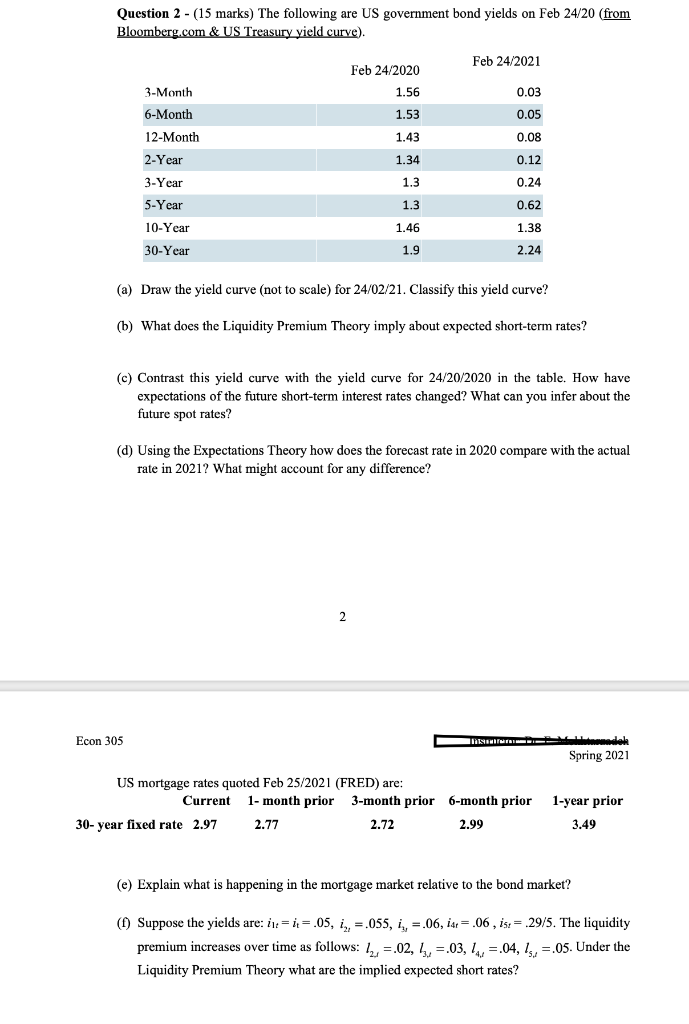

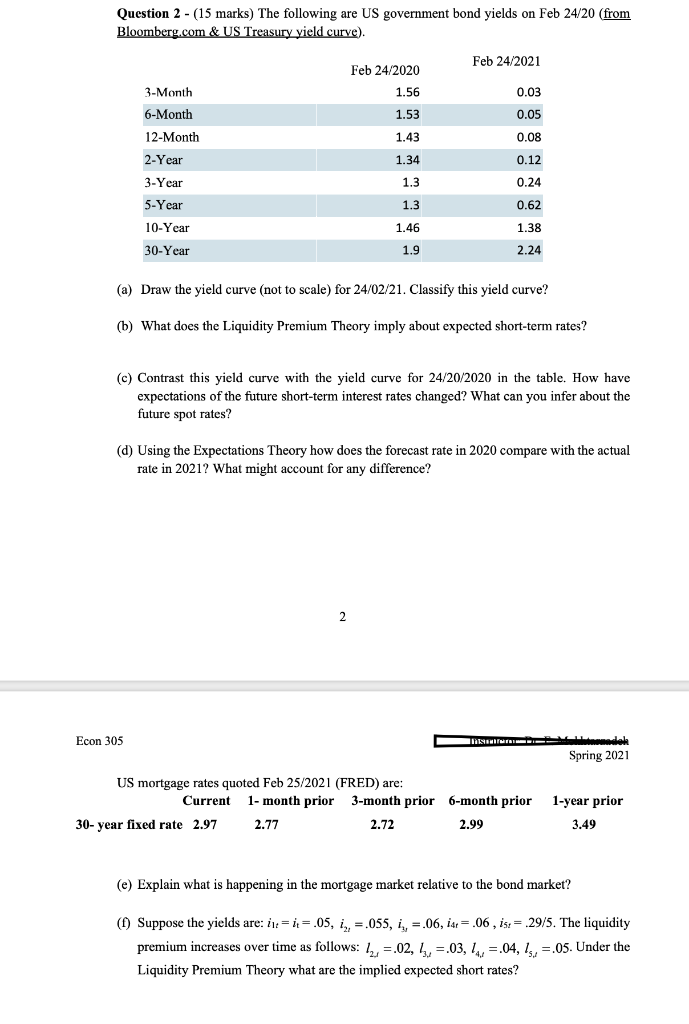

Question 2 - (15 marks) The following are US government bond yields on Feb 24/20 (from Bloomberg.com & US Treasury yield curve). Feb 24/2021 Feb 24/2020 1.56 0.03 0.05 3-Month 6-Month 12-Month 2-Year 1.53 1.43 0.08 1.34 0.12 0.24 3-Year 1.3 5-Year 1.3 0.62 1.38 10-Year 1.46 30-Year 1.9 2.24 (a) Draw the yield curve (not to scale) for 24/02/21. Classify this yield curve? (b) What does the Liquidity Premium Theory imply about expected short-term rates? (c) Contrast this yield curve with the yield curve for 24/20/2020 in the table. How have expectations of the future short-term interest rates changed? What can you infer about the future spot rates? (d) Using the Expectations Theory how does the forecast rate in 2020 compare with the actual rate in 2021? What might account for any difference? 2 Econ 305 IRISHINIHIRISH Spring 2021 US mortgage rates quoted Feb 25/2021 (FRED) are: Current 1-month prior 3-month prior 6-month prior 1-year prior 30-year fixed rate 2.97 2.77 2.72 2.99 3.49 (e) Explain what is happening in the mortgage market relative to the bond market? (1) Suppose the yields are: 11: = 1= .05, 1,, =.055, 13 =.06, 14=.06, is:= 29/5. The liquidity premium increases over time as follows: 12=.02, 1,0 =.03, lv =.04, 13, =.05. Under the Liquidity Premium Theory what are the implied expected short rates? Question 2 - (15 marks) The following are US government bond yields on Feb 24/20 (from Bloomberg.com & US Treasury yield curve). Feb 24/2021 Feb 24/2020 1.56 0.03 0.05 3-Month 6-Month 12-Month 2-Year 1.53 1.43 0.08 1.34 0.12 0.24 3-Year 1.3 5-Year 1.3 0.62 1.38 10-Year 1.46 30-Year 1.9 2.24 (a) Draw the yield curve (not to scale) for 24/02/21. Classify this yield curve? (b) What does the Liquidity Premium Theory imply about expected short-term rates? (c) Contrast this yield curve with the yield curve for 24/20/2020 in the table. How have expectations of the future short-term interest rates changed? What can you infer about the future spot rates? (d) Using the Expectations Theory how does the forecast rate in 2020 compare with the actual rate in 2021? What might account for any difference? 2 Econ 305 IRISHINIHIRISH Spring 2021 US mortgage rates quoted Feb 25/2021 (FRED) are: Current 1-month prior 3-month prior 6-month prior 1-year prior 30-year fixed rate 2.97 2.77 2.72 2.99 3.49 (e) Explain what is happening in the mortgage market relative to the bond market? (1) Suppose the yields are: 11: = 1= .05, 1,, =.055, 13 =.06, 14=.06, is:= 29/5. The liquidity premium increases over time as follows: 12=.02, 1,0 =.03, lv =.04, 13, =.05. Under the Liquidity Premium Theory what are the implied expected short rates