Answered step by step

Verified Expert Solution

Question

1 Approved Answer

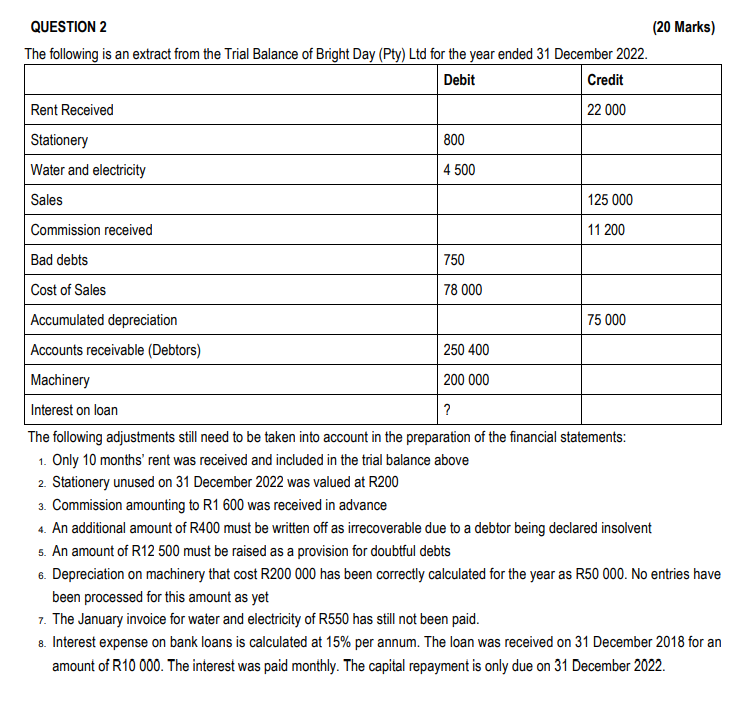

QUESTION 2 (20 Marks) The following is an extract from the Trial Balance of Bright Day (Pty) Ltd for the year ended 31 December 2022.

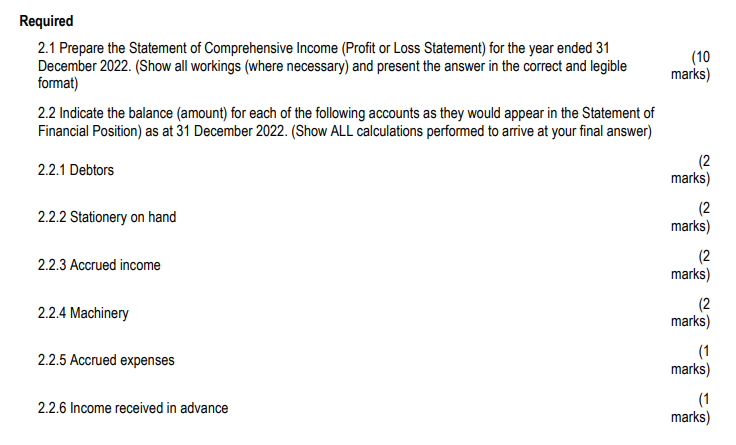

QUESTION 2 (20 Marks) The following is an extract from the Trial Balance of Bright Day (Pty) Ltd for the year ended 31 December 2022. The following adjustments still need to be taken into account in the preparation of the financial statements: 1. Only 10 months' rent was received and included in the trial balance above 2. Stationery unused on 31 December 2022 was valued at R200 3. Commission amounting to R1600 was received in advance 4. An additional amount of R400 must be written off as irrecoverable due to a debtor being declared insolvent 5. An amount of R12 500 must be raised as a provision for doubtful debts 6. Depreciation on machinery that cost R200 000 has been correctly calculated for the year as R50 000. No entries have been processed for this amount as yet 7. The January invoice for water and electricity of R550 has still not been paid. 8. Interest expense on bank loans is calculated at 15% per annum. The loan was received on 31 December 2018 for an amount of R10 000. The interest was paid monthly. The capital repayment is only due on 31 December 2022. Required 2.1 Prepare the Statement of Comprehensive Income (Profit or Loss Statement) for the year ended 31 December 2022. (Show all workings (where necessary) and present the answer in the correct and legible format) (10 marks) 2.2 Indicate the balance (amount) for each of the following accounts as they would appear in the Statement of Financial Position) as at 31 December 2022. (Show ALL calculations performed to arrive at your final answer) 2.2.1 Debtors 2.2.2 Stationery on hand 2.2.3 Accrued income 2.2.4 Machinery 2.2.5 Accrued expenses 2.2.6 Income received in advance (2 marks) (2 marks) (2 marks) (2 marks) (1 marks) (1 marks) QUESTION 2 (20 Marks) The following is an extract from the Trial Balance of Bright Day (Pty) Ltd for the year ended 31 December 2022. The following adjustments still need to be taken into account in the preparation of the financial statements: 1. Only 10 months' rent was received and included in the trial balance above 2. Stationery unused on 31 December 2022 was valued at R200 3. Commission amounting to R1600 was received in advance 4. An additional amount of R400 must be written off as irrecoverable due to a debtor being declared insolvent 5. An amount of R12 500 must be raised as a provision for doubtful debts 6. Depreciation on machinery that cost R200 000 has been correctly calculated for the year as R50 000. No entries have been processed for this amount as yet 7. The January invoice for water and electricity of R550 has still not been paid. 8. Interest expense on bank loans is calculated at 15% per annum. The loan was received on 31 December 2018 for an amount of R10 000. The interest was paid monthly. The capital repayment is only due on 31 December 2022. Required 2.1 Prepare the Statement of Comprehensive Income (Profit or Loss Statement) for the year ended 31 December 2022. (Show all workings (where necessary) and present the answer in the correct and legible format) (10 marks) 2.2 Indicate the balance (amount) for each of the following accounts as they would appear in the Statement of Financial Position) as at 31 December 2022. (Show ALL calculations performed to arrive at your final answer) 2.2.1 Debtors 2.2.2 Stationery on hand 2.2.3 Accrued income 2.2.4 Machinery 2.2.5 Accrued expenses 2.2.6 Income received in advance (2 marks) (2 marks) (2 marks) (2 marks) (1 marks) (1 marks)

