Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 (20 marks) Your line manager has called you in and asked you to prepare a cash flow forecast for the new 'Edible Gardens'

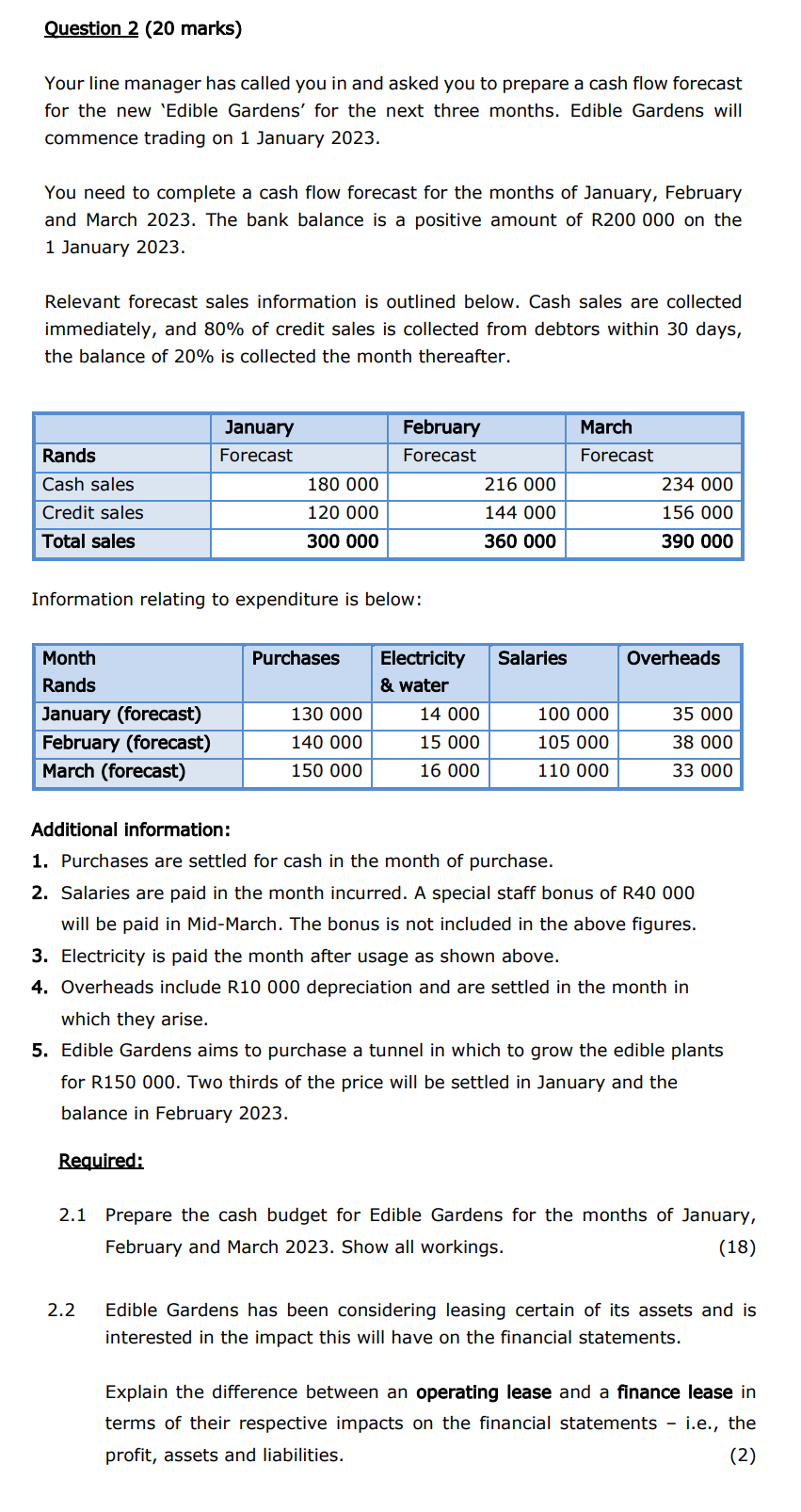

Question 2 (20 marks) Your line manager has called you in and asked you to prepare a cash flow forecast for the new 'Edible Gardens' for the next three months. Edible Gardens will commence trading on 1 January 2023. You need to complete a cash flow forecast for the months of January, February and March 2023. The bank balance is a positive amount of R200 000 on the 1 January 2023. Relevant forecast sales information is outlined below. Cash sales are collected immediately, and 80% of credit sales is collected from debtors within 30 days, the balance of 20% is collected the month thereafter. Information relating to expenditure is below: Additional information: 1. Purchases are settled for cash in the month of purchase. 2. Salaries are paid in the month incurred. A special staff bonus of R40 000 will be paid in Mid-March. The bonus is not included in the above figures. 3. Electricity is paid the month after usage as shown above. 4. Overheads include R10 000 depreciation and are settled in the month in which they arise. 5. Edible Gardens aims to purchase a tunnel in which to grow the edible plants for R150 000. Two thirds of the price will be settled in January and the balance in February 2023. Required: 2.1 Prepare the cash budget for Edible Gardens for the months of January, February and March 2023. Show all workings. 2.2 Edible Gardens has been considering leasing certain of its assets and is interested in the impact this will have on the financial statements. Explain the difference between an operating lease and a finance lease in terms of their respective impacts on the financial statements - i.e., the profit, assets and liabilities

Question 2 (20 marks) Your line manager has called you in and asked you to prepare a cash flow forecast for the new 'Edible Gardens' for the next three months. Edible Gardens will commence trading on 1 January 2023. You need to complete a cash flow forecast for the months of January, February and March 2023. The bank balance is a positive amount of R200 000 on the 1 January 2023. Relevant forecast sales information is outlined below. Cash sales are collected immediately, and 80% of credit sales is collected from debtors within 30 days, the balance of 20% is collected the month thereafter. Information relating to expenditure is below: Additional information: 1. Purchases are settled for cash in the month of purchase. 2. Salaries are paid in the month incurred. A special staff bonus of R40 000 will be paid in Mid-March. The bonus is not included in the above figures. 3. Electricity is paid the month after usage as shown above. 4. Overheads include R10 000 depreciation and are settled in the month in which they arise. 5. Edible Gardens aims to purchase a tunnel in which to grow the edible plants for R150 000. Two thirds of the price will be settled in January and the balance in February 2023. Required: 2.1 Prepare the cash budget for Edible Gardens for the months of January, February and March 2023. Show all workings. 2.2 Edible Gardens has been considering leasing certain of its assets and is interested in the impact this will have on the financial statements. Explain the difference between an operating lease and a finance lease in terms of their respective impacts on the financial statements - i.e., the profit, assets and liabilities Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started