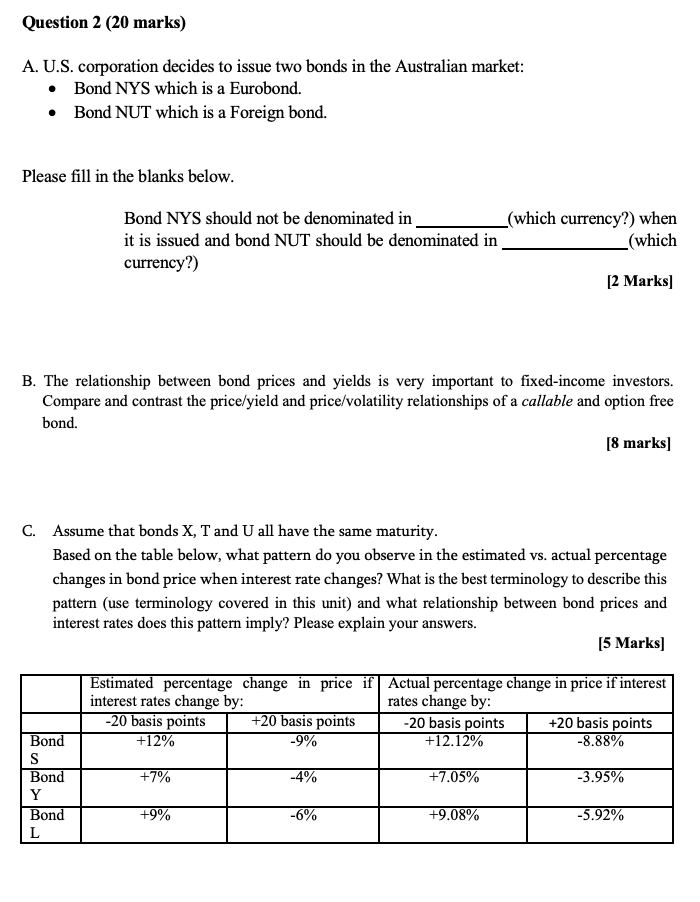

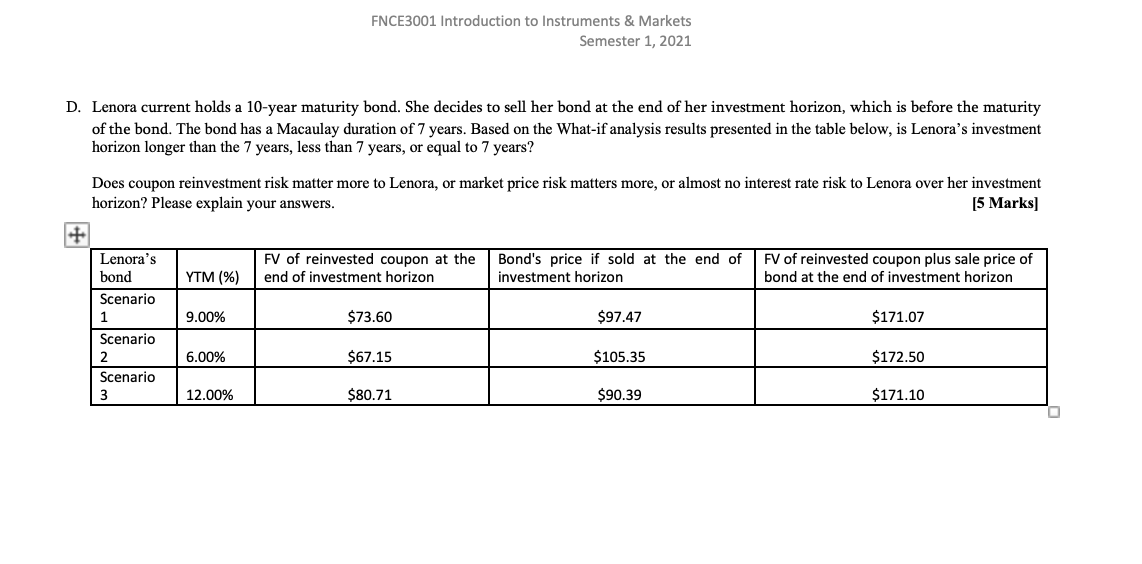

Question 2 (20 marks) A. U.S. corporation decides to issue two bonds in the Australian market: Bond NYS which is a Eurobond. Bond NUT which is a Foreign bond. Please fill in the blanks below. Bond NYS should not be denominated in (which currency?) when it is issued and bond NUT should be denominated in _(which currency?) [2 Marks) B. The relationship between bond prices and yields is very important to fixed-income investors. Compare and contrast the price/yield and price/volatility relationships of a callable and option free bond. [8 marks) C. Assume that bonds X, T and U all have the same maturity. Based on the table below, what pattern do you observe in the estimated vs. actual percentage changes in bond price when interest rate changes? What is the best terminology to describe this pattern (use terminology covered in this unit) and what relationship between bond prices and interest rates does this pattern imply? Please explain your answers. [5 Marks) Estimated percentage change in price if | Actual percentage change in price if interest interest rates change by: rates change by: -20 basis points +20 basis points -20 basis points +20 basis points +12% -9% +12.12% -8.88% +7% -4% +7.05% -3.95% Bond S Bond Y Bond L +9% -6% +9.08% -5.92% FNCE3001 Introduction to Instruments & Markets Semester 1, 2021 D. Lenora current holds a 10-year maturity bond. She decides to sell her bond at the end of her investment horizon, which is before the maturity of the bond. The bond has a Macaulay duration of 7 years. Based on the What-if analysis results presented in the table below, is Lenora's investment horizon longer than the 7 years, less than 7 years, or equal to 7 years? Does coupon reinvestment risk matter more to Lenora, or market price risk matters more, or almost no interest rate risk to Lenora over her investment horizon? Please explain your answers. [5 Marks) + Lenora's bond FV of reinvested coupon at the end of investment horizon Bond's price if sold at the end of investment horizon FV of reinvested coupon plus sale price of bond at the end of investment horizon YTM (%) Scenario 1 9.00% $73.60 $97.47 $171.07 6.00% $67.15 $105.35 $172.50 Scenario 