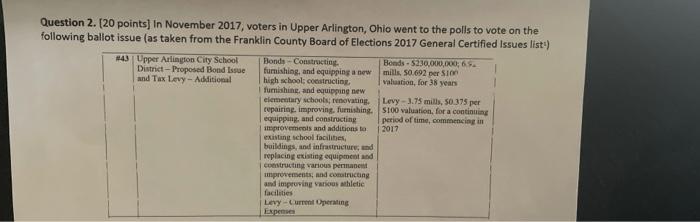

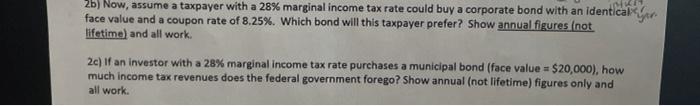

Question 2. (20 points) in November 2017, voters in Upper Arlington, Ohio went to the polls to vote on the following ballot issue (as taken from the Franklin County Board of Elections 2017 General Certified Issues lists) #43Upper Arlington City School Bonds - Constructing Bonds - 5130,000,000; 6 %. District - Proposed Bond Issue furnishing, and equipping a new mills 50.692 per SI and Tax Levy - Additional high school constructing, valuation, for 38 years furnishing and equipping new elementary schools, renovating. Levy-3.75 mills, 50.375 per cepairing, improving, furnishing. 5100 valuation, for a continuing equipping and constructing period of time, commencing in improvements and additions to 2017 existing school facilities, buildings, and infrastructures and replacing existing equipment and constructing various permane improvements and constructing and improving various hletic facilities Lay-Current Operating Expenses 25) Now, assume a taxpayer with a 28% marginal income tax rate could buy a corporate bond with an identical yor face value and a coupon rate of 8.25%. Which bond will this taxpayer prefer? Show annual figures (not lifetime) and all work 2) If an investor with a 28% marginal income tax rate purchases a municipal bond (face value = $20,000), how much income tax revenues does the federal government forego? Show annual (not lifetime) figures only and all work. Question 2. (20 points) in November 2017, voters in Upper Arlington, Ohio went to the polls to vote on the following ballot issue (as taken from the Franklin County Board of Elections 2017 General Certified Issues lists) #43Upper Arlington City School Bonds - Constructing Bonds - 5130,000,000; 6 %. District - Proposed Bond Issue furnishing, and equipping a new mills 50.692 per SI and Tax Levy - Additional high school constructing, valuation, for 38 years furnishing and equipping new elementary schools, renovating. Levy-3.75 mills, 50.375 per cepairing, improving, furnishing. 5100 valuation, for a continuing equipping and constructing period of time, commencing in improvements and additions to 2017 existing school facilities, buildings, and infrastructures and replacing existing equipment and constructing various permane improvements and constructing and improving various hletic facilities Lay-Current Operating Expenses 25) Now, assume a taxpayer with a 28% marginal income tax rate could buy a corporate bond with an identical yor face value and a coupon rate of 8.25%. Which bond will this taxpayer prefer? Show annual figures (not lifetime) and all work 2) If an investor with a 28% marginal income tax rate purchases a municipal bond (face value = $20,000), how much income tax revenues does the federal government forego? Show annual (not lifetime) figures only and all work