Answered step by step

Verified Expert Solution

Question

1 Approved Answer

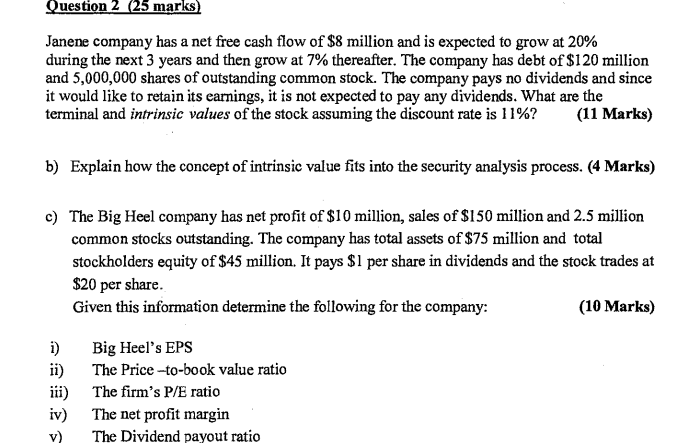

Question 2 ( 2 5 marks ) Janene company has a net free cash flow of $ 8 million and is expected to grow at

Question marks

Janene company has a net free cash flow of $ million and is expected to grow at

during the next years and then grow at thereafter. The company has debt of $ million

and shares of outstanding common stock. The company pays no dividends and since

it would like to retain its earnings, it is not expected to pay any dividends. What are the

terminal and intrinsic values of the stock assuming the discount rate is

Marks

b Explain how the concept of intrinsic value fits into the security analysis process. Marks

c The Big Heel company has net profit of $ million, sales of $ million and million

common stocks outstanding. The company has total assets of $ million and total

stockholders equity of $ million. It pays $ per share in dividends and the stock trades at

$ per share.

Given this information determine the following for the company:

Marks

i Big Heel's EPS

ii The Pricetobook value ratio

iii The firm's ratio

iv The net profit margin

v The Dividend payout ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started