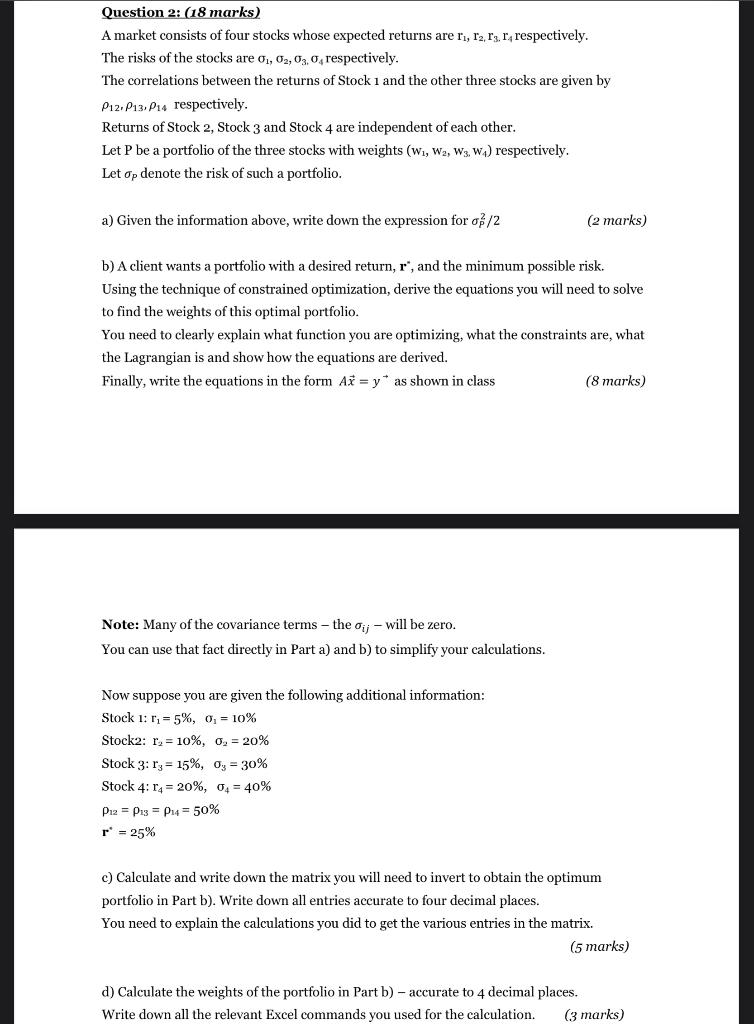

Question 2: (18 marks) A market consists of four stocks whose expected returns are r1,r2,r3,r4 respectively. The risks of the stocks are 1,2,3,4 respectively. The correlations between the returns of Stock 1 and the other three stocks are given by 12,13,14 respectively. Returns of Stock 2, Stock 3 and Stock 4 are independent of each other. Let P be a portfolio of the three stocks with weights ( w1,w2,w3,w4 ) respectively. Let P denote the risk of such a portfolio. a) Given the information above, write down the expression for P2/2 (2 marks) b) A client wants a portfolio with a desired return, r, and the minimum possible risk. Using the technique of constrained optimization, derive the equations you will need to solve to find the weights of this optimal portfolio. You need to clearly explain what function you are optimizing, what the constraints are, what the Lagrangian is and show how the equations are derived. Finally, write the equations in the form Ax=yas shown in class (8 marks) Note: Many of the covariance terms - the ij - will be zero. You can use that fact directly in Part a) and b) to simplify your calculations. Now suppose you are given the following additional information: Stock 1: r1=5%,1=10% Stock2: r2=10%,2=20% Stock 3:r3=15%,3=30% Stock 4:r4=20%,4=40% 12=13=14=50% r=25% c) Calculate and write down the matrix you will need to invert to obtain the optimum portfolio in Part b). Write down all entries accurate to four decimal places. You need to explain the calculations you did to get the various entries in the matrix. (5 marks) d) Calculate the weights of the portfolio in Part b) - accurate to 4 decimal places. Write down all the relevant Excel commands you used for the calculation. (3 marks) Question 2: (18 marks) A market consists of four stocks whose expected returns are r1,r2,r3,r4 respectively. The risks of the stocks are 1,2,3,4 respectively. The correlations between the returns of Stock 1 and the other three stocks are given by 12,13,14 respectively. Returns of Stock 2, Stock 3 and Stock 4 are independent of each other. Let P be a portfolio of the three stocks with weights ( w1,w2,w3,w4 ) respectively. Let P denote the risk of such a portfolio. a) Given the information above, write down the expression for P2/2 (2 marks) b) A client wants a portfolio with a desired return, r, and the minimum possible risk. Using the technique of constrained optimization, derive the equations you will need to solve to find the weights of this optimal portfolio. You need to clearly explain what function you are optimizing, what the constraints are, what the Lagrangian is and show how the equations are derived. Finally, write the equations in the form Ax=yas shown in class (8 marks) Note: Many of the covariance terms - the ij - will be zero. You can use that fact directly in Part a) and b) to simplify your calculations. Now suppose you are given the following additional information: Stock 1: r1=5%,1=10% Stock2: r2=10%,2=20% Stock 3:r3=15%,3=30% Stock 4:r4=20%,4=40% 12=13=14=50% r=25% c) Calculate and write down the matrix you will need to invert to obtain the optimum portfolio in Part b). Write down all entries accurate to four decimal places. You need to explain the calculations you did to get the various entries in the matrix. (5 marks) d) Calculate the weights of the portfolio in Part b) - accurate to 4 decimal places. Write down all the relevant Excel commands you used for the calculation