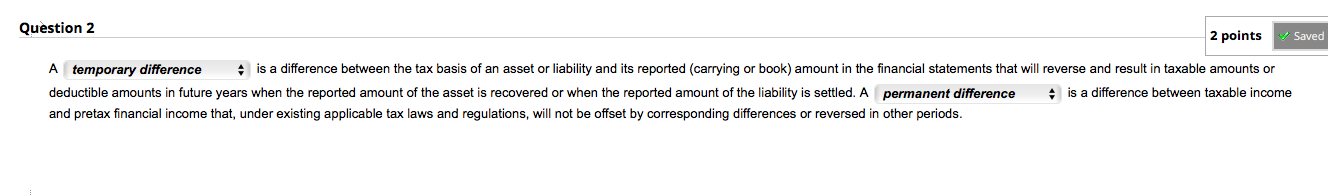

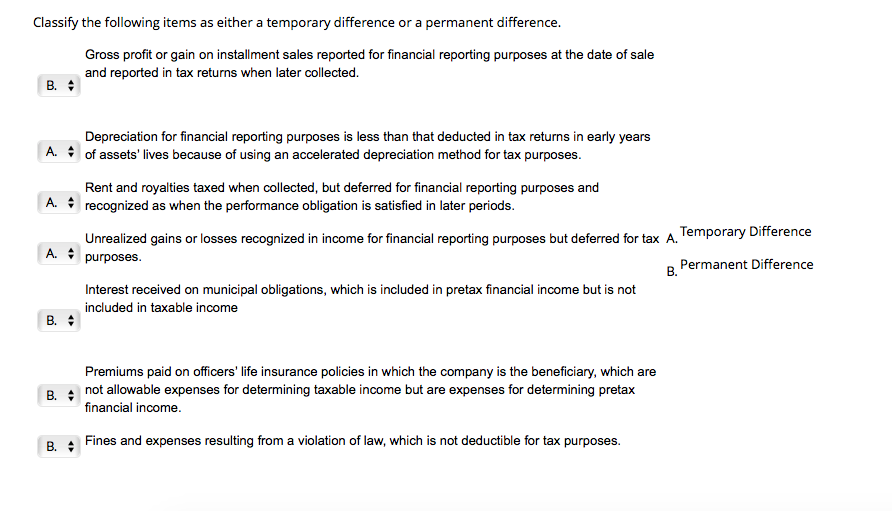

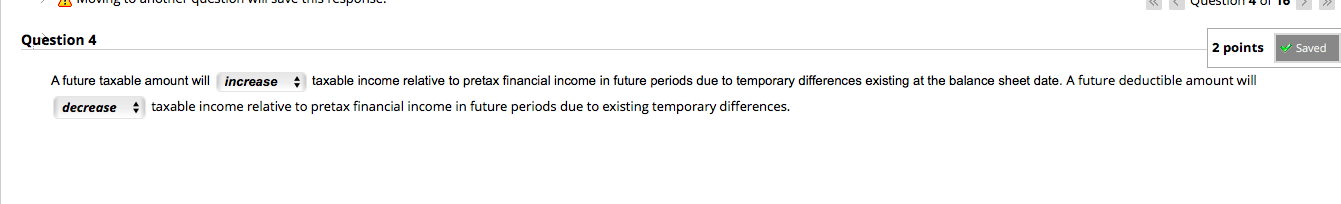

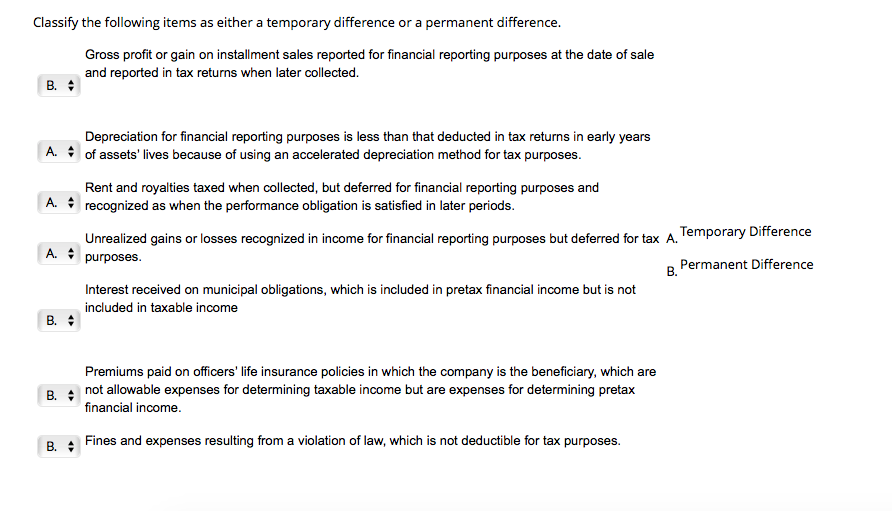

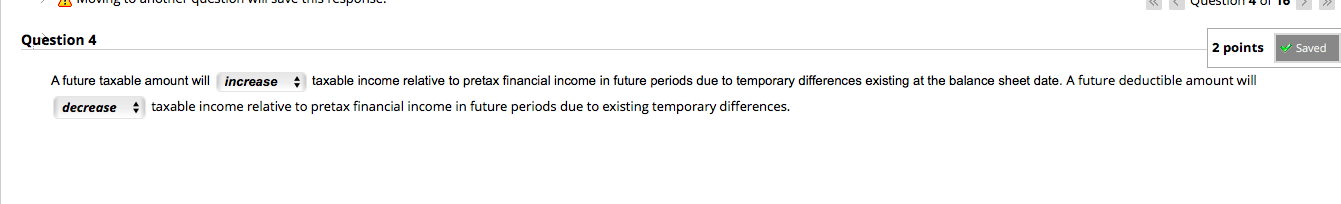

Question 2 2 points Saved A temporary difference is a difference between the tax basis of an asset or liability and its reported (carrying or book) amount in the financial statements that will reverse and result in taxable amounts or deductible amounts in future years when the reported amount of the asset is recovered or when the reported amount of the liability is settled. A permanent difference is a difference between taxable income and pretax financial income that, under existing applicable tax laws and regulations, will not be offset by corresponding differences or reversed in other periods. Classify the following items as either a temporary difference or a permanent difference. Gross profit or gain on installment sales reported for financial reporting purposes at the date of sale and reported in tax returns when later collected. B. Depreciation for financial reporting purposes is less than that deducted in tax returns in early years A. . of assets' lives because of using an accelerated depreciation method for tax purposes. A. A. Rent and royalties taxed when collected, but deferred for financial reporting purposes and recognized as when the performance obligation is satisfied in later periods. Unrealized gains or losses recognized in income for financial reporting purposes but deferred for tax A. Temporary bitte rred for tax Temporary Difference purposes. B Permanent Difference Interest received on municipal obligations, which is included in pretax financial income but is not included in taxable income B. B Premiums paid on officers' life insurance policies in which the company is the beneficiary, which are not allowable expenses for determining taxable income but are expenses for determining pretax financial income. B Fines and expenses resulting from a violation of law, which is not deductible for tax purposes. SIVUVILO UIIULICI UCJLIUI V JUVC LINIJICJPUTIJ QuesLIUIT 4 UI IL >> Question 4 2 points Saved A future taxable amount will increase taxable income relative to pretax financial income in future periods due to temporary differences existing at the balance sheet date. A future deductible amount will decrease taxable income relative to pretax financial income in future periods due to existing temporary differences