Answered step by step

Verified Expert Solution

Question

1 Approved Answer

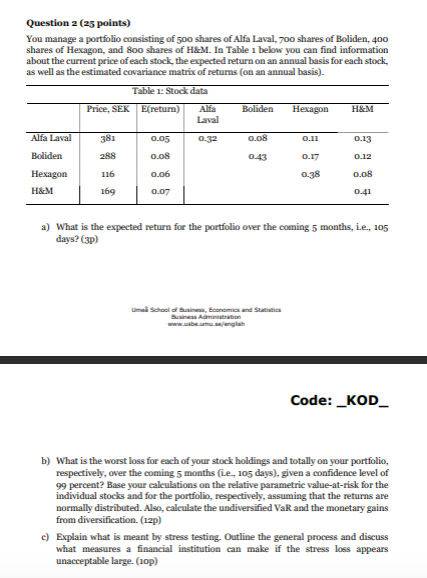

Question 2 ( 2 5 points ) You manage a portfolio consisting of 5 0 0 shares of Alfa Laval, 7 0 0 shares of

Question points

You manage a portfolio consisting of shares of Alfa Laval, shares of Boliden,

shares of Hexagon, and shares of H&M In Table below you can find information

about the current price of each stock, the expected return on an annual basis for each stock,

as well as the estimated covariance matrix of returns on an annual basis

Table : Stock data

a What is the expected return for the portfolio over the coming months, ie

days? p

b What is the worst loss for each of your stock holdings and totally on your portfolio,

respectively, over the coming months ie days given a confidence level of

percent? Base your calculations on the relative parametric valueatrisk for the

individual stocks and for the portfolio, respectively, assuming that the returns are

normally distributed. Also, calculate the undiversified VaR and the monetary gains

from diversification. p

c Explain what is meant by stress testing. Outline the general process and discuss

what measures a financial institution can make if the stress loss appears

unacceptable large. p

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started