 (Dated 10 November 2017) No. 358 (Dated 10 October 2018) No. 400 (Dated 15 October 2018) R 17.00 R 360.00 R 956.50Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started