Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following financial information is provided by Ray: a) Rent paid in advance for the next two months, $6,500 b) Monthly gross salary, $21,850

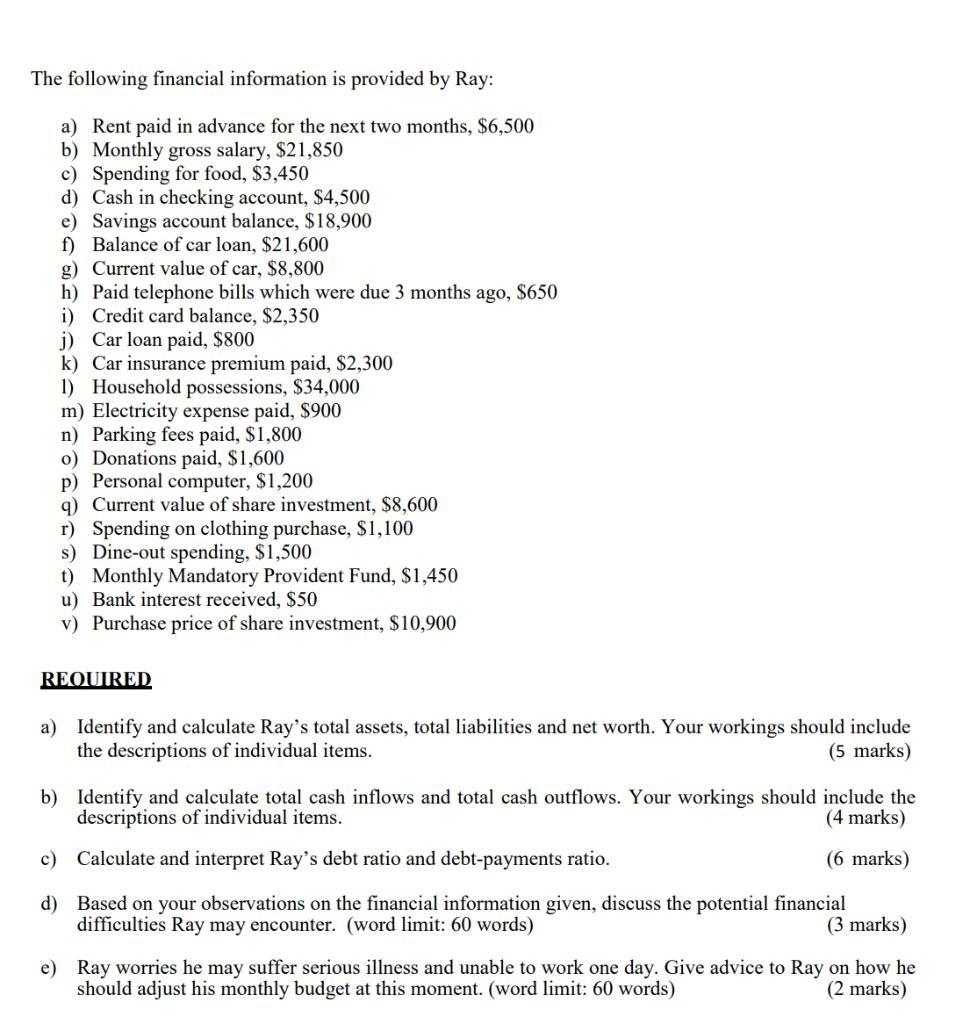

The following financial information is provided by Ray: a) Rent paid in advance for the next two months, $6,500 b) Monthly gross salary, $21,850 c) Spending for food, $3,450 d) Cash in checking account, $4,500 e) Savings account balance, $18,900 f) Balance of car loan, $21,600 g) Current value of car, $8,800 h) Paid telephone bills which were due 3 months ago, $650 i) Credit card balance, $2,350 j) Car loan paid, $800 k) Car insurance premium paid, $2,300 1) Household possessions, $34,000 m) Electricity expense paid, $900 n) Parking fees paid, $1,800 o) Donations paid, $1,600 p) Personal computer, $1,200 q) Current value of share investment, $8,600 r) Spending on clothing purchase, $1,100 s) Dine-out spending, $1,500 t) Monthly Mandatory Provident Fund, $1,450 u) Bank interest received, $50 v) Purchase price of share investment, $10,900 REQUIRED a) Identify and calculate Ray's total assets, total liabilities and net worth. Your workings should include the descriptions of individual items. (5 marks) b) Identify and calculate total cash inflows and total cash outflows. Your workings should include the descriptions of individual items. (4 marks) c) Calculate and interpret Ray's debt ratio and debt-payments ratio. (6 marks) d) Based on your observations on the financial information given, discuss the potential financial difficulties Ray may encounter. (word limit: 60 words) (3 marks) e) Ray worries he may suffer serious illness and unable to work one day. Give advice to Ray on how he should adjust his monthly budget at this moment. (word limit: 60 words) (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Assets 1 Investment 8600 2Personal Computer 1200 3 Household Possessions 340...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started