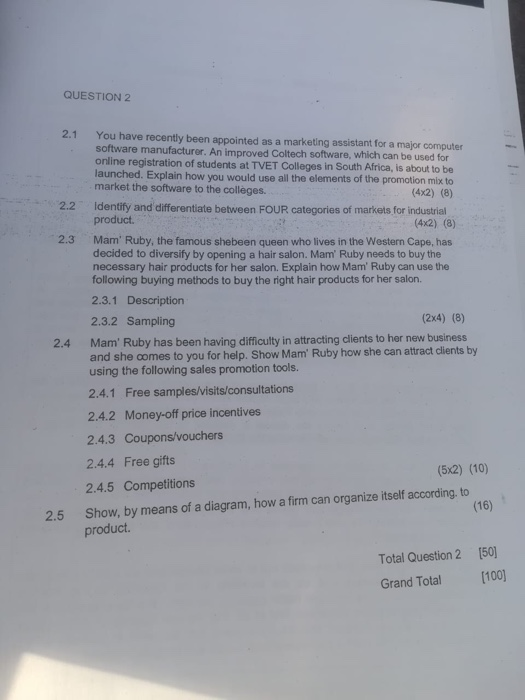

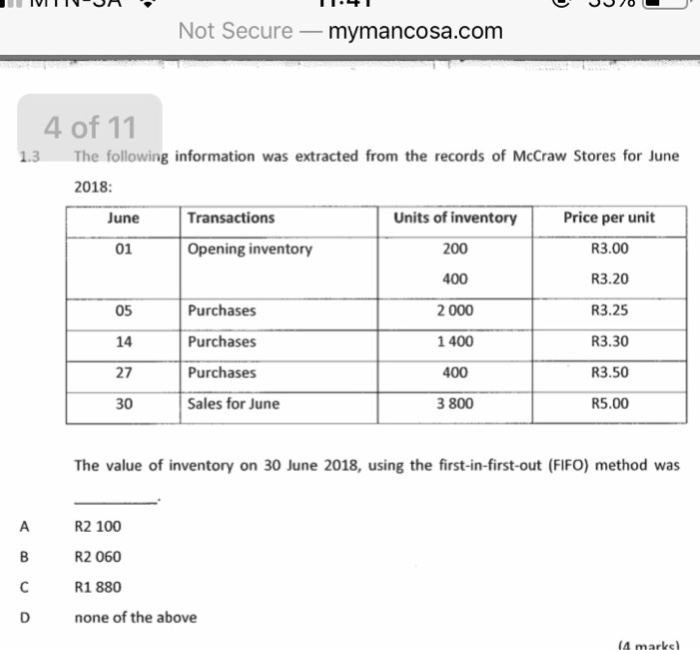

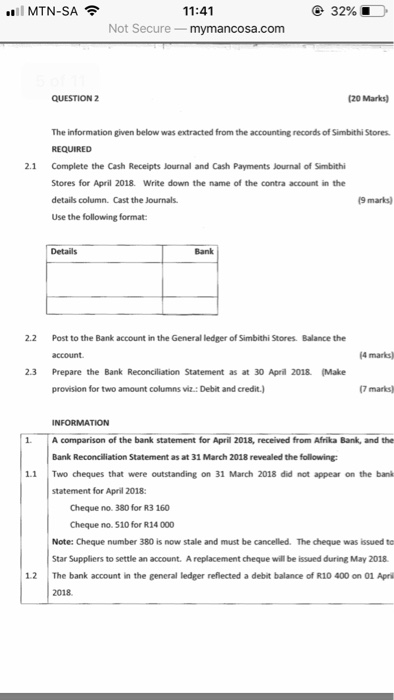

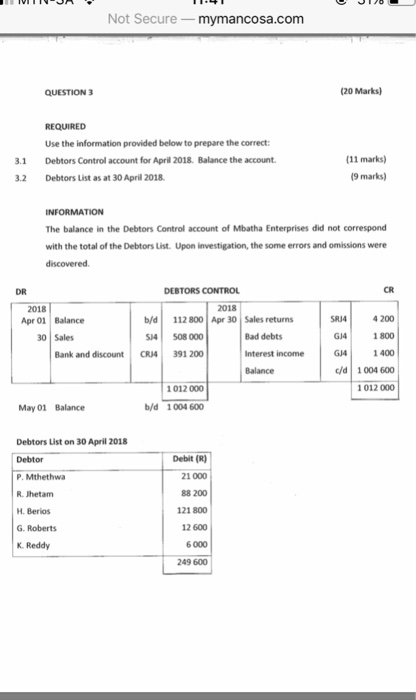

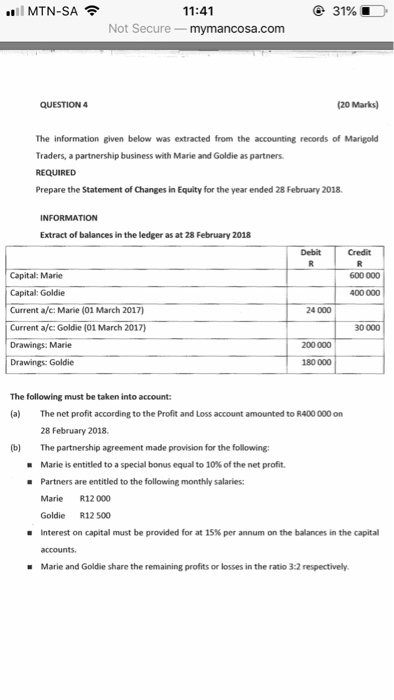

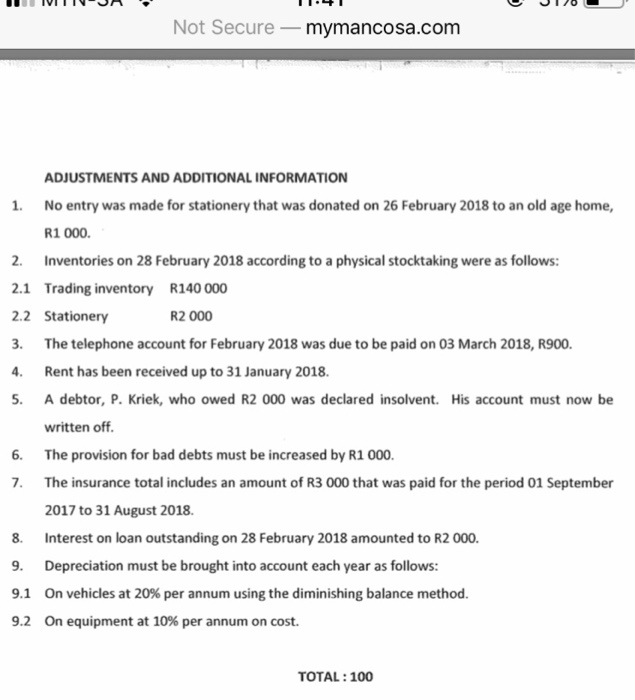

QUESTION 2 2.1 You have recently been appointed as a marketing assistant for a major computer software manufacturer. An improved Coltech software, which can be used for online registration of students at TVET Colleges in South Africa, is about to be launched. Explain how you would use all the elements of the promotion mix to market the software to the colleges. (4x2) (8) 2.2 Identify and differentiate between FOUR categories of markets for industrial (4x2) (8) 2.3 Mam Ruby, the famous shebeen queen who lives in the Western Cape, has product decided to diversify by opening a hair salon. Mam Ruby needs to buy the necessary hair products for her salon. Explain how Mam Ruby can use the following buying methods to buy the right hair products for her salon. 2.3.1 Description 2.3.2 Sampling (2x4) (8) 2.4 Mam' Ruby has been having difficulty in attracting clients to her new business and she comes to you for help. Show Mam Ruby how she can attract clients by using the following sales promotion tools. 2.4.1 Free samples/visits/consultations 2.4.2 Money-off price incentives 2.4.3 Coupons/vouchers 2.4.4 Free gifts (5x2) (10) 2.4.5 Competitions Show, by means of a diagram, how a firm can organize itself according, to product. (16) 2.5 Total Question 2 [50 Grand Total[100] Not Secure-mymancosa.com 4 of 11 1.3 The following information was extracted from the records of McCraw Stores for June 2018 Units of inventory 200 400 2 000 1 400 400 3 800 June Transactions Price per unit R3.00 R3.20 R3.25 R3.30 R3.50 R5.00 Opening inventory 01 05 14 27 30 Purchases Purchases Purchases Sales for June The value of inventory on 30 June 2018, using the first-in-first-out (FIFO) method was R2 100 R2 060 R1 880 none of the above 11:41 MTN-SA @ 32% . Not Secure -mymancosa.com QUESTION 2 (20 Marks) The information given below was extracted from the accounting records of Simbithi Stores REQUIRED Complete the Cash Receipts Journal and Cash Payments Journal of Simbithi Stores for April 2018. Write down the name of the contra account in the details column. Cast the Journals Use the following format 2.1 (9 marks) Details Bank 2.2 Post to the Bank account in the General ledger of Simbithi Stores. Balance the (4 marks) account Prepare the Bank Reconciliation Statement as at 30 April 2018 (Make provision for two amount columns viz.: Debit and credit 2.3 (7 marks) INFORMATION 1 A comparison of the bank statement for April 2018, received from Afrika Bank, and the Bank Reconciliation Statement as at 31 March 2018 revealed the following: 1.1 Two cheques that were outstanding on 31 March 2018 did not appear on the bank statement for April 2018 Cheque no. 380 for R3 160 Cheque no. 510 for R14 000 Note: Cheque number 380 is now stale and must be cancelled. The cheque was issued to Star Suppliers to settle an account. A replacement cheque will be issued during May 2018 12 The bank account in the general ledger reflected a debit balance of R10 400 on 01 April 018 Not Secure mymancosa.com (20 Marks) QUESTION 3 REQUIRED Use the information provided below to prepare the correct (11 marks) 9 marks) 3.1 Debtors Control account for April2018 Balance the account. 