Answered step by step

Verified Expert Solution

Question

1 Approved Answer

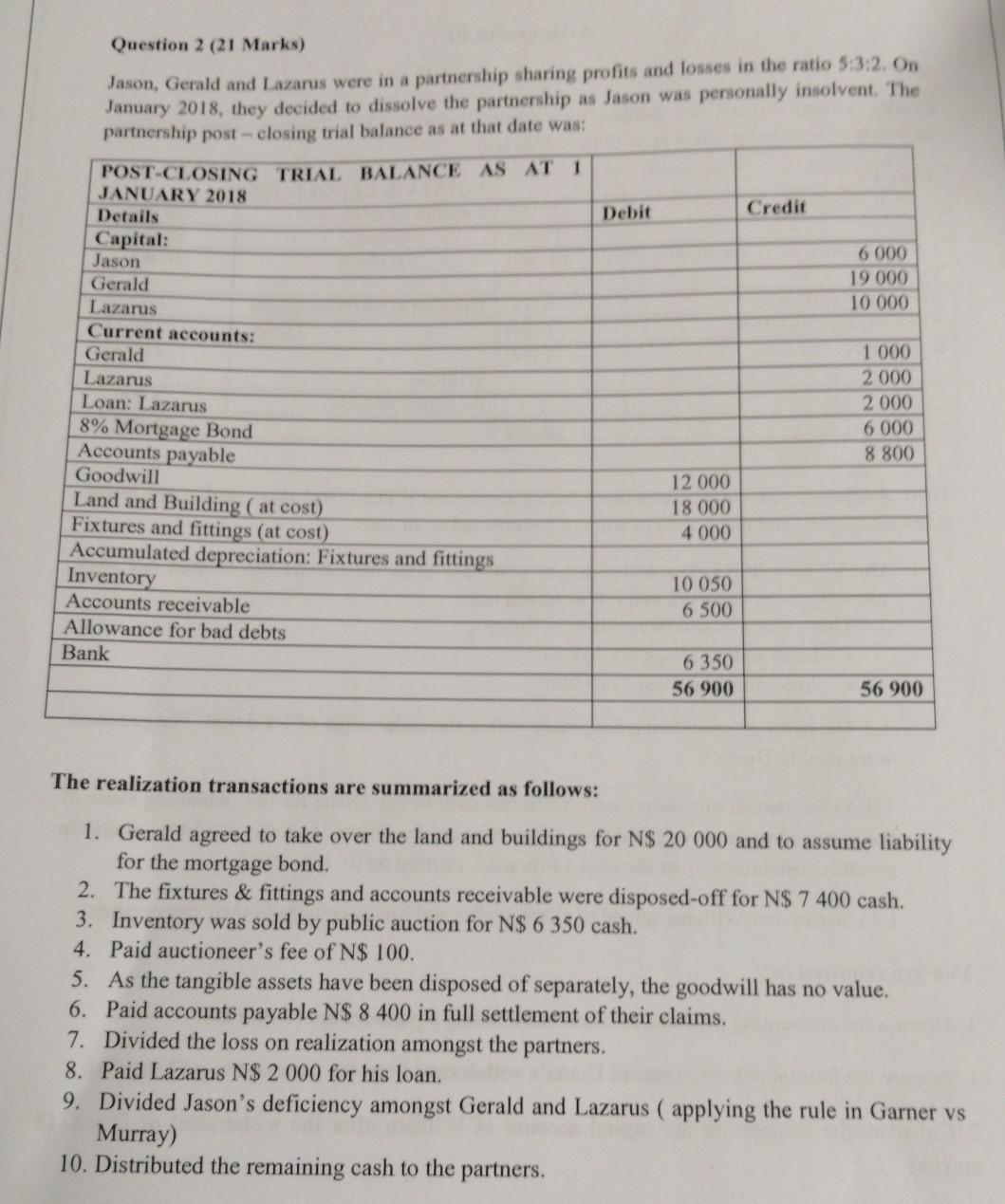

Question 2 (21 Marks) Jason, Gerald and Lazarus were in a partnership sharing profits and losses in the ratio 5:3:2. On January 2018, they decided

