Answered step by step

Verified Expert Solution

Question

1 Approved Answer

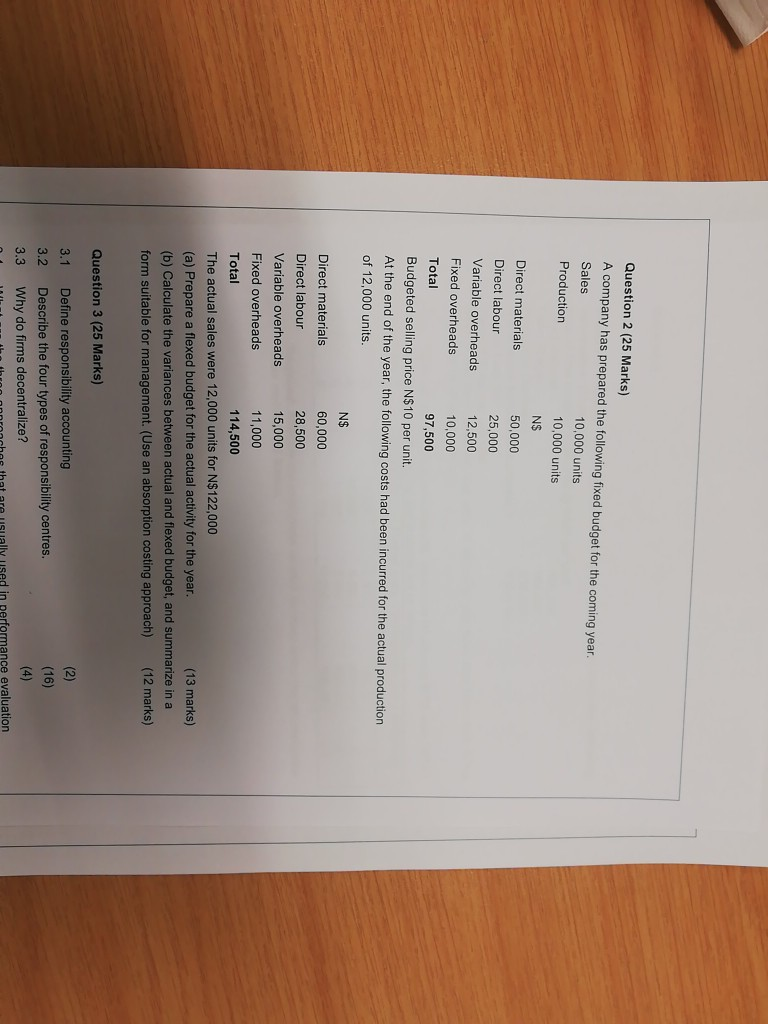

Question 2 (25 Marks) A company has prepared the following fixed budget for the coming year. Sales 10,000 units Production 10,000 units N$ Direct materials

Question 2 (25 Marks) A company has prepared the following fixed budget for the coming year. Sales 10,000 units Production 10,000 units N$ Direct materials 50,000 Direct labour 25,000 Variable overheads 12,500 Fixed overheads 10,000 Total 97,500 Budgeted selling price N$10 per unit. At the end of the year, the following costs had been incurred for the actual production of 12,000 units. N$ Direct materials 60,000 Direct labour 28,500 Variable overheads 15,000 Fixed overheads 11,000 Total 114,500 The actual sales were 12,000 units for N$ 122,000 (a) Prepare a flexed budget for the actual activity for the year. (13 marks) (b) Calculate the variances between actual and flexed budget, and summarize in a form suitable for management. (Use an absorption costing approach) (12 marks) Question 3 (25 Marks) 3.1 3.2 3.3 (2) (16) Define responsibility accounting Describe the four types of responsibility centres. Why do firms decentralize? Then the thron nnnrenches that are usually used in performance evaluation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started