3.2 Debtors List as at 30 April 2018 INFORMATION The balance in the Debtors Control account of Mbatha Enterprises did not correspond with the total of the Debtors List. Upon investigation, the some errors and omissions were discovered CR DEBTORS CONTROL DR 2018 2018 SRJ4 4 GJ4 GJ4 4 200 1 800 1 400 c/d 1004 600 1 012 000 b/d 112 800 Apr 30 Sales returns Apr 01 Balance S4 508 000 Bad debts Interest income Balance 30 Sales Bank and discount CRI4 391 200 1012000 May 01 Balance b/d 1004 600 Debtors List on 30 April 2018 Debtor P. Mthethwa R. Jhetam H. Berios G. Roberts K. Reddy Debit (R) 21 000 88 200 121 800 12 600 6 000 249 600 11:41 Not Secure -mymancosa.com (20 Marks) QUESTION 4 The information given below was extracted from the accounting records of Marigold Traders, a partnership business with Marie and Goldie as partners REQUIRED Prepare the Statement of Changes in Equity for the year ended 28 February 2018. INFORMATION Extract of balances in the ledger as at 28 February 2018 Debit Credit 600 000 400000 Capital: Marie Capital: Goldie Current a/c: Marie (01 March 2017) Current a/c: Goldie (01 March 2017) Drawings: Marie Drawings: Goldie 24 000 30 000 200000 180000 The following must be taken into account: (a) The net profit according to the Profit and Loss account amounted to R400 000 on 28 February 2018 (b) The partnership agreement made provision for the following Marie is entitled to a special bonus equal to 10% of the net profit. Partners are entitled to the following monthly salaries Marie R12 000 Goldie R12 500 Interest on capital must be provided for at 15% per annum on the balances in the capital accounts . Marie and Goldie share the remaining profits or losses in the ratio 3:2 respectively. Not Secure-mymancosa.com ADJUSTMENTS AND ADDITIONAL INFORMATION No entry was made for stationery that was donated on 26 February 2018 to an old age home, R1 000 1. 2. Inventories on 28 February 2018 according to a physical stocktaking were as follows 2.1 Trading inventory R140 000 2 Stationery 3. The telephone account for February 2018 was due to be paid on 03 March 2018, R900. 4. Rent has been received up to 31 January 2018 5. A debtor, P. Kriek, who owed R2 000 was declared insolvent. His account must now be R2 000 written off The provision for bad debts must be increased by R1 000. The insurance total includes an amount of R3 000 that was paid for the period 01 September 2017 to 31 August 2018. 6. 7. 8 Interest on loan outstanding on 28 February 2018 amounted to R2 000. 