Answered step by step

Verified Expert Solution

Question

1 Approved Answer

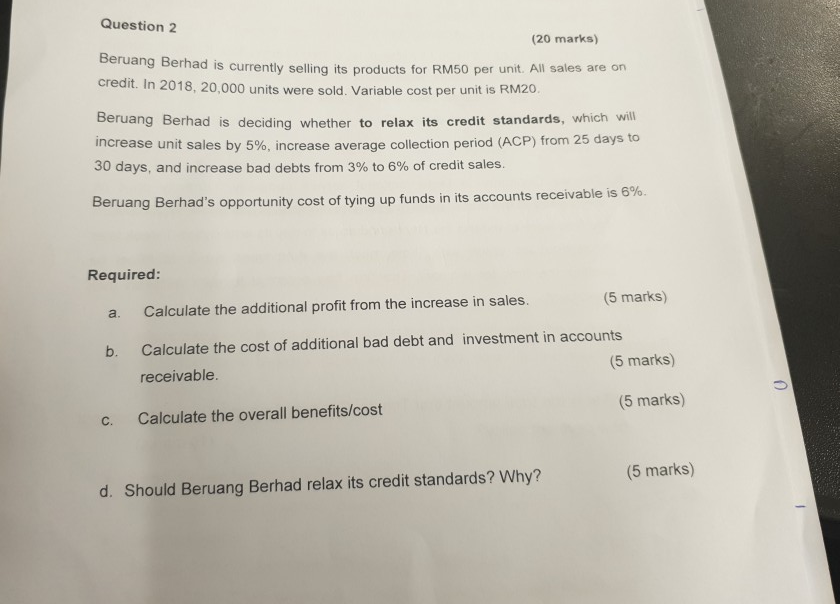

Question 2 (20 marks) bernad is currently selling its products for RM50 per unit. All sales are on credit. In 2018, 20,000 units were sold.

Question 2 (20 marks) bernad is currently selling its products for RM50 per unit. All sales are on credit. In 2018, 20,000 units were sold. Variable cost per unit is RM20. beruang Berhad is deciding whether to relax its credit standards, which will increase unit sales by 5%, increase average collection period (ACP) from 25 days to 30 days, and increase bad debts from 3% to 6% of credit sales. Beruang Berhad's opportunity cost of tying up funds in its accounts receivable is 6%. Required: (5 marks) a. Calculate the additional profit from the increase in sales. b. Calculate the cost of additional bad debt and investment in accounts receivable. (5 marks) (5 marks) c. Calculate the overall benefits/cost (5 marks) d. Should Beruang Berhad relax its credit standards? Why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started