2 Scenario 3 12.00% $80.71 $90.39 $171.10 Question 2 (20 marks) A. U.S. corporation decides to issue two bonds in the Australian market: Bond NYS which is a Eurobond. Bond NUT which is a Foreign bond. Please fill in the blanks below. Bond NYS should not be denominated in (which currency?) when it is issued and bond NUT should be denominated in _(which currency?) [2 Marks) B. The relationship between bond prices and yields is very important to fixed-income investors. Compare and contrast the price/yield and price/volatility relationships of a callable and option free bond. [8 marks) C. Assume that bonds X, T and U all have the same maturity. Based on the table below, what pattern do you observe in the estimated vs. actual percentage changes in bond price when interest rate changes? What is the best terminology to describe this pattern (use terminology covered in this unit) and what relationship between bond prices and interest rates does this pattern imply? Please explain your answers. [5 Marks) Estimated percentage change in price if | Actual percentage change in price if interest interest rates change by: rates change by: -20 basis points +20 basis points -20 basis points +20 basis points +12% -9% +12.12% -8.88% +7% -4% +7.05% -3.95% Bond S Bond Y Bond L +9% -6% +9.08% -5.92% FNCE3001 Introduction to Instruments & Markets Semester 1, 2021 D. Lenora current holds a 10-year maturity bond. She decides to sell her bond at the end of her investment horizon, which is before the maturity of the bond. The bond has a Macaulay duration of 7 years. Based on the What-if analysis results presented in the table below, is Lenora's investment horizon longer than the 7 years, less than 7 years, or equal to 7 years? Does coupon reinvestment risk matter more to Lenora, or market price risk matters more, or almost no interest rate risk to Lenora over her investment horizon? Please explain your answers. [5 Marks) + Lenora's bond FV of reinvested coupon at the end of investment horizon Bond's price if sold at the end of investment horizon FV of reinvested coupon plus sale price of bond at the end of investment horizon YTM (%) Scenario 1 9.00% $73.60 $97.47 $171.07 6.00% $67.15 $105.35 $172.50 Scenario 2 Scenario 3 12.00% $80.71 $90.39 $171.10