Answered step by step

Verified Expert Solution

Question

1 Approved Answer

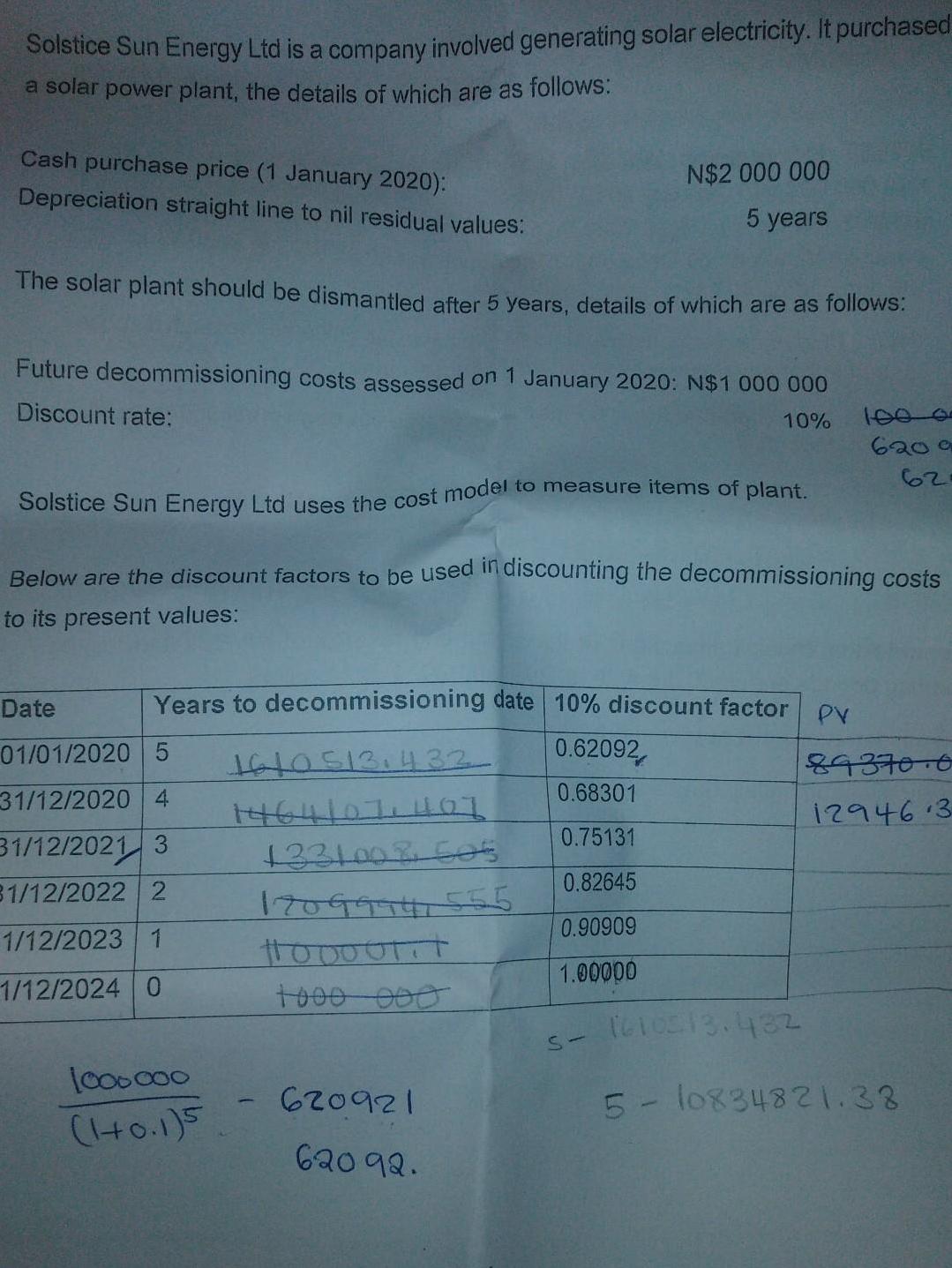

Solstice Sun Energy Ltd is a company involved generating solar electricity. It purchased a solar power plant, the details of which are as follows:

