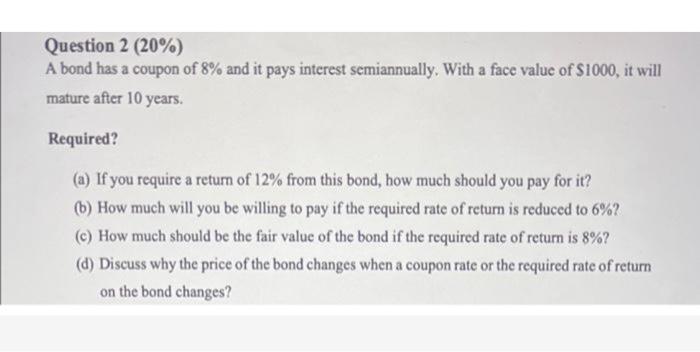

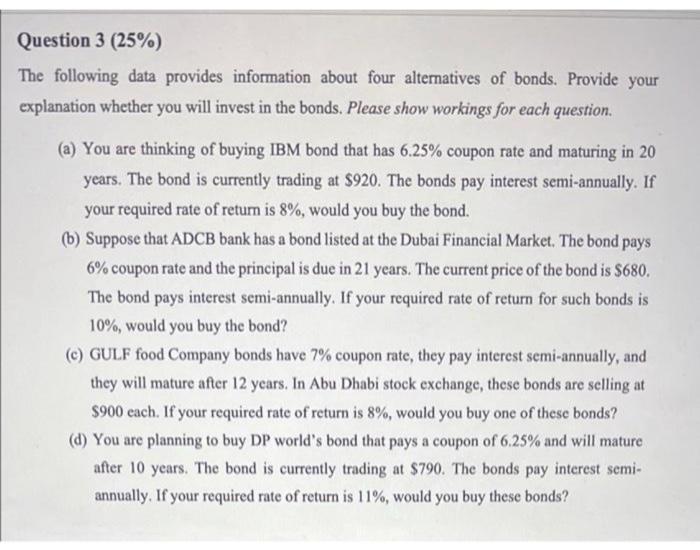

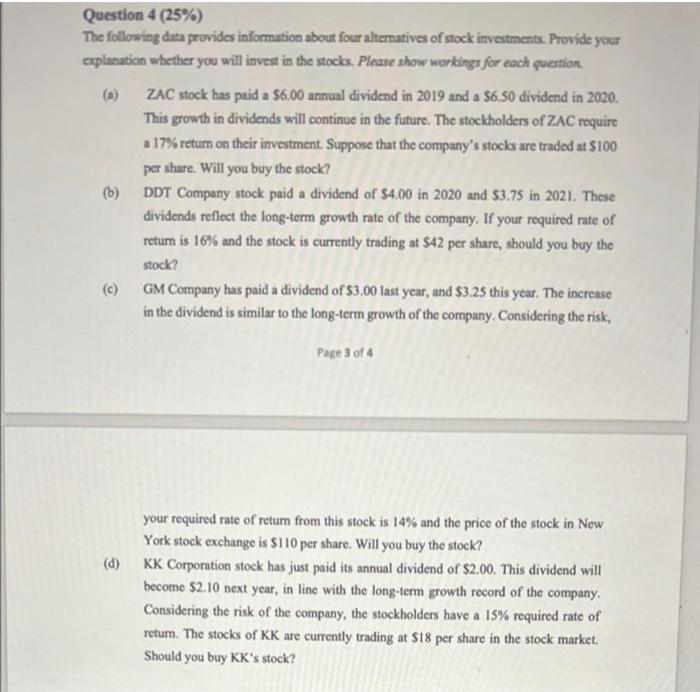

Question 2 (20%) A bond has a coupon of 8% and it pays interest semiannually. With a face value of $1000, it will mature after 10 years. Required? (a) If you require a return of 12% from this bond, how much should you pay for it? (b) How much will you be willing to pay if the required rate of return is reduced to 6%? (e) How much should be the fair value of the bond if the required rate of return is 8%? (d) Discuss why the price of the bond changes when a coupon rate or the required rate of return on the bond changes? Question 3 (25%) The following data provides information about four alternatives of bonds. Provide your explanation whether you will invest in the bonds. Please show workings for each question. (a) You are thinking of buying IBM bond that has 6.25% coupon rate and maturing in 20 years. The bond is currently trading at $920. The bonds pay interest semi-annually. If your required rate of return is 8%, would you buy the bond. (b) Suppose that ADCB bank has a bond listed at the Dubai Financial Market. The bond pays 6% coupon rate and the principal is due in 21 years. The current price of the bond is $680. The bond pays interest semi-annually. If your required rate of return for such bonds is 10%, would you buy the bond? (C) GULF food Company bonds have 7% coupon rate, they pay interest semi-annually, and they will mature after 12 years. In Abu Dhabi stock exchange, these bonds are selling at $900 each. If your required rate of return is 8%, would you buy one of these bonds? (d) You are planning to buy DP world's bond that pays a coupon of 6.25% and will mature after 10 years. The bond is currently trading at $790. The bonds pay interest semi- annually. If your required rate of return is 11%, would you buy these bonds? Question 3 (25%) The following data provides information about four alternatives of bonds. Provide your explanation whether you will invest in the bonds. Please show workings for each question. (a) You are thinking of buying IBM bond that has 6.25% coupon rate and maturing in 20 years. The bond is currently trading at $920. The bonds pay interest semi-annually. If your required rate of return is 8%, would you buy the bond. (b) Suppose that ADCB bank has a bond listed at the Dubai Financial Market. The bond pays 6% coupon rate and the principal is due in 21 years. The current price of the bond is $680. The bond pays interest semi-annually. If your required rate of return for such bonds is 10%, would you buy the bond? (e) GULF food Company bonds have 7% coupon rate, they pay interest semi-annually, and they will mature after 12 years. In Abu Dhabi stock exchange, these bonds are selling at $900 each. If your required rate of return is 8%, would you buy one of these bonds? (d) You are planning to buy DP world's bond that pays a coupon of 6.25% and will mature after 10 years. The bond is currently trading at $790. The bonds pay interest semi- annually. If your required rate of return is 11%, would you buy these bonds? Question 4 (25%) The following data provides information about four alteratives of stock investments. Provide your explanation whether you will invest in the stocks. Please show workings for each question ZAC stock has paid a $6.00 annual dividend in 2019 and a $6.50 dividend in 2020. This growth in dividends will continue in the future. The stockholders of ZAC require a 17% retum on their investment Suppose that the company's stocks are traded at $100 per share. Will you buy the stock? (b) DDT Company stock paid a dividend of $4.00 in 2020 and $3.75 in 2021. These dividends reflect the long-term growth rate of the company. If your required rate of return is 16% and the stock is currently trading at $42 per share, should you buy the stock? (e) GM Company has paid a dividend of $3.00 last year, and $3.25 this year. The increase in the dividend is similar to the long-term growth of the company. Considering the risk, Page 3 of 4 your required rate of retum from this stock is 14% and the price of the stock in New York stock exchange is $110 per share. Will you buy the stock? (d) KK Corporation stock has just paid its annual dividend of $2.00. This dividend will become $2.10 next year, in line with the long-term growth record of the company. Considering the risk of the company, the stockholders have a 15% required rate of return. The stocks of KK are currently trading at $18 per share in the stock market. Should you buy KK's stock