Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2 (20 Marks) As CFO for Stowme Corp, you have initiated discussions to refinance the business. Funds 4YOU Corp. has presented an offer to

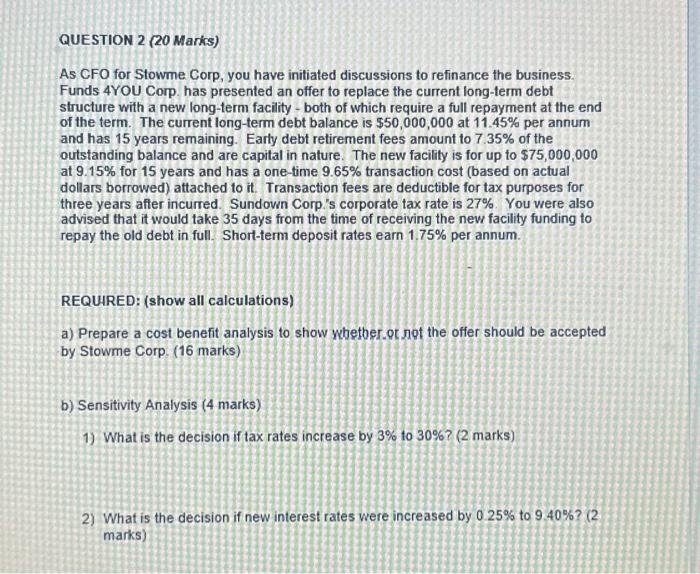

QUESTION 2 (20 Marks) As CFO for Stowme Corp, you have initiated discussions to refinance the business. Funds 4YOU Corp. has presented an offer to replace the current long-term debt structure with a new long-term facility - both of which require a full repayment at the end of the term. The current long-term debt balance is $50,000,000 at 11.45% per annum and has 15 years remaining. Early debt retirement fees amount to 7.35% of the outstanding balance and are capital in nature. The new facility is for up to $75,000,000 at 9.15% for 15 years and has a one-time 9.65% transaction cost (based on actual dollars borrowed) attached to it. Transaction fees are deductible for tax purposes for three years after incurred. Sundown Corp.'s corporate tax rate is 27%. You were also advised that it would take 35 days from the time of receiving the new facility funding to repay the old debt in full. Short-term deposit rates earn 1.75% per annum. REQUIRED: (show all calculations) a) Prepare a cost benefit analysis to show whether or not the offer should be accepted by Stowme Corp. (16 marks) b) Sensitivity Analysis (4 marks) 1) What is the decision if tax rates increase by 3% to 30%? (2 marks) 2) What is the decision if new interest rates were increased by 0.25% to 9.40%? (2) marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started