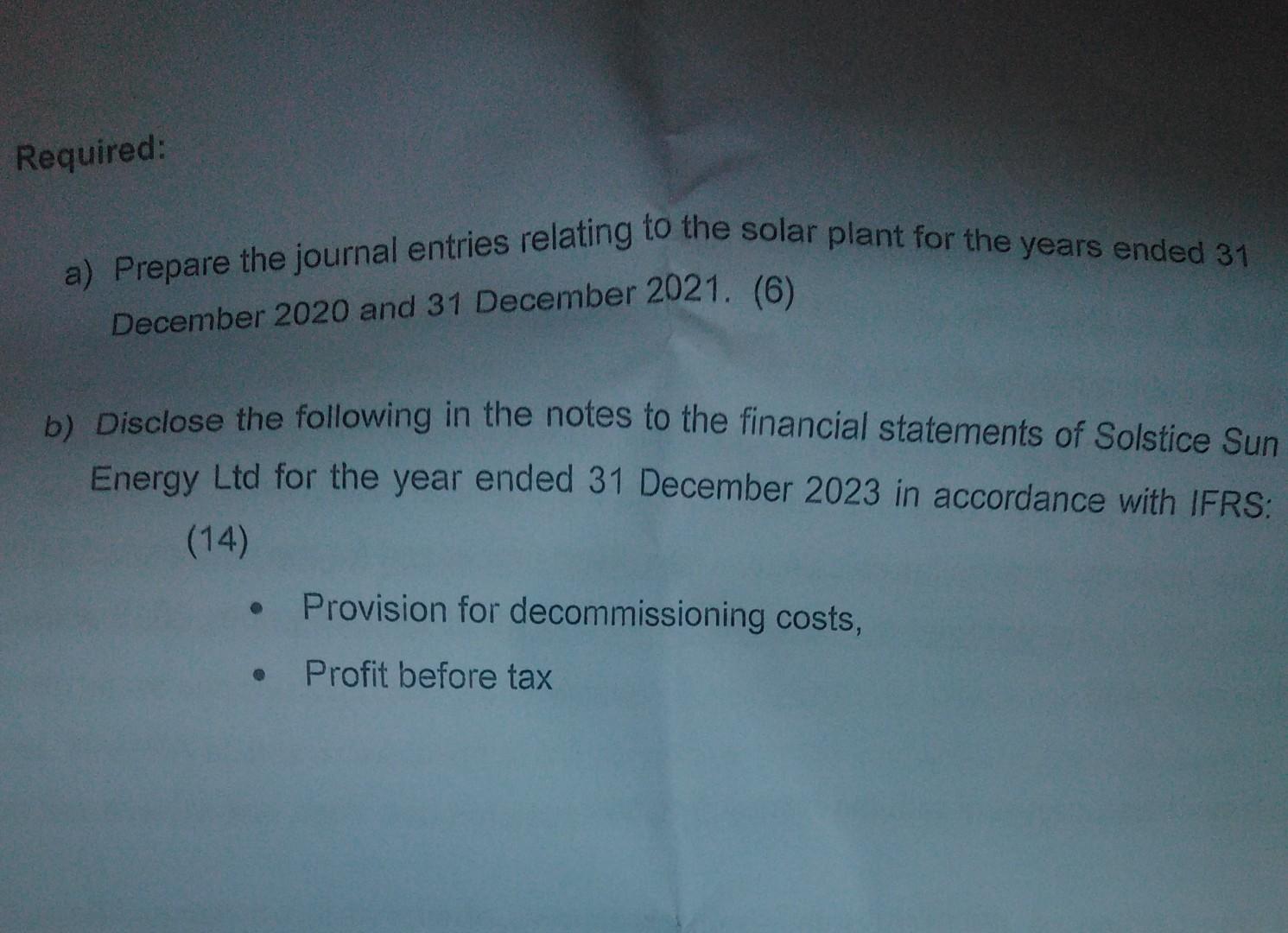

Solstice Sun Energy Ltd is a company involved generating solar electricity. It purchased a solar power plant, the details of which are as follows: Cash purchase price (1 January 2020): N$2 000 000 Depreciation straight line to nil residual values: 5 years The solar plant should be dismantled after 5 years, details of which are as follows. Future decommissioning costs assessed on 1 January 2020: N$1 000 000 Discount rate: 10% 1000 620 a 62 Solstice Sun Energy Ltd uses the cost model to measure items of plant. Below are the discount factors to be used ln discounting the decommissioning costs to its present values: Date Years to decommissioning date 10% discount factor PV 01/01/2020 5 0.62092, 16/0513.432 89370-6 31/12/2020 4 0.68301 1464107-1107 12946 3 0.75131 31/12/2021 3 1331008.505 0.82645 31/12/2022 2 0.90909 1/12/2023 1 1.00000 1/12/2024 0 to00 000 T610513.432 S lo00000 620921 5- lo834821.38 (+o.1)5 620 92. a) Prepare the journal entries relating to the solar plant for the years ended 31 Required: December 2020 and 31 December 2021. (6) b) Disclose the following in the notes to the financial statements of Solstice Sun Energy Ltd for the year ended 31 December 2023 in accordance with IFRS: (14) Provision for decommissioning costs, Profit before tax

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

As per IAS 16 Property plant and equipment Initially PPE is recorded at purchase cost dire...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started