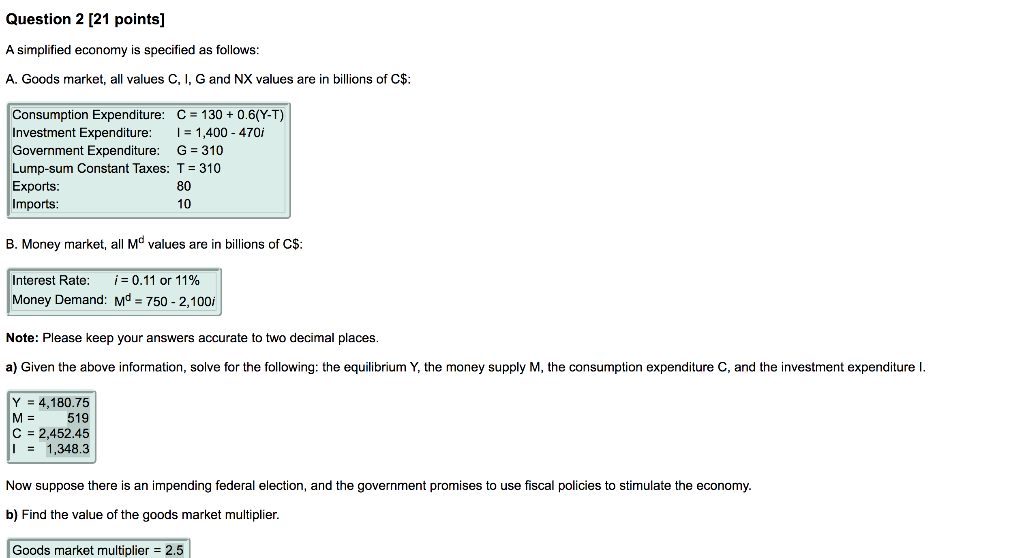

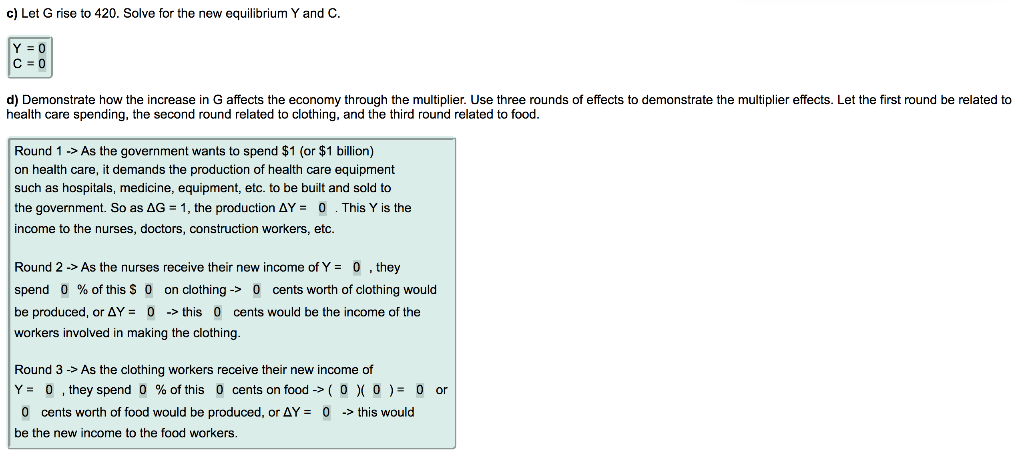

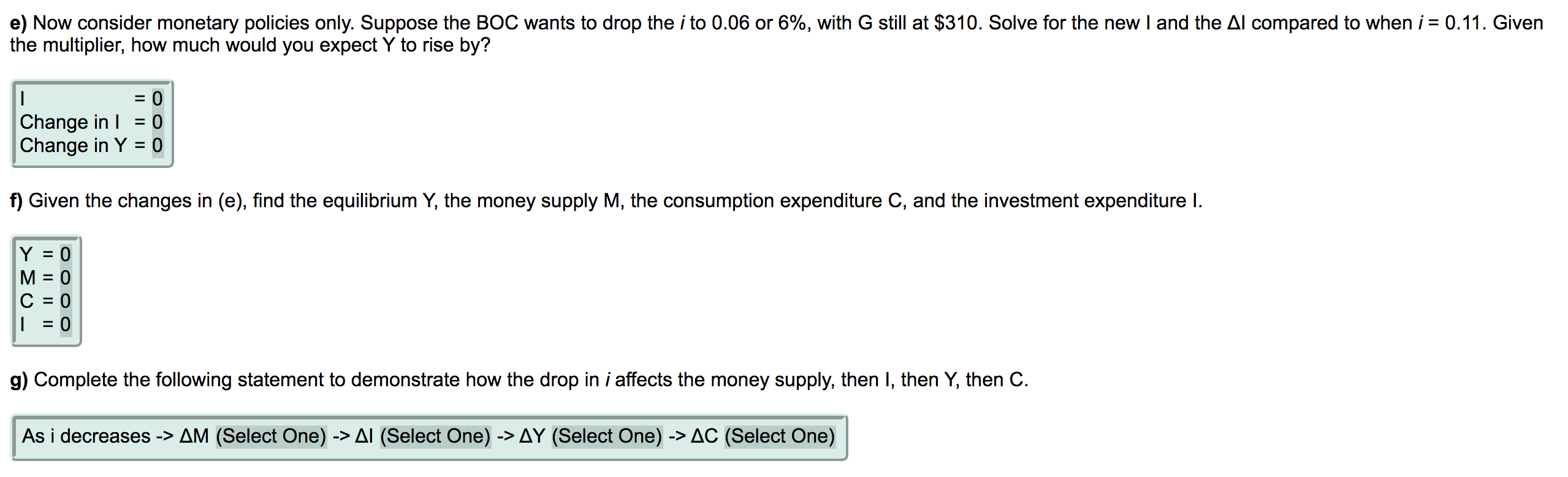

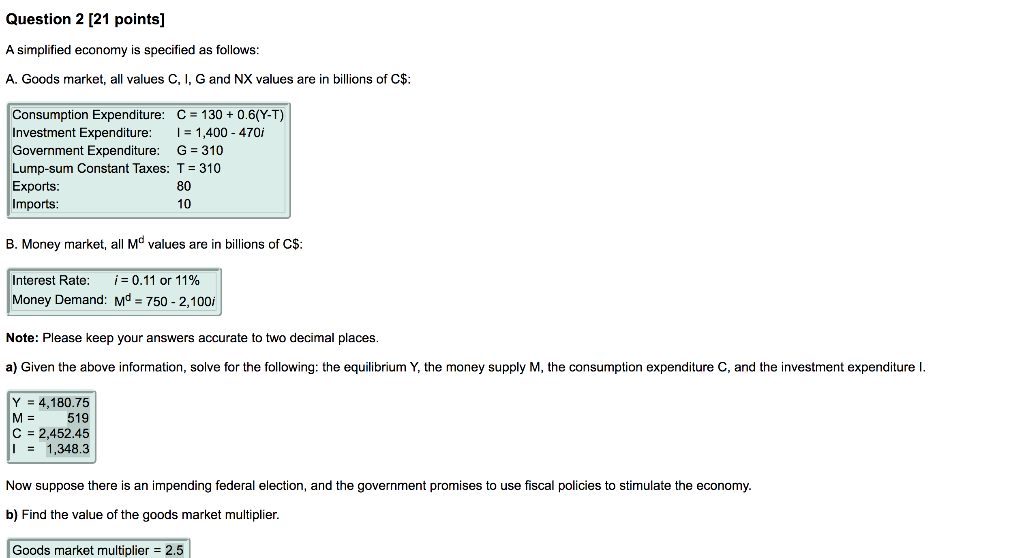

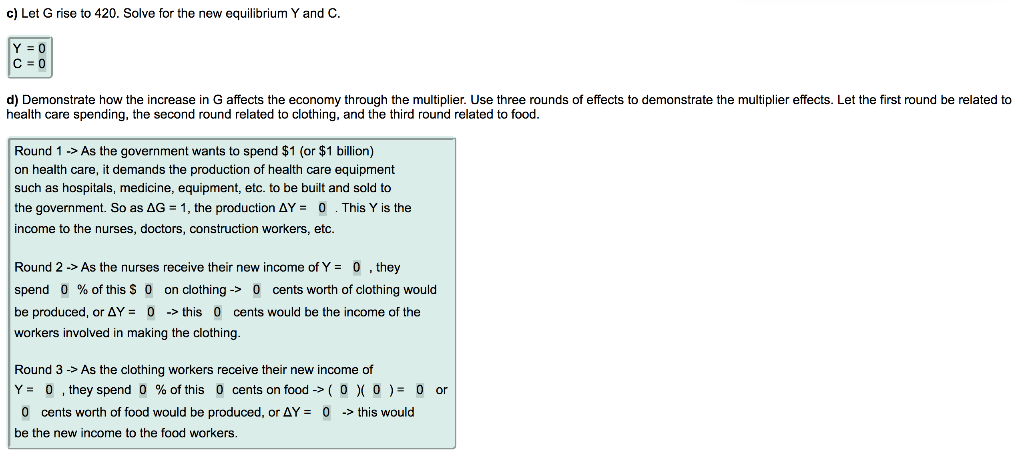

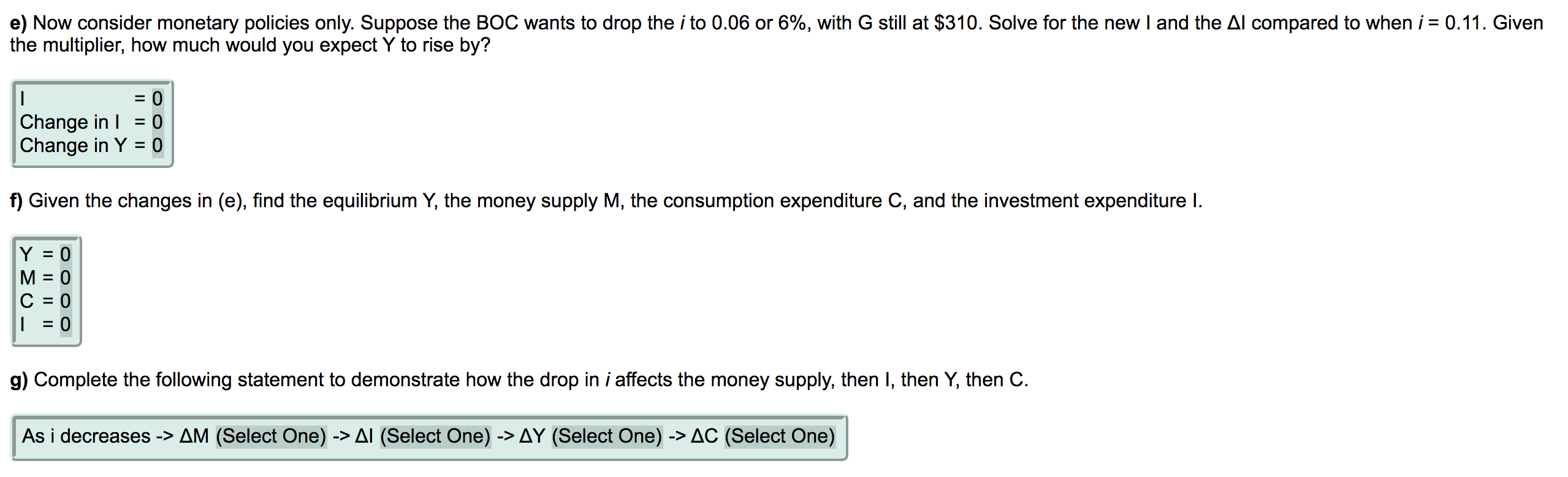

Question 2 [21 points] A simplified economy is specified as follows: A. Goods market, all values C, I, G and NX values are in billions of C$ Consumption Expenditure: C = 130 + 0.6(Y-T) Investment Expenditure: 1 = 1,400 - 4701 Government Expenditure: G= 310 Lump-sum Constant Taxes: T = 310 Exports: 80 Imports: 10 B. Money market, all values are in billions of C$ Interest Rate: i = 0.11 or 11% Money Demand: Md = 750 - 2,1001 Note: Please keep your answers accurate to two decimal places. a) Given the above information, solve for the following: the equilibrium Y, the money supply M, the consumption expenditure C, and the investment expenditure I. Y = 4,180.75 M = 519 C = 2,452.45 = 1,348.3 Now suppose there is an impending federal election, and the government promises to use fiscal policies to stimulate the economy. b) Find the value of the goods market multiplier. Goods market multiplier = 2.5 c) Let G rise to 420. Solve for the new equilibrium Y and C. Y = 0 C = 0 d) Demonstrate how the increase in G affects the economy through the multiplier. Use three rounds of effects to demonstrate the multiplier effects. Let the first round be related to