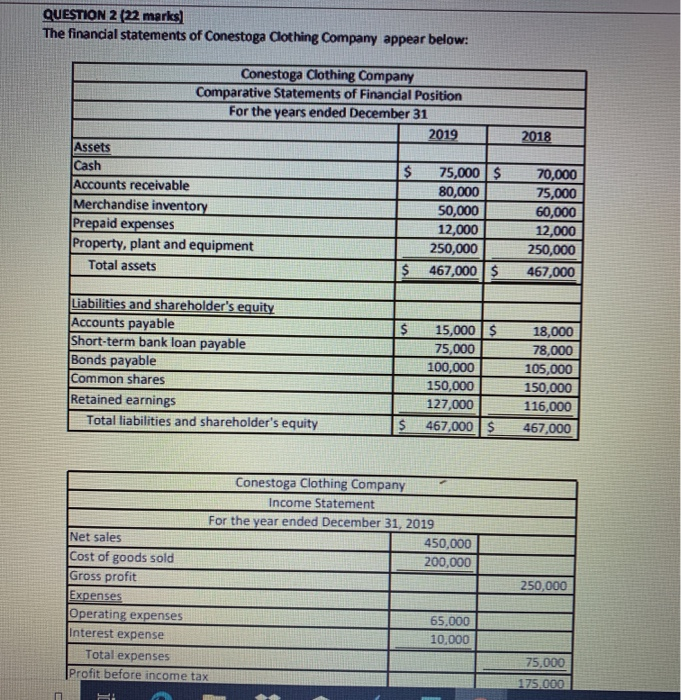

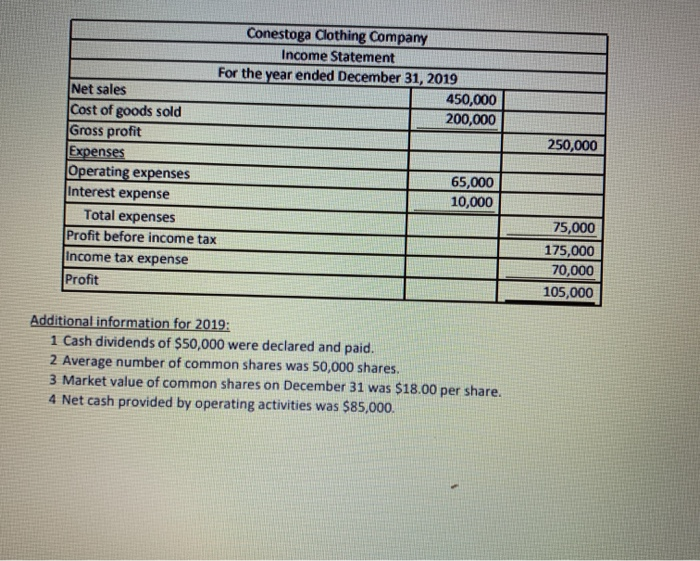

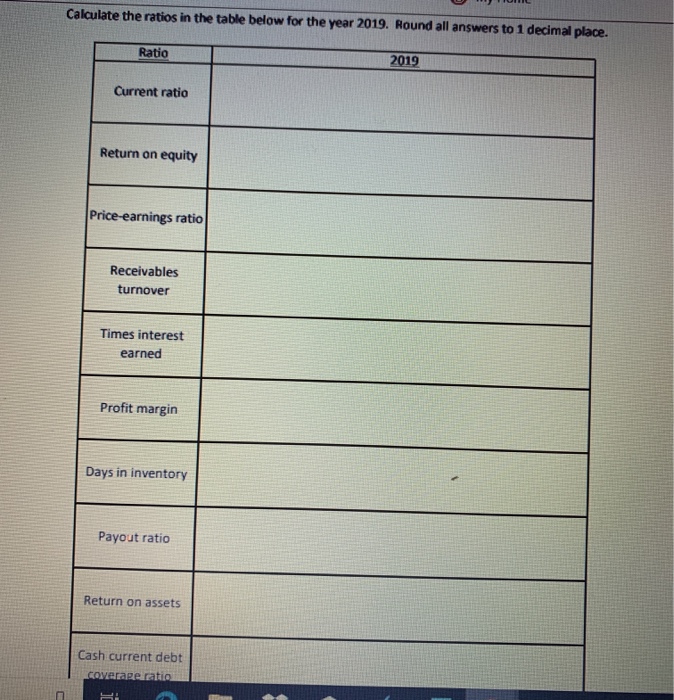

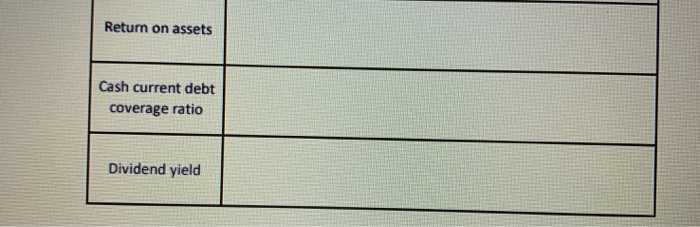

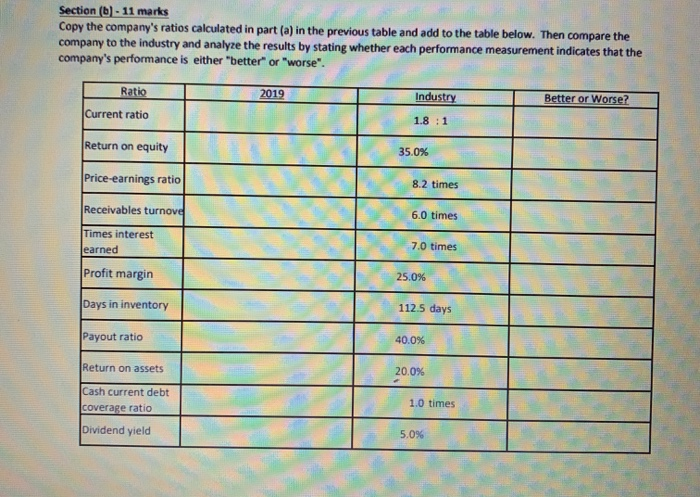

QUESTION 2 (22 marks) The financial statements of Conestoga Clothing Company appear below! Conestoga Clothing Company Comparative Statements of Financial Position For the years ended December 31 2019 2018 Assets $ $ Cash Accounts receivable Merchandise inventory Prepaid expenses Property, plant and equipment Total assets 75,000 80,000 50,000 12,000 250,000 467,000 70,000 75,000 60,000 12.000 250,000 467,000 $ $ $ $ Liabilities and shareholder's equity Accounts payable Short-term bank loan payable Bonds payable Common shares Retained earnings Total liabilities and shareholder's equity 15,000 75,000 100,000 150,000 127,000 467,000 18,000 78,000 105,000 150,000 116,000 467,000 S $ Conestoga Clothing Company Income Statement For the year ended December 31, 2019 Net sales 450,000 Cost of goods sold 200,000 Gross profit Expenses Operating expenses 65,000 Interest expense 10,000 Total expenses Profit before income tax 250,000 75,000 175.000 250,000 Conestoga Clothing Company Income Statement For the year ended December 31, 2019 Net sales 450,000 Cost of goods sold 200,000 Gross profit Expenses Operating expenses 65,000 Interest expense 10,000 Total expenses Profit before income tax Income tax expense Profit 75,000 175,000 70,000 105,000 Additional information for 2019: 1 Cash dividends of $50,000 were declared and paid. 2 Average number of common shares was 50,000 shares. 3 Market value of common shares on December 31 was $18.00 per share. 4 Net cash provided by operating activities was $85,000. Calculate the ratios in the table below for the year 2019. Round all answers to 1 decimal place. Ratio 2019 Current ratio Return on equity Price-earnings ratio Receivables turnover Times interest earned Profit margin Days in inventory Payout ratio Return on assets Cash current debt Covamentin Return on assets Cash current debt coverage ratio Dividend yield Section (b) - 11 marks Copy the company's ratios calculated in part (a) in the previous table and add to the table below. Then compare the company to the industry and analyze the results by stating whether each performance measurement indicates that the company's performance is either "better or "worse". Ratio 2019 Industry Better or worse? Current ratio 1.8 : 1 Return on equity 35.0% Price-earnings ratio Receivables turnove Times interest earned Profit margin 8.2 times 6.0 times 7.0 times 25.0% 112.5 days Days in inventory Payout ratio Return on assets 20.0% Cash current debt coverage ratio times Dividend yield