Answered step by step

Verified Expert Solution

Question

1 Approved Answer

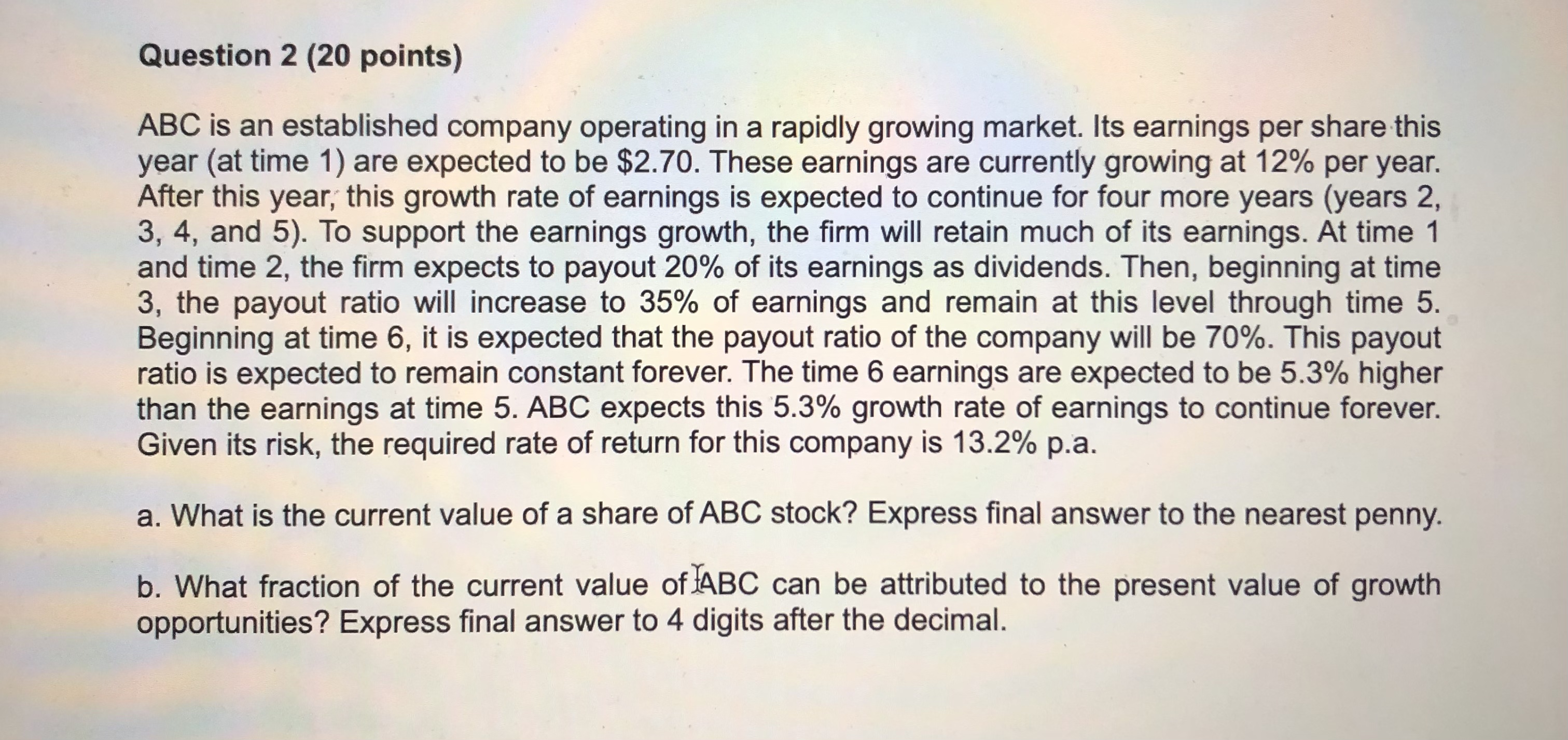

Question 2 ( 2 0 points ) ABC is an established company operating in a rapidly growing market. Its earnings per share this year (

Question points

ABC is an established company operating in a rapidly growing market. Its earnings per share this

year at time are expected to be $ These earnings are currently growing at per year.

After this year, this growth rate of earnings is expected to continue for four more years years

and To support the earnings growth, the firm will retain much of its earnings. At time

and time the firm expects to payout of its earnings as dividends. Then, beginning at time

the payout ratio will increase to of earnings and remain at this level through time

Beginning at time it is expected that the payout ratio of the company will be This payout

ratio is expected to remain constant forever. The time earnings are expected to be higher

than the earnings at time ABC expects this growth rate of earnings to continue forever.

Given its risk, the required rate of return for this company is pa

a What is the current value of a share of ABC stock? Express final answer to the nearest penny.

b What fraction of the current value of AABC can be attributed to the present value of growth

opportunities? Express final answer to digits after the decimal.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started