Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2 (20 points) LO-5: evaluate Long Term Financial Decision on Dividend Payout Policy and Capital Structure and Short-Term Financial Decision on Working Capital Management

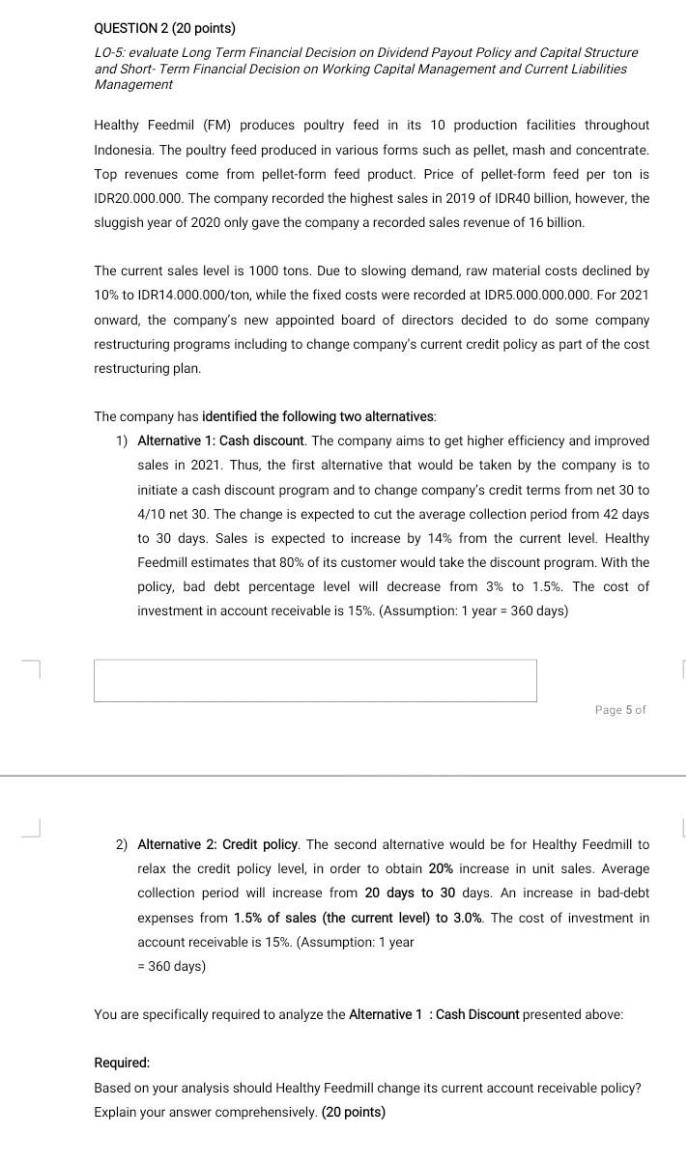

QUESTION 2 (20 points) LO-5: evaluate Long Term Financial Decision on Dividend Payout Policy and Capital Structure and Short-Term Financial Decision on Working Capital Management and Current Liabilities Management Healthy Feedmil (FM) produces poultry feed in its 10 production facilities throughout Indonesia. The poultry feed produced in various forms such pellet, mash and concentrate. Top revenues come from pellet-form feed product. Price of pellet-form feed per ton is IDR20.000.000. The company recorded the highest sales in 2019 of IDR40 billion, however, the sluggish year of 2020 only gave the company a recorded sales revenue of 16 billion The current sales level is 1000 tons. Due to slowing demand, raw material costs declined by 10% to IDR14.000.000/ton, while the fixed costs were recorded at IDR5.000.000.000. For 2021 onward, the company's new appointed board of directors decided to do some company restructuring programs including to change company's current credit policy as part of the cost restructuring plan The company has identified the following two alternatives 1) Alternative 1: Cash discount. The company aims to get higher efficiency and improved sales in 2021. Thus, the first alternative that would be taken by the company is to initiate a cash discount program and to change company's credit terms from net 30 to 4/10 net 30. The change is expected to cut the average collection period from 42 days to 30 days. Sales is expected to increase by 14% from the current level. Healthy Feedmill estimates that 80% of its customer would take the discount program. With the policy, bad debt percentage level will decrease from 3% to 1.5%. The cost of investment in account receivable is 15%. (Assumption: 1 year = 360 days) Page 5 of 2) Alternative 2: Credit policy. The second alternative would be for Healthy Feedmill to relax the credit policy level, in order to obtain 20% increase in unit sales. Average collection period will increase from 20 days to 30 days. An increase in bad-debt expenses from 1.5% of sales (the current level) to 3.0%. The cost of investment in account receivable is 15% (Assumption: 1 year = 360 days) You are specifically required to analyze the Alternative 1 : Cash Discount presented above: Required: Based on your analysis should Healthy Feedmill change its current account receivable policy? Explain your answer comprehensively. (20 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started