health care spending, the second round related to clothing, and the third round related to food. Round 1 -> As the government wants to spend $1 (or $1 billion) on health care, it demands the production of health care equipment such as hospitals, medicine, equipment, etc. to be built and sold to the government. So as AG = 1, the production AY = 0 . This Y is the income to the nurses, doctors, construction workers, etc. Round 2 -> As the nurses receive their new income of Y = 0 , they spend 0 % of this so on clothing -> Ocents worth of clothing would be produced, or AY = 0 -> this Ocents would be the income of the workers involved in making the clothing. Round 3 -> As the clothing workers receive their new income of Y = 0 , they spend 0 % of this Ocents on food -> ( 0 XO )= 0 or 0 cents worth of food would be produced, or AY = 0 -> this would be the new income to the food workers. e) Now consider monetary policies only. Suppose the BOC wants to drop the i to 0.06 or 6%, with G still at $310. Solve for the new I and the Al compared to when i = 0.11. Given the multiplier, how much would you expect Y to rise by? = 0 1 Change in 1 = 0 Change in Y = 0 f) Given the changes in (e), find the equilibrium Y, the money supply M, the consumption expenditure C, and the investment expenditure I. Y = 0 M = 0 C = 0 | - 0 = g) Complete the following statement to demonstrate how the drop in i affects the