Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2 (25 Marks) A 35 year old human resource executive, Nancy, needs consultation on her retirement and investment planning. She wishes to retire at

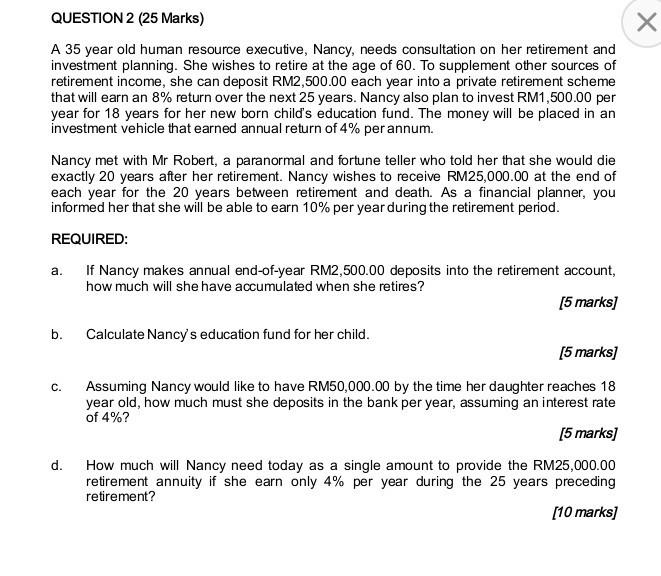

QUESTION 2 (25 Marks) A 35 year old human resource executive, Nancy, needs consultation on her retirement and investment planning. She wishes to retire at the age of 60. To supplement other sources of retirement income, she can deposit RM2,500.00 each year into a private retirement scheme that will earn an 8% return over the next 25 years. Nancy also plan to invest RM1,500.00 per year for 18 years for her new born child's education fund. The money will be placed in an investment vehicle that earned annual return of 4% per annum. Nancy met with Mr Robert, a paranormal and fortune teller who told her that she would die exactly 20 years after her retirement. Nancy wishes to receive RM25,000.00 at the end of each year for the 20 years between retirement and death. As a financial planner, you informed her that she will be able to earn 10% per year during the retirement period. REQUIRED: If Nancy makes annual end-of-year RM2,500.00 deposits into the retirement account, how much will she have accumulated when she retires? [5 marks] b. Calculate Nancy's education fund for her child. [5 marks] a. C. Assuming Nancy would like to have RM50,000.00 by the time her daughter reaches 18 year old, how much must she deposits in the bank per year, assuming an interest rate of 4%? [5 marks] How much will Nancy need today as a single amount to provide the RM25,000.00 retirement annuity if she earn only 4% per year during the 25 years preceding retirement? [10 marks] d

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started