9. Depreciation must be brought into account each year as follows: 9.1 On vehicles at 20% per annum using the diminishing balance method. 9.2 On equipment at 10% per annum on cost. TOTAL: 100 QUESTION 2 2.1 You have recently been appointed as a marketing assistant for a major computer software manufacturer. An improved Coltech software, which can be used for online registration of students at TVET Colleges in South Africa, is about to be launched. Explain how you would use all the elements of the promotion mix to market the software to the colleges. (4x2) (8) 2.2 Identify and differentiate between FOUR categories of markets for industrial (4x2) (8) 2.3 Mam Ruby, the famous shebeen queen who lives in the Western Cape, has product decided to diversify by opening a hair salon. Mam Ruby needs to buy the necessary hair products for her salon. Explain how Mam Ruby can use the following buying methods to buy the right hair products for her salon. 2.3.1 Description 2.3.2 Sampling (2x4) (8) 2.4 Mam' Ruby has been having difficulty in attracting clients to her new business and she comes to you for help. Show Mam Ruby how she can attract clients by using the following sales promotion tools. 2.4.1 Free samples/visits/consultations 2.4.2 Money-off price incentives 2.4.3 Coupons/vouchers 2.4.4 Free gifts (5x2) (10) 2.4.5 Competitions Show, by means of a diagram, how a firm can organize itself according, to product. (16) 2.5 Total Question 2 [50 Grand Total[100] Not Secure-mymancosa.com 4 of 11 1.3 The following information was extracted from the records of McCraw Stores for June 2018 Units of inventory 200 400 2 000 1 400 400 3 800 June Transactions Price per unit R3.00 R3.20 R3.25 R3.30 R3.50 R5.00 Opening inventory 01 05 14 27 30 Purchases Purchases Purchases Sales for June The value of inventory on 30 June 2018, using the first-in-first-out (FIFO) method was R2 100 R2 060 R1 880 none of the above 11:41 MTN-SA @ 32% . Not Secure -mymancosa.com QUESTION 2 (20 Marks) The information given below was extracted from the accounting records of Simbithi Stores REQUIRED Complete the Cash Receipts Journal and Cash Payments Journal of Simbithi Stores for April 2018. Write down the name of the contra account in the details column. Cast the Journals Use the following format 2.1 (9 marks) Details Bank 2.2 Post to the Bank account in the General ledger of Simbithi Stores. Balance the (4 marks) account Prepare the Bank Reconciliation Statement as at 30 April 2018 (Make provision for two amount columns viz.: Debit and credit 2.3 (7 marks) INFORMATION 1 A comparison of the bank statement for April 2018, received from Afrika Bank, and the Bank Reconciliation Statement as at 31 March 2018 revealed the following: 1.1 Two cheques that were outstanding on 31 March 2018 did not appear on the bank statement for April 2018 Cheque no. 380 for R3 160 Cheque no. 510 for R14 000 Note: Cheque number 380 is now stale and must be cancelled. The cheque was issued to Star Suppliers to settle an account. A replacement cheque will be issued during May 2018 12 The bank account in the general ledger reflected a debit balance of R10 400 on 01 April 018 Not Secure mymancosa.com (20 Marks) QUESTION 3 REQUIRED Use the information provided below to prepare the correct (11 marks) 9 marks) 3.1 Debtors Control account for April2018 Balance the account. 