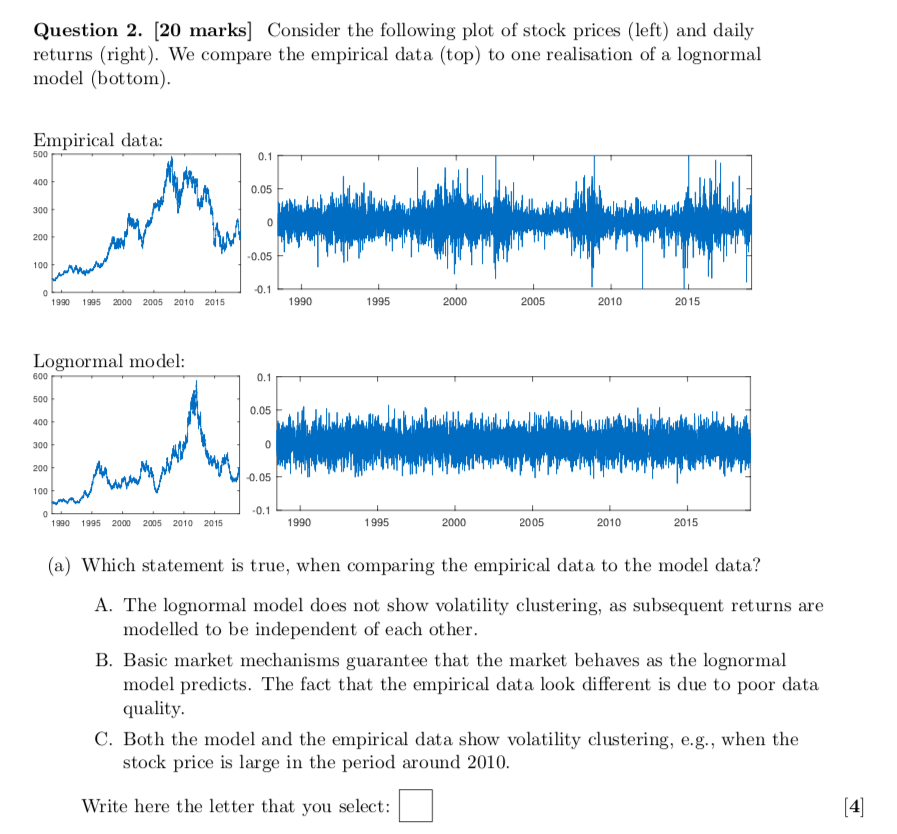

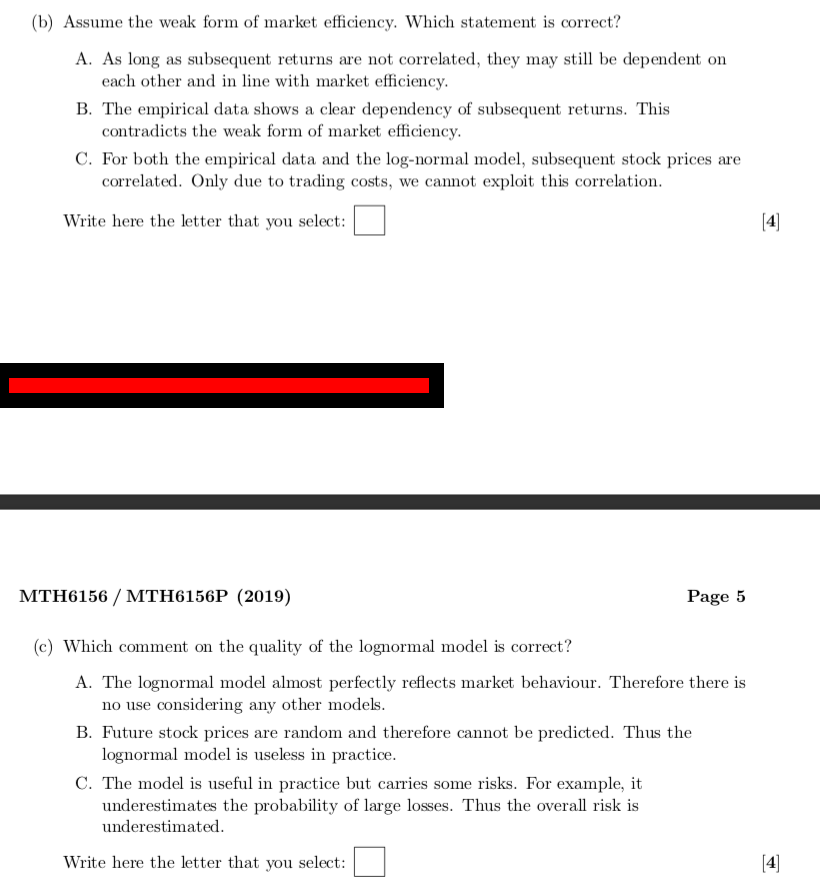

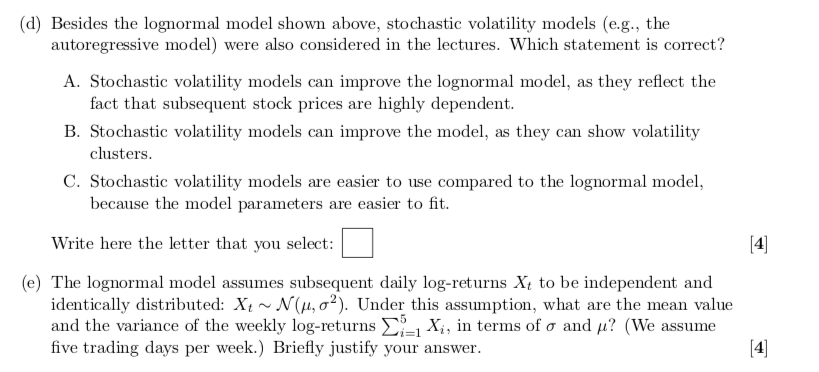

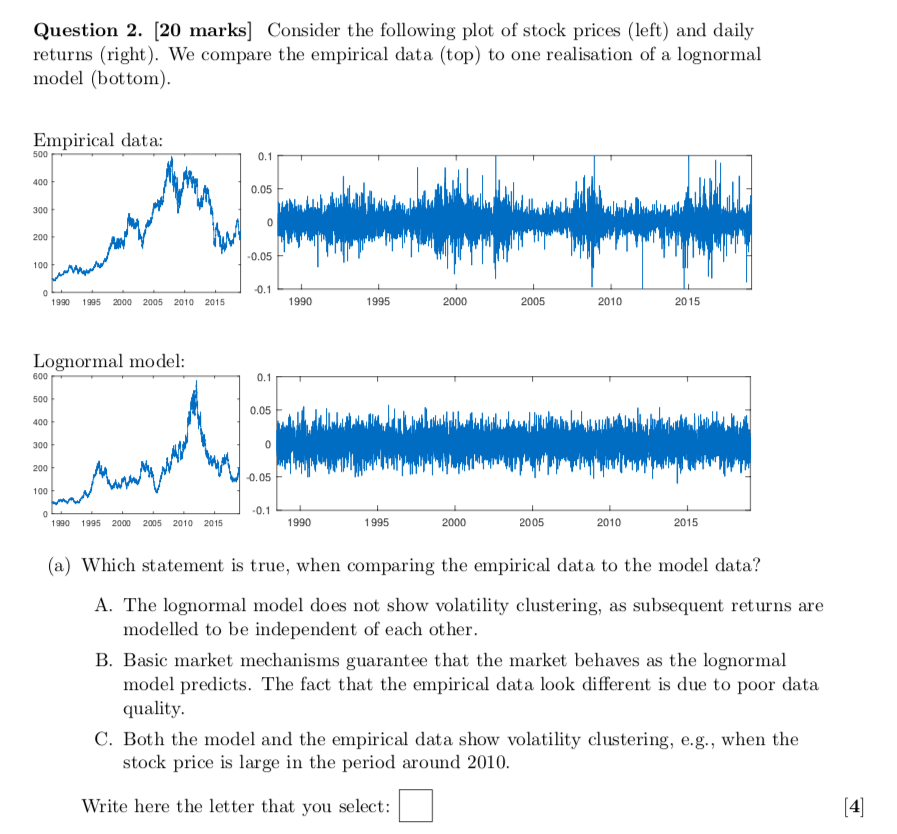

Question 2. [20 marks] Consider the following plot of stock prices (left) and daily returns (right). We compare the empirical data (top) to one realisation of a lognormal model (bottom). Empirical data: 500 0.1 400 0.05 300 0 200 -0.05 100 0 -0.1 1990 1995 2000 2005 2010 2015 1990 1995 2000 2005 2010 2015 Lognormal model: 600 0.1 500 0.05 400 300 Zutphen 200 -0.05 100 0 -0.1 1990 1995 2000 2005 2010 2015 1990 1995 2000 2005 2010 2015 (a) Which statement is true, when comparing the empirical data to the model data? A. The lognormal model does not show volatility clustering, as subsequent returns are modelled to be independent of each other. B. Basic market mechanisms guarantee that the market behaves as the lognormal model predicts. The fact that the empirical data look different is due to poor data quality. C. Both the model and the empirical data show volatility clustering, e.g., when the stock price is large in the period around 2010. Write here the letter that you select: [4] (b) Assume the weak form of market efficiency. Which statement is correct? A. As long as subsequent returns are not correlated, they may still be dependent on each other and in line with market efficiency. B. The empirical data shows a clear dependency of subsequent