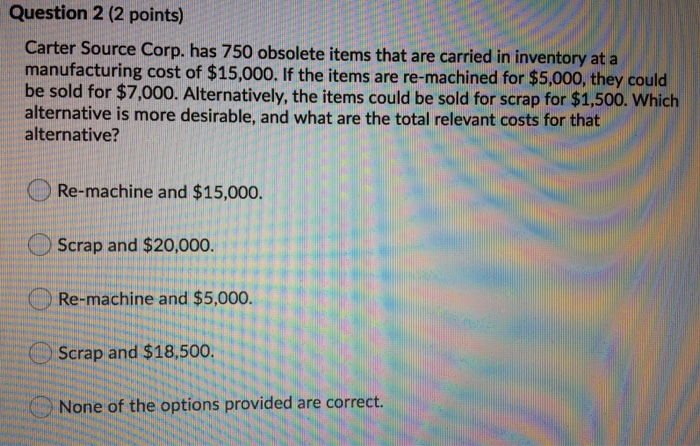

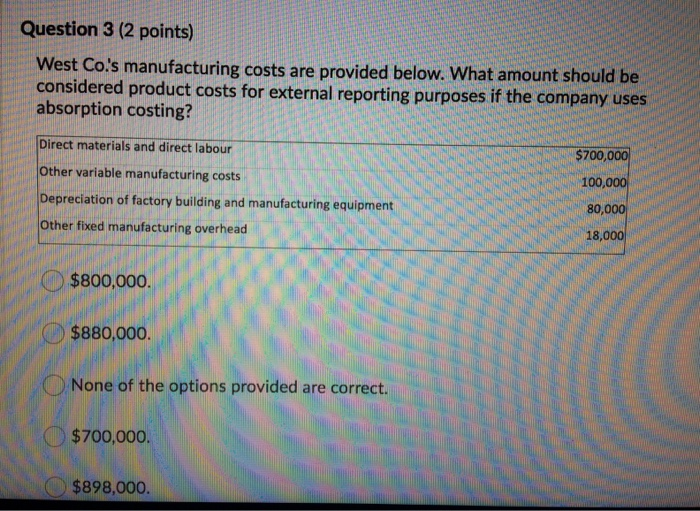

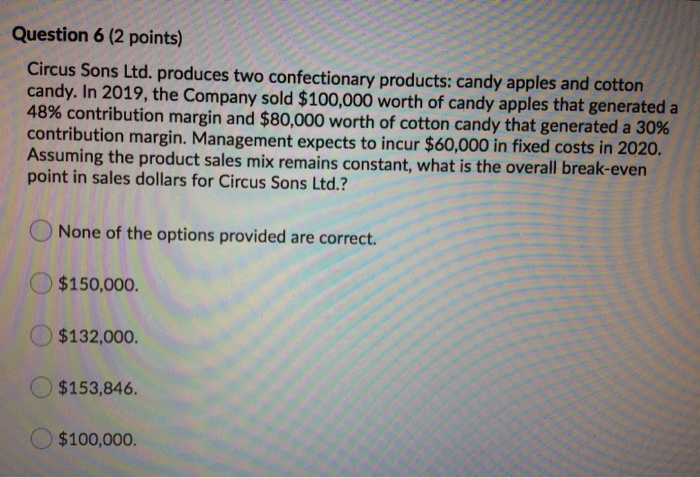

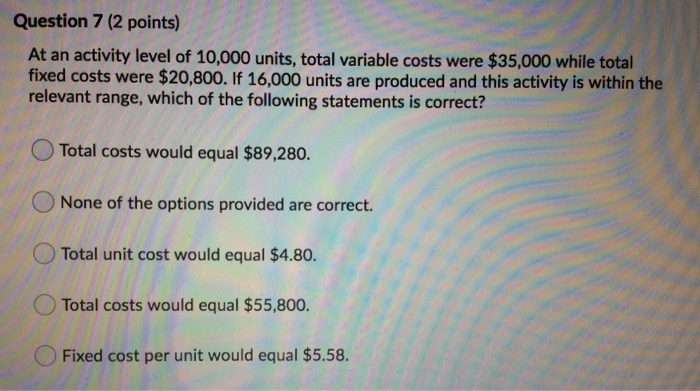

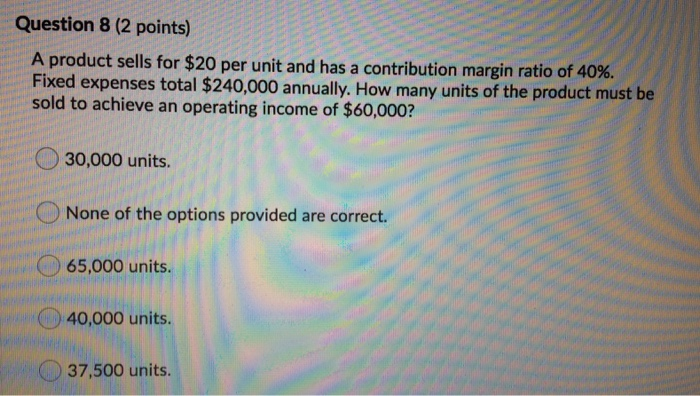

Question 2 (2 points) Carter Source Corp. has 750 obsolete items that are carried in inventory at a manufacturing cost of $15,000. If the items are re-machined for $5,000, they could be sold for $7,000. Alternatively, the items could be sold for scrap for $1,500. Which alternative is more desirable, and what are the total relevant costs for that alternative? Re-machine and $15,000. Scrap and $20,000. Re-machine and $5,000. Scrap and $18,500. None of the options provided are correct. Question 3 (2 points) West Co.'s manufacturing costs are provided below. What amount should be considered product costs for external reporting purposes if the company uses absorption costing? S200 000 $700,000 100,000 Direct materials and direct labour Other variable manufacturing costs Depreciation of factory building and manufact Other fixed manufacturing overhead WANT 10 nr equipment 90.000 On 18,000 $800,000. $880,000. None of the options provided are correct $700,000. $898,000. Question 6 (2 points) Circus Sons Ltd. produces two confectionary products: candy apples and cotton candy. In 2019, the Company sold $100,000 worth of candy apples that generated a 48% contribution margin and $80,000 worth of cotton candy that generated a 30% contribution margin. Management expects to incur $60,000 in fixed costs in 2020. Assuming the product sales mix remains constant, what is the overall break-even point in sales dollars for Circus Sons Ltd.? None of the options provided are correct. $150,000. $132,000. $153,846. $100,000 Question 7 (2 points) At an activity level of 10,000 units, total variable costs were $35,000 while total fixed costs were $20,800. If 16,000 units are produced and this activity is within the relevant range, which of the following statements is correct? Total costs would equal $89,280. None of the options provided are correct. Total unit cost would equal $4.80. Total costs would equal $55,800. Fixed cost per unit would equal $5.58. Question 8 (2 points) A product sells for $20 per unit and has a contribution margin ratio of 40%. Fixed expenses total $240,000 annually. How many units of the product must be sold to achieve an operating income of $60,000? 30,000 units. None of the options provided are correct. 65,000 units. 40,000 units. 37,500 units