3.2 Debtors List as at 30 April 2018 INFORMATION The balance in the Debtors Control account of Mbatha Enterprises did not correspond with the total of the Debtors List. Upon investigation, the some errors and omissions were discovered CR DEBTORS CONTROL DR 2018 2018 SRJ4 4 GJ4 GJ4 4 200 1 800 1 400 c/d 1004 600 1 012 000 b/d 112 800 Apr 30 Sales returns Apr 01 Balance S4 508 000 Bad debts Interest income Balance 30 Sales Bank and discount CRI4 391 200 1012000 May 01 Balance b/d 1004 600 Debtors List on 30 April 2018 Debtor P. Mthethwa R. Jhetam H. Berios G. Roberts K. Reddy Debit (R) 21 000 88 200 121 800 12 600 6 000 249 600 11:41 Not Secure -mymancosa.com (20 Marks) QUESTION 4 The information given below was extracted from the accounting records of Marigold Traders, a partnership business with Marie and Goldie as partners REQUIRED Prepare the Statement of Changes in Equity for the year ended 28 February 2018. INFORMATION Extract of balances in the ledger as at 28 February 2018 Debit Credit 600 000 400000 Capital: Marie Capital: Goldie Current a/c: Marie (01 March 2017) Current a/c: Goldie (01 March 2017) Drawings: Marie Drawings: Goldie 24 000 30 000 200000 180000 The following must be taken into account: (a) The net profit according to the Profit and Loss account amounted to R400 000 on 28 February 2018 (b) The partnership agreement made provision for the following Marie is entitled to a special bonus equal to 10% of the net profit. Partners are entitled to the following monthly salaries Marie R12 000 Goldie R12 500 Interest on capital must be provided for at 15% per annum on the balances in the capital accounts . Marie and Goldie share the remaining profits or losses in the ratio 3:2 respectively. Not Secure-mymancosa.com ADJUSTMENTS AND ADDITIONAL INFORMATION No entry was made for stationery that was donated on 26 February 2018 to an old age home, R1 000 1. 2. Inventories on 28 February 2018 according to a physical stocktaking were as follows 2.1 Trading inventory R140 000 2 Stationery 3. The telephone account for February 2018 was due to be paid on 03 March 2018, R900. 4. Rent has been received up to 31 January 2018 5. A debtor, P. Kriek, who owed R2 000 was declared insolvent. His account must now be R2 000 written off The provision for bad debts must be increased by R1 000. The insurance total includes an amount of R3 000 that was paid for the period 01 September 2017 to 31 August 2018. 6. 7. 8 Interest on loan outstanding on 28 February 2018 amounted to R2 000. 9. Depreciation must be brought into account each year as follows: 9.1 On vehicles at 20% per annum using the diminishing balance method. 9.2 On equipment at 10% per annum on cost. TOTAL: 100