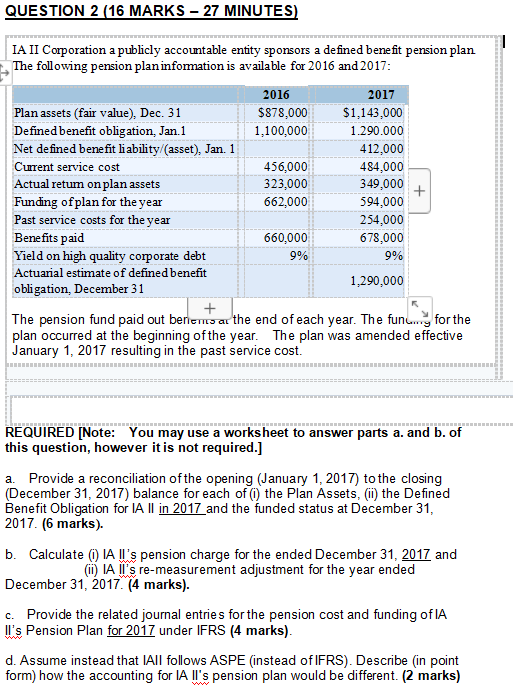

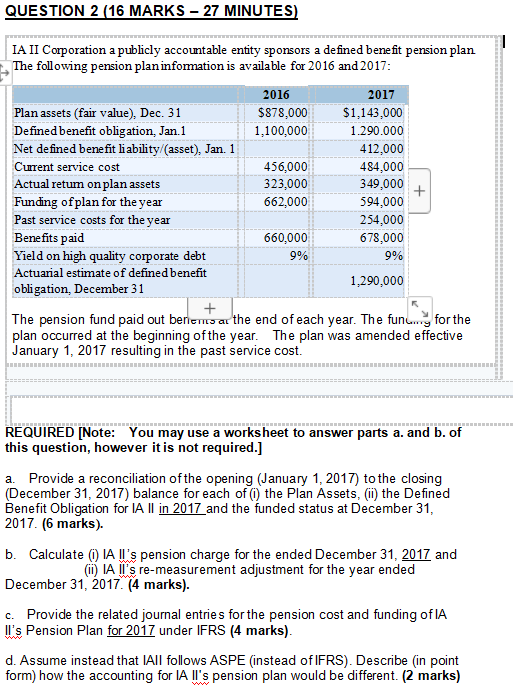

QUESTION 2 (16 MARKS - 27 MINUTES) IA II Corporation a publicly accountable entity sponsors a defined benefit pension plan The following pension plan information is available for 2016 and 2017: 2016 2017 Plan assets (fair value), Dec. 31 $878,000 $1,143,000 Defined benefit obligation, Jan.1 1,100,000 1.290.000 Net defined benefit liability/asset), Jan. 1 412,000 Current service cost 456,000 484,000 Actual retum on plan assets 323,000 349,000 + Funding of plan for the year 662,000 594,000 Past service costs for the year 254,000 Benefits paid 660,000 678,000 Yield on high quality corporate debt 9% 9% Actuarial estimate of defined benefit 1,290,000 obligation. December 31 + The pension fund paid out berichts at the end of each year. The fun...., for the plan occurred at the beginning of the year. The plan was amended effective January 1, 2017 resulting in the past service cost. REQUIRED [Note: You may use a worksheet to answer parts a. and b. of this question, however it is not required.] a. Provide a reconciliation of the opening (January 1, 2017) to the closing (December 31, 2017) balance for each of the Plan Assets, (i) the Defined Benefit Obligation for IA Il in 2017 and the funded status at December 31, 2017. (6 marks). b. Calculate () A ll's pension charge for the ended December 31, 2017 and () IA Il's re-measurement adjustment for the year ended December 31, 2017. (4 marks). c. Provide the related journal entries for the pension cost and funding of IA II's Pension Plan for 2017 under IFRS (4 marks). d. Assume instead that All follows ASPE (instead of IFRS). Describe (in point form) how the accounting for IA Il's pension plan would be different. (2 marks) QUESTION 2 (16 MARKS - 27 MINUTES) IA II Corporation a publicly accountable entity sponsors a defined benefit pension plan The following pension plan information is available for 2016 and 2017: 2016 2017 Plan assets (fair value), Dec. 31 $878,000 $1,143,000 Defined benefit obligation, Jan.1 1,100,000 1.290.000 Net defined benefit liability/asset), Jan. 1 412,000 Current service cost 456,000 484,000 Actual retum on plan assets 323,000 349,000 + Funding of plan for the year 662,000 594,000 Past service costs for the year 254,000 Benefits paid 660,000 678,000 Yield on high quality corporate debt 9% 9% Actuarial estimate of defined benefit 1,290,000 obligation. December 31 + The pension fund paid out berichts at the end of each year. The fun...., for the plan occurred at the beginning of the year. The plan was amended effective January 1, 2017 resulting in the past service cost. REQUIRED [Note: You may use a worksheet to answer parts a. and b. of this question, however it is not required.] a. Provide a reconciliation of the opening (January 1, 2017) to the closing (December 31, 2017) balance for each of the Plan Assets, (i) the Defined Benefit Obligation for IA Il in 2017 and the funded status at December 31, 2017. (6 marks). b. Calculate () A ll's pension charge for the ended December 31, 2017 and () IA Il's re-measurement adjustment for the year ended December 31, 2017. (4 marks). c. Provide the related journal entries for the pension cost and funding of IA II's Pension Plan for 2017 under IFRS (4 marks). d. Assume instead that All follows ASPE (instead of IFRS). Describe (in point form) how the accounting for IA Il's pension plan would be different. (2 marks)