Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2 ( 2 0 Marks ) REQUIRED 2 . 1 Use the information provided below to calculate the ratios for 2 0 2 2

QUESTION Marks

REQUIRED

Use the information provided below to calculate the ratios for expressed to two decimal places

that would reflect each of the following. Note: Use the formulas provided in the formula sheet only that

appear after QUESTION

The efficiency with which the company can produce and sell its products before

extraneous costs are deducted. marks

The amount of time taken by the company to pay its trade debts. marks

A measurement of the ability of management to use the companys net assets to generate

sales revenue. marks

The amount of profit that the company generates in relation to its equity and borrowed

capital. marks

The portion of the company's profit that is allocated to each outstanding ordinary share. marks

The percentage of the profit that has been put back into the company. marks

Comment on the following ratios by stating TWO significant points in each case:

Profit margin Net profit margin marks

Price earnings ratio times times marks

Return on assets marks

Debt to assets marks

INFORMATION

Excerpts of the financial data of Premier Limited for are as follows:

STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED DECEMBER

R

Sales

Cost of sales

Operating profit

Interest expense

Profit before tax

Company tax

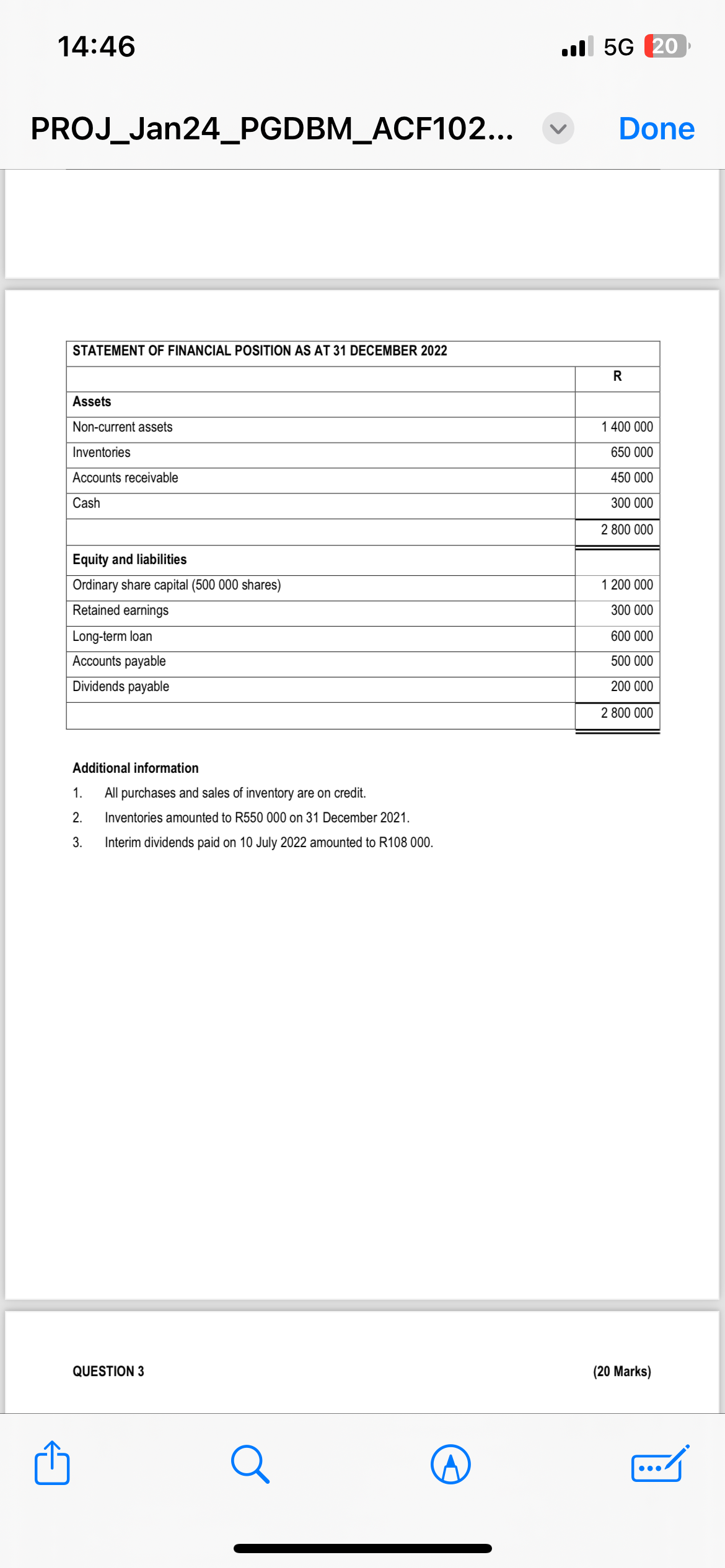

STATEMENT OF FINANCIAL POSITION AS AT DECEMBER

R

Assets

Noncurrent assets

Inventories

Accounts receivable

Cash

Equity and liabilities

Ordinary share capital shares

Retained earnings

Longterm loan

Accounts payable

Dividends payable

Additional information

All purchases and sales of inventory are on credit.

Inventories amounted to R on December

Interim dividends paid on July amounted to R

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started