QUESTION 2 (20 Marks) The following is an extract from the Trial Balance of Bright Day (Pty) Ltd for the year ended 31 December 2022. The following adjustments still need to be taken into account in the preparation of the financial statements: 1. Only 10 months' rent was received and included in the trial balance above 2. Stationery unused on 31 December 2022 was valued at R200 3. Commission amounting to R1600 was received in advance 4. An additional amount of R400 must be written off as irrecoverable due to a debtor being declared insolvent 5. An amount of R12 500 must be raised as a provision for doubtful debts 6. Depreciation on machinery that cost R200 000 has been correctly calculated for the year as R50 000. No entries have been processed for this amount as yet 7. The January invoice for water and electricity of R550 has still not been paid. 8. Interest expense on bank loans is calculated at 15% per annum. The loan was received on 31 December 2018 for an amount of R10 000. The interest was paid monthly. The capital repayment is only due on 31 December 2022. Required 2.1 Prepare the Statement of Comprehensive Income (Profit or Loss Statement) for the year ended 31 December 2022. (Show all workings (where necessary) and present the answer in the correct and legible format) (10 marks) 2.2 Indicate the balance (amount) for each of the following accounts as they would appear in the Statement of Financial Position) as at 31 December 2022. (Show ALL calculations performed to arrive at your final answer) 2.2.1 Debtors 2.2.2 Stationery on hand 2.2.3 Accrued income 2.2.4 Machinery 2.2.5 Accrued expenses 2.2.6 Income received in advance (2 marks) (2 marks) (2 marks) (2 marks) (1 marks) (1 marks) QUESTION 2 (20 Marks) The following is an extract from the Trial Balance of Bright Day (Pty) Ltd for the year ended 31 December 2022. The following adjustments still need to be taken into account in the preparation of the financial statements: 1. Only 10 months' rent was received and included in the trial balance above 2. Stationery unused on 31 December 2022 was valued at R200 3. Commission amounting to R1600 was received in advance 4. An additional amount of R400 must be written off as irrecoverable due to a debtor being declared insolvent 5. An amount of R12 500 must be raised as a provision for doubtful debts 6. Depreciation on machinery that cost R200 000 has been correctly calculated for the year as R50 000. No entries have been processed for this amount as yet 7. The January invoice for water and electricity of R550 has still not been paid. 8. Interest expense on bank loans is calculated at 15% per annum. The loan was received on 31 December 2018 for an amount of R10 000. The interest was paid monthly. The capital repayment is only due on 31 December 2022. Required 2.1 Prepare the Statement of Comprehensive Income (Profit or Loss Statement) for the year ended 31 December 2022. (Show all workings (where necessary) and present the answer in the correct and legible format) (10 marks) 2.2 Indicate the balance (amount) for each of the following accounts as they would appear in the Statement of Financial Position) as at 31 December 2022. (Show ALL calculations performed to arrive at your final answer) 2.2.1 Debtors 2.2.2 Stationery on hand 2.2.3 Accrued income 2.2.4 Machinery 2.2.5 Accrued expenses 2.2.6 Income received in advance (2 marks) (2 marks) (2 marks) (2 marks) (1 marks) (1 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started