returns. This contradicts the weak form of market efficiency. C. For both the empirical data and the log-normal model, subsequent stock prices are correlated. Only due to trading costs, we cannot exploit this correlation. Write here the letter that you select: MTH6156/MTH6156P (2019) Page 5 (c) Which comment on the quality of the lognormal model is correct? A. The lognormal model almost perfectly reflects market behaviour. Therefore there is no use considering any other models. B. Future stock prices are random and therefore cannot be predicted. Thus the lognormal model is useless in practice. C. The model is useful in practice but carries some risks. For example, it underestimates the probability of large losses. Thus the overall risk is underestimated Write here the letter that you select: Question 2. [20 marks] Consider the following plot of stock prices (left) and daily returns (right). We compare the empirical data (top) to one realisation of a lognormal model (bottom). Empirical data: 500 0.1 400 0.05 300 0 200 -0.05 100 0 -0.1 1990 1995 2000 2005 2010 2015 1990 1995 2000 2005 2010 2015 Lognormal model: 600 0.1 500 0.05 400 300 Zutphen 200 -0.05 100 0 -0.1 1990 1995 2000 2005 2010 2015 1990 1995 2000 2005 2010 2015 (a) Which statement is true, when comparing the empirical data to the model data? A. The lognormal model does not show volatility clustering, as subsequent returns are modelled to be independent of each other. B. Basic market mechanisms guarantee that the market behaves as the lognormal model predicts. The fact that the empirical data look different is due to poor data quality. C. Both the model and the empirical data show volatility clustering, e.g., when the stock price is large in the period around 2010. Write here the letter that you select: [4] (b) Assume the weak form of market efficiency. Which statement is correct? A. As long as subsequent returns are not correlated, they may still be dependent on each other and in line with market efficiency. B. The empirical data shows a clear dependency of subsequent returns. This contradicts the weak form of market efficiency. C. For both the empirical data and the log-normal model, subsequent stock prices are correlated. Only due to trading costs, we cannot exploit this correlation. Write here the letter that you select: MTH6156/MTH6156P (2019) Page 5 (c) Which comment on the quality of the lognormal model is correct? A. The lognormal model almost perfectly reflects market behaviour. Therefore there is no use considering any other models. B. Future stock prices are random and therefore cannot be predicted. Thus the lognormal model is useless in practice. C. The model is useful in practice but carries some risks. For example, it underestimates the probability of large losses. Thus the overall risk is underestimated Write here the letter that you select