money supply, then I, then Y, then C. As i decreases -> AM (Select One) -> Al(Select One) -> AY (Select One) -> AC (Select One) Question 2 [21 points] A simplified economy is specified as follows: A. Goods market, all values C, I, G and NX values are in billions of C$ Consumption Expenditure: C = 130 + 0.6(Y-T) Investment Expenditure: 1 = 1,400 - 4701 Government Expenditure: G= 310 Lump-sum Constant Taxes: T = 310 Exports: 80 Imports: 10 B. Money market, all values are in billions of C$ Interest Rate: i = 0.11 or 11% Money Demand: Md = 750 - 2,1001 Note: Please keep your answers accurate to two decimal places. a) Given the above information, solve for the following: the equilibrium Y, the money supply M, the consumption expenditure C, and the investment expenditure I. Y = 4,180.75 M = 519 C = 2,452.45 = 1,348.3 Now suppose there is an impending federal election, and the government promises to use fiscal policies to stimulate the economy. b) Find the value of the goods market multiplier. Goods market multiplier = 2.5 c) Let G rise to 420. Solve for the new equilibrium Y and C. Y = 0 C = 0 d) Demonstrate how the increase in G affects the economy through the multiplier. Use three rounds of effects to demonstrate the multiplier effects. Let the first round be related to health care spending, the second round related to clothing, and the third round related to food. Round 1 -> As the government