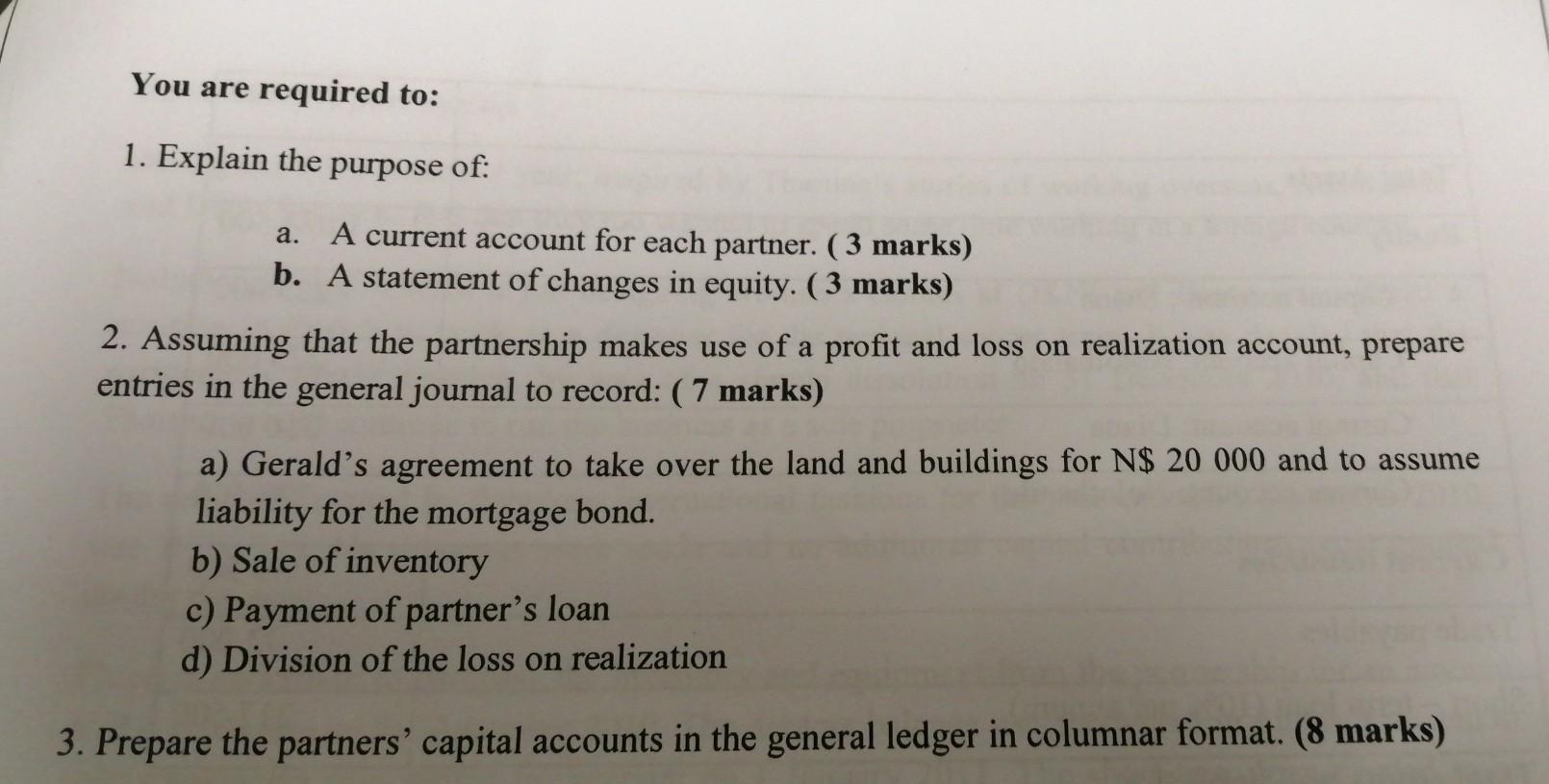

Question 2 (21 Marks) Jason, Gerald and Lazarus were in a partnership sharing profits and losses in the ratio 5:3:2. On January 2018, they decided to dissolve the partnership as Jason was personally insolvent. The partnership post - closing trial balance as at that date was: Debit Credit 6 000 19 000 10 000 POST-CLOSING TRIAL BALANCE AS AT 1 JANUARY 2018 Details Capital: Jason Gerald Lazarus Current accounts: Gerald Lazarus Loan: Lazarus 8% Mortgage Bond Accounts payable Goodwill Land and Building ( at cost) Fixtures and fittings (at cost) Accumulated depreciation: Fixtures and fittings Inventory Accounts receivable Allowance for bad debts Bank 1 000 2000 2000 6 000 8 800 12 000 18 000 4 000 10 050 6 500 6 350 56 900 56 900 The realization transactions are summarized as follows: 1. Gerald agreed to take over the land and buildings for N$ 20 000 and to assume liability for the mortgage bond. 2. The fixtures & fittings and accounts receivable were disposed-off for N$ 7 400 cash. 3. Inventory was sold by public auction for N$ 6 350 cash. 4. Paid auctioneer's fee of N$ 100. 5. As the tangible assets have been disposed of separately, the goodwill has no value. 6. Paid accounts payable N$ 8 400 in full settlement of their claims. 7. Divided the loss on realization amongst the partners, 8. Paid Lazarus N$ 2 000 for his loan. 9. Divided Jason's deficiency amongst Gerald and Lazarus ( applying the rule in Garner vs Murray) 10. Distributed the remaining cash to the partners. You are required to: 1. Explain the purpose of: a. A current account for each partner. (3 marks) b. A statement of changes in equity. (3 marks) 2. Assuming that the partnership makes use of a profit and loss on realization account, prepare entries in the general journal to record: (7 marks) a) Gerald's agreement to take over the land and buildings for N$ 20 000 and to assume liability for the mortgage bond. b) Sale of inventory c) Payment of partner's loan d) Division of the loss on realization 3. Prepare the partners' capital accounts in the general ledger in columnar format. (8 marks) Question 