wants to spend $1 (or $1 billion) on health care, it demands the production of health care equipment such as hospitals, medicine, equipment, etc. to be built and sold to the government. So as AG = 1, the production AY = 0 . This Y is the income to the nurses, doctors, construction workers, etc. Round 2 -> As the nurses receive their new income of Y = 0 , they spend 0 % of this so on clothing -> Ocents worth of clothing would be produced, or AY = 0 -> this Ocents would be the income of the workers involved in making the clothing. Round 3 -> As the clothing workers receive their new income of Y = 0 , they spend 0 % of this Ocents on food -> ( 0 XO )= 0 or 0 cents worth of food would be produced, or AY = 0 -> this would be the new income to the food workers. e) Now consider monetary policies only. Suppose the BOC wants to drop the i to 0.06 or 6%, with G still at $310. Solve for the new I and the Al compared to when i = 0.11. Given the multiplier, how much would you expect Y to rise by? = 0 1 Change in 1 = 0 Change in Y = 0 f) Given the changes in (e), find the equilibrium Y, the money supply M, the consumption expenditure C, and the investment expenditure I. Y = 0 M = 0 C = 0 | - 0 = g) Complete the following statement to demonstrate how the drop in i affects the money supply, then I, then Y, then C. As i decreases -> AM (Select One) -> Al(Select One) -> AY (Select One) -> AC (Select One)