2 (21 Marks) Jason, Gerald and Lazarus were in a partnership sharing profits and losses in the ratio 5:3:2. On January 2018, they decided to dissolve the partnership as Jason was personally insolvent. The partnership post - closing trial balance as at that date was: Debit Credit 6 000 19 000 10 000 POST-CLOSING TRIAL BALANCE AS AT 1 JANUARY 2018 Details Capital: Jason Gerald Lazarus Current accounts: Gerald Lazarus Loan: Lazarus 8% Mortgage Bond Accounts payable Goodwill Land and Building ( at cost) Fixtures and fittings (at cost) Accumulated depreciation: Fixtures and fittings Inventory Accounts receivable Allowance for bad debts Bank 1 000 2000 2000 6 000 8 800 12 000 18 000 4 000 10 050 6 500 6 350 56 900 56 900 The realization transactions are summarized as follows: 1. Gerald agreed to take over the land and buildings for N$ 20 000 and to assume liability for the mortgage bond. 2. The fixtures & fittings and accounts receivable were disposed-off for N$ 7 400 cash. 3. Inventory was sold by public auction for N$ 6 350 cash. 4. Paid auctioneer's fee of N$ 100. 5. As the tangible assets have been disposed of separately, the goodwill has no value. 6. Paid accounts payable N$ 8 400 in full settlement of their claims. 7. Divided the loss on realization amongst the partners, 8. Paid Lazarus N$ 2 000 for his loan. 9. Divided Jason's deficiency amongst Gerald and Lazarus ( applying the rule in Garner vs Murray) 10. Distributed the remaining cash to the partners. You are required to: 1. Explain the purpose of: a. A current account for each partner. (3 marks) b. A statement of changes in equity. (3 marks) 2. Assuming that the partnership makes use of a profit and loss on realization account, prepare entries in the general journal to record: (7 marks) a) Gerald's agreement to take over the land and buildings for N$ 20 000 and to assume liability for the mortgage bond. b) Sale of inventory c) Payment of partner's loan d) Division of the loss on realization 3. Prepare the partners' capital accounts in the